Hello team, help me understand something. Suppose I took a MTF trade with 2x leverage of Rs 10000.. hence it should mean I have to pay interest on 5000. After pledging the stock with a haircut of 25% I ended up paying interest on 7500. Why is it charged like that? While checking my daily MTF margin and position report, it shows I require 2500 margin for the stock I had purchased… but I actually paid 5000 for it. What happened to the remaining 2500 that I funded? This is confusing me.

Hi @CHANDAR

We just launched an MTF Calculator to make these queries clear, can you please check this here - MTF Calculator - Calculate Interest, MTF Charges & Margin Available | Dhan

Let know if you still have questions, in that case we will have to make this even better.

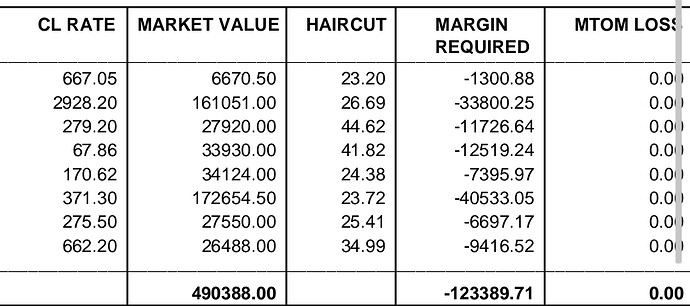

Need a better understanding and more information on it. please refer to the image below… For these individual scrips here, the margin required is shown after charging the haircut % from the current market value. I have purchased these scrips at 50% margin so after pledging the haircut should have been 50% or been adjusted according to what I have paid. The actual margin required now as shown here is less than what I have actually paid during the purchase. For this reason, the funded value now increases and I end up paying more interest than I expected. Help me understand this part.

Hi @CHANDAR,

Our team is connecting with you to address this.

Hi @CHANDAR,

As per our discussion, we understand that your concern related to MTF interest has been addressed. Also, we have your feedback on required margin in MTF.

Thank you for the clarification… that helped a lot. I request the team to please consider including these updates for more better user experiences:

Requesting adjustable haircut % slider on MTF positions according to user requirements (allowing us to adjust our required margin based on not just market volatility but also margin availability with user. For example, whenever I have extra funds… I want to increase the haircut % on a specific stock, which will help saving money on mtf interest)

Requesting annual subscription based package which can include financial advisor, lower mtf interest rate, zero brokerage on mtfs, derivatives & futures, higher leverage, stock analysis reports etc.

Requesting stock search filter based on technical, financial indicators such as.. stocks crossing 50 ema, stocks with increasing quarterly profits etc.