@iamshrimohan now even when quicko is re-tagged with @Dhan but when you import using quicko – the values imported are NIL

My Tax Report shows Realized PNL for transferred shares , I had this issue with Angelone which they fixed in 1 day.

I dropped email to dhan care on July 10th ,But still they are not able to solve it.

I got email on 31st July which was the last day to file ITR ,still you guys give me wrong report.

I was following with @Divyesh also ,but still not corrected on Aug 1st also.

I tried to reach customer care which I got connected after 2 hours of waiting and they asked me to calculate manually.

@PravinJ - Unfortunately I am a person who got suffered with your July Glitches ,BSE issue and now most of reports not matching , current year financials report also I may get problems when I file next year ITR.

No help after multiple emails ,chats and calls.

I am done with Dhan!!

![]()

@PravinJ @iamshrimohan @Hardik @shraddha @t7support @quicko @RahulDeshpande @Sameet

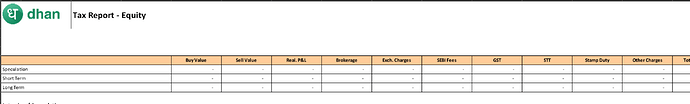

This is to acknowledge that @Dhan team has successfully deployed the correct capital gains report format – which can now be used for ITR filing by the users subscribers

This report is available under “Tax PNL report” which has the ‘Equity’ worksheet, in addition to the other worksheets

The format will enable you file your ITR in compliance with what the indian tax authorities want

Appreciate…

With regards

Vineet Aggarwal

Note: Dhan team please act now to ensure timely updates to the deduction and tax related formulas – because the leviable taxes will change e.g. STCG changed w.e.f july 2024 , STT change is w.e.f Oct 2024 etc.

Latest Report received after JULY with no values in report.

I don’t want you guys to work on this , I calculated manually with help of CA and filed ITR and at the same time I stopped trading in Dhan.

Atleast have a look on report before you sending. Customer Service and Reports are pathetic.

@kesav Do let me know your UCC and for which period had you requested the Tax Report. At our end it is working fine.

Frue. You are lucky that your issue was resolved.

When I contacted @Dhan_Cares they simply said they don’t have and feedback noted.

There is dividend earned during financial year report too. You have to go to mobile app and type manually. No other option at all. @Dhan_Cares did even try to help on this matter unfortunately.

As a CA, i struggled for my own ITR. But my major transactions were in groww. So managed using mobile app and AIS. Lost lot of time in this.

For our clients who are also using dhan we had to suffer. Especially when we get details late and always IT site works slow and after this if we face this improper information it is hard to digest.

Additionally demat holding statement doesn’t show the date of holding. So please add date of holdings (a separate table in addition to what is available now).

