These are still not implemented. This is pathetic because this is the basic requirement for filing the ITR

Tax pnl is for a FY. The Tax PNL is showing LTCG, STCG etc. That is what you need for computing tax.

AGTS has dates for commodity trades. I checked the AGTS received in my mail as well as the tradewise AGTS in Tax PNL

![]()

What am I missing ? ![]()

yes the dates should be there for the every segment…The individual transaction details are needed instead of just reporting the ‘Net P&L value’

this is basic requirement…That is why dhan has been removed and no longer supported by Quinko apparently…

Its been more than 1 year since this issue was reported by so many users , but they are not caring to implement. This violates the income tax requirements for which I plan to drag dhan to courts as this is sheer deficiency of service and harassment to the retail investor

I had 78+ trade in commodity tab but i am getting only four trades there in AGTS

Brian has already highlighted and given the details in Jan '23. They are still struggling for same or didn’t consider this as priority

Dear sir, is it possible to include buy date on demat holding summary?

yeah. the issue of number of buy is not equal to number sell is true. as @t7support said, we will have to create it by comparing last years P&L. its hectic work. I wish DHAN update their P&L like the one GROWW and others provide with both buy and sell dates.

![]() yes naturally Quicko preferred to break the relationship – no one wants to get entangled in illegal and tax non-compliance especially when you are a broker or trader

yes naturally Quicko preferred to break the relationship – no one wants to get entangled in illegal and tax non-compliance especially when you are a broker or trader

@t7support in the AGTS worksheet of the ‘Tax PNL report’ , @Dhan_Cares has to enlist – clearly SEGREGATED SCRIP WISE, (BOUGHT/SOLD) QUANTITY, TRANSACTION VALUE, BUY DATE, SELL DATE , CAPITAL GAINS/LOSS which happened :

whereas they are giving trade date which the not importable and requires us to do manual efforts for hundreds and thousands of transactions done during the FY

So the very purpose of providing the Tax PNL report is defeated and plus it is not importing into IT website, and other vendors like mentioned by users in this forum already

Note: The above pieces of details are to be ADDED in ADDITION TO the following details which dhan is already reporting in Tax PNL report. Telling so that they dont remove these fields while adding the ones which I have enlisted above ![]()

@iamshrimohan @PravinJ

![]()

![]()

Hi @VAggarwal Requesting you to share your consolidated feedback with on on feedback@dhan.co., we will incorporate the suggestions.

I understand our Customer Service team had already shared you the workings on 23 July and they spoke with you again yesterday. Thank you for your patience, our team is also working with Quicko to restore the process via their platform.

yes @PravinJ my issue has been solved – but with SO MUCH stress and (you know very well from our interactions on other channels) the brink to which the situation came.

In the end, I am your end user and want to avoid similar ordeal for other co-users traders – when filing ITR for 2024 2025 (comes up every quarter and/or year), so I am sending you feedback at your specified email

Hoping to see these inclusions at HIGHEST PRIORITY unlike jan 2023 feedback – which went into cold water @Brian

We are part of same trader community – and because @iamshrimohan you evolve based on feedback – so I will cooperate BUT NOT READY TO SUFFER taxation related ordeals

we have a popular saying : utna hi welfare karo ki khud ka farewell na ho jaye

I am sending consolidated feedback to your specified email → feedback@dhan.co., and confirm me when the feature has been deployed – so I will immediately like to check by generating the capital gains statement reports there and then etc.

I am willing to cooperate and let us make trading smooth for both sides Dhan and end user subscribers

Trust me – you will hate the rude looks and abuses of CA (who are rightfully already under so much pressure) – when you go to them with half cooked data for filing ITR

@PravinJ I have emailed the format proposed to feedback which you have promised to take action upon

this is FYA…thanks

personal decision:

I will deploy more funds into dhan ONLY AFTER THIS PROPER Capital Gains STATEMENT and drop down feature HAS BEEN deployed to us – just to be on safe side…

And in the event of no/slow progress on this regards, I will migrate to another trading platform – assuming you are not bothered about the users subscribers. I want to avoid ordeal and stay focus on trading instead of tax hassles because of your technical lapses

@PravinJ @iamshrimohan I had flagged the issues to Dhan cares on 18th July. I am still waiting for the updated sheet. Please help

@iamshrimohan Yesterday I sent the UCC to you.

Quicko has reactivated the linkage for ITR filing with dhan – however today I re-tried to extract the data to draft my ITR (only testing purpose)

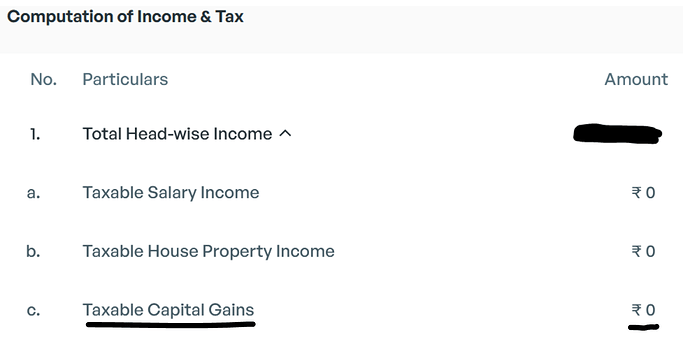

As you can clearly see from the attached screen shot → the capital gains is showing ZERO VALUE – which reflects the fact that – CAPITAL GAINS STATEMENT FORMAT – is still DEFICIENT AND NOT IMPORTING CORRECT DATA from dhan

I assume moneylicious (dhan) is actively working to add the missing dates columns into the Profit and Loss report format – which should help solve this bottleneck of ITR filing for the users subscribers

@PravinJ @iamshrimohan @Dhan_Cares please specify an earliest date by which this missing date fields in the format shall be added and hosted for use by end users

@VAggarwal Am not privy to this. Hopefully, this will be resolved as @iamshrimohan said few days back that the team is working towards revamping the reports.

Buy and sell dates are not in the PNL statement. it is required for filling tax. Pls clarify asap. its urgent

@PravinJ see EVERY users subsribers of dhan moneylicious is facing this same issue of missing buy date and sell date in the PNL report

You just need to – ‘ADD’ the

BUY DATE

and

SELL DATE

into the row-wise transactions details which exists in the ‘PNL report’ .

Only giving the ‘Trade date’ is useless for ITR filing

@kharea PNL statement does not have buy and sell date as the statement is intended to show scripwise PNL irrespective of holding period.

@VAggarwal Yes, we are aware of this and had already this up already. This will be made live soon post testing on all the possible scenarios.

@iamshrimohan looking forward to the deployment of the proper format which shall smoothen the ITR filing in future …would appreciate if you also specify the date by which this – transaction wise, buy date + sell date + earned or burned value format will be deployed on the ‘statements and reports’ section – because you already informed here that testing of this rectification/enhancement is nearing completion?

@iamshrimohan Dhan P&L integration is not working for glyde, tax2win and cleartax. None of them is able to import capital gain report from dhan for me. It is working fine for other brokers. Dhan should sent capital gain in a general format which can be accepted by all taxation platform to all of its users for last financial year.