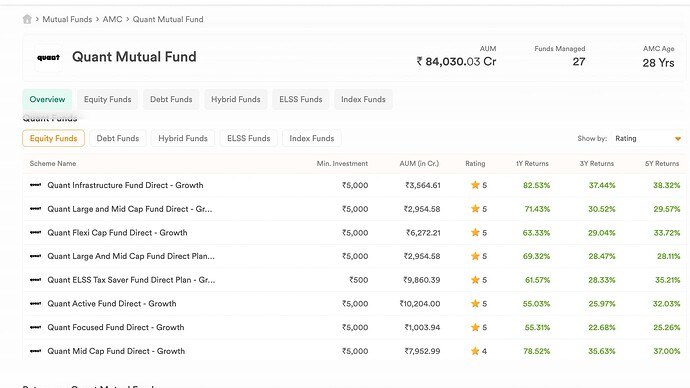

I was recently looking at switching a few of my mutual funds from a flexi cap fund. I was surprised to see the returns of Quant’s funds. I had not heard about them until very recently so these returns look even more surprising.

Do you invest in any of their funds?

And we are loosing that return because Dhan don’t have mutual fund pledging feature

Ha, ha ha ha

1 Like

Not invested in them. But i have followed there fund since they became quant AMC from Escorts AMC (quant capital acquired Escorts MF). Few things i have noted since 5~6 years:

-

They purely follow momentum investing style whichever funds you take out of there AMC which will definitely work well in multi year bull run phase like Indian markets are in since 2020 April (but also fails incredibly when liquidity gets out of market like in January 2022 to May 2022 time period when there was war, FIIs and DIIs decreased investing and central banks all across the world started increasing rates).

-

They invest most of there holdings in not so quality stocks (ROCE, ROE and D/E ratio being skewed towards lower end as well as companies with known governance issues as opposed to buying “higher quality stocks”) which will defnitely have issues when the companies with such characters fail. Example a. they held Adani group of companies in there different funds and when Hindenburg came out with a set of issues in the Adani group they quant AMC were unable to exit without taking a transient loss, b. they had held Zee Entertainment Ltd (they had hopefully exited to certain level before it started hitting lower circuits for few days) and when Sony - Zee merger issues came out they had to face an issue, c. Happened recently where there multiple funds suffered (especially small and midcap and some sectoral funds) on June 4th when they suffered somewhere from 5-10% loss in NAV in different funds on a single day (this loss could’ve been transient in a sense but what if there was even further fall?).

In such occassions i don’t know how they will get an exit without losing a chunk of the money they made for past 1-2 years (As Nilesh Shah of Kotak AMC says in a meaning that no fund manager or AMCs will come forward to pick stocks that you picked out of greed and without taking valuation into framework quant AMC fund would be first casualty if any such sudden crash / corrections happens).

-

As a profitable fund manager i highly respect Sandeep Tandon and others of quant AMC for there views regarding markets. But i really want to see how they would perform under long bear phases and then form an opinion on them (they use VLRT framework for there funds. But i really doubt they get L when bad T comes when most of there holdings have high R without taking huge cut in there profitability)

2 Likes

This is my Last month with Dhan I came from Zerodha to dhan and from July I am sifting my money to Zerodha means going back i don’t like Dhan because it doesn’t have basic feature of pledging

It’s not easy to moved large fund from one account to another but F&O trading against mutual fund pledge is best way to accumulate wealth in mutual fund

2 Likes

Hi @peeruverma09 We are exploring this., building these features takes up a long time. Many users on Dhan pledge ETFs and Bonds, beyond usual stocks to avail margin benefits.

1 Like

What? Retailers are getting rich? Making good money on a mutual fund? No way.

Clients pulled about ₹1,398 crore in three days through June 26 due to the SEBI investigation.

Detailed article here - Quant mutual fund front-running case: Clients pulled ₹1,398cr days after SEBI probe, says founder-CEO Sandeep Tandon | Mint

Here’s one more take on this:

“However, one can expect some selling pressure on low-float stocks where quant has built significant positions. But remember, every crisis has the opportunity, particularly when the crisis is driven by liquidity.”

https://x.com/vivbajaj/status/1805069986312146967

@shraddha Here’s the presentation from Sandeep Tandon of Quant AMC of 24 June 2024: https://quanttransaction.quantmutual.com:722/video/26062024.mp4

Investors should never get catapulted based on rumours, especially when the fund has been the best since inception, in all the categories.

Rumour trading is a function of traders and long-term investors should always make informed decisions based on FACTS. That too when the AMC industry is now the safest. Nothing is proven yet.

₹1398crs is just 1.5% of the AUM. They have liquid assets of about 55% across their entire portfolio.

Personally, IMHO, I don’t think that Sandeep Tandon would indulge in such activities since his personal assets of ₹3000 crore is in Quant AMC itself.

Might be the brokerages are doing such things or some junior traders but most likely it is nothing of that magnitude, not even of the Axis AMC front-running case.