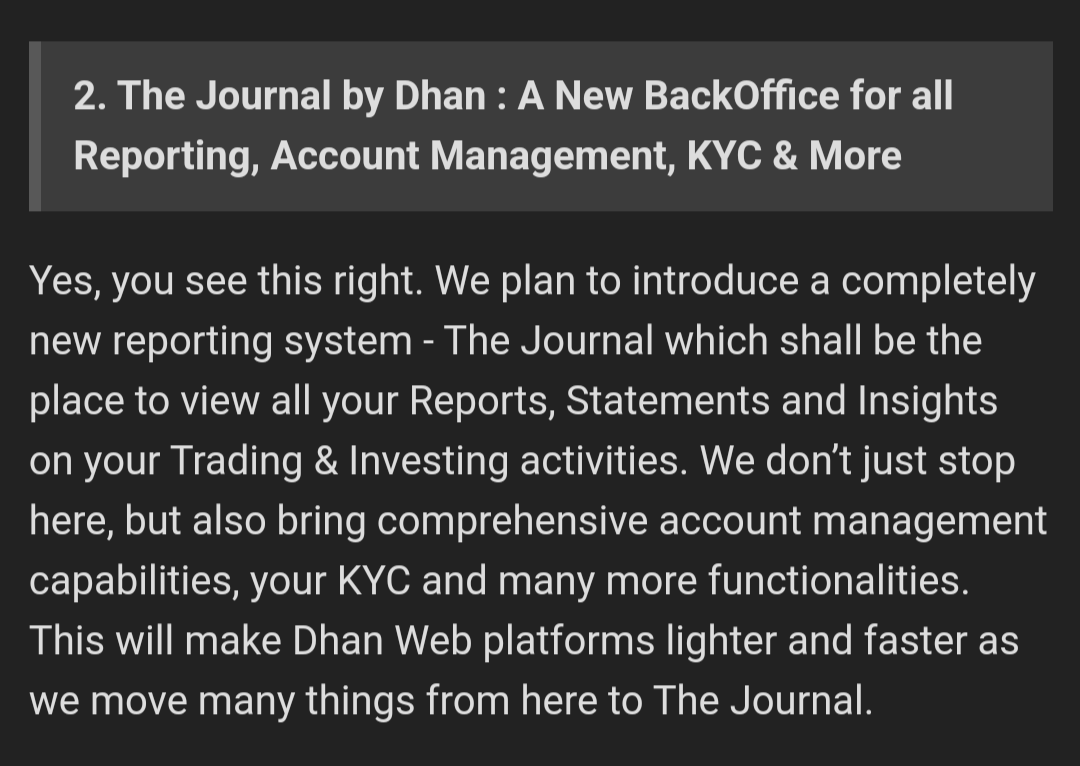

@KSB hopefully the new reporting system under dev will solve the issues

Although the format with the dates of buy and sell , value and quantity – has been deployed (and this is what I stated as resolved) – BUT – STILL NO DATA FROM DHAN is getting IMPORTED into ANY ITax filing platforms – which defeats the very purpose. As you can see these ISSUE OF being UNABLE TO FILE ITR – BECAUSE OF MISSING DHAN DATA – IS STILL BEING COMPLAINED by ALL YOUR USERS which also INCLUDING CAs – because we are forced to do manual compiling of so many transactions (like I did this one time now) – under various categories – and this is very painful and UNACCEPTABLE

Rather than waiting any further – WORK ON WAR FOOTING to IMMEDIATELY CHECK RECTIFY and DO THE NEEDFUL SO THAT CORRECT AND COMPLETE CAPITAL GAINS ETC. DATA – GETS AUTOMATICALLY IMPORTED and processed (as happens with all other brokers) into sites like CLEARTAX, QUICKO and OTHER SUCH ITR filing platforms

AND which can easily be used by the CAs for filing ITRs

AND which can be easily downloaded and imported onto the income tax website for ITR filing by the individuals themselves

@KSB Dividend holding statement in under creation and will be added in the Tax Report from this FY onwards. Demat holding statement is intended to show only the holdings and current valuation (unrealized). Moreover, when you sell the holdings, we calculate capital gains as per FIFO (including corporate actions). For users having daily SIP in stocks / ETFs will make the Holding Statement multi-paged in terms of number of rows. Will explore if adding this as a separate sheet in the holding statement could be possible.

@VAggarwal The aggregator platform utilizes raw data and for them nothing changed. Let me know incase you are facing issue with any of our tax filing partners. Will get this checked.

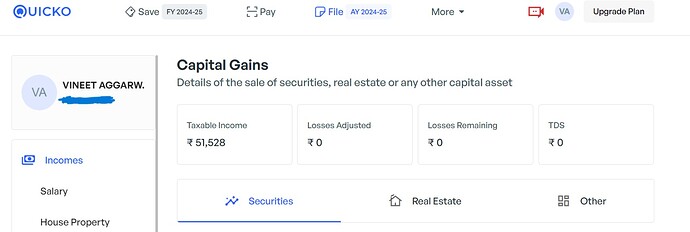

Whereas now data is getting imported into quicko BUT as you see there is mismatch between quicko and dhan after import

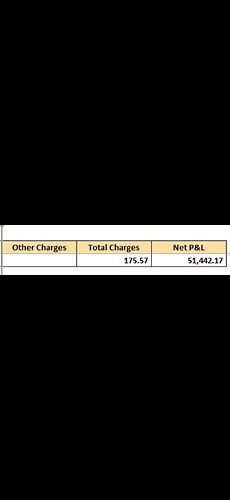

Quicko data is 51528

Dhan value data is 51442.17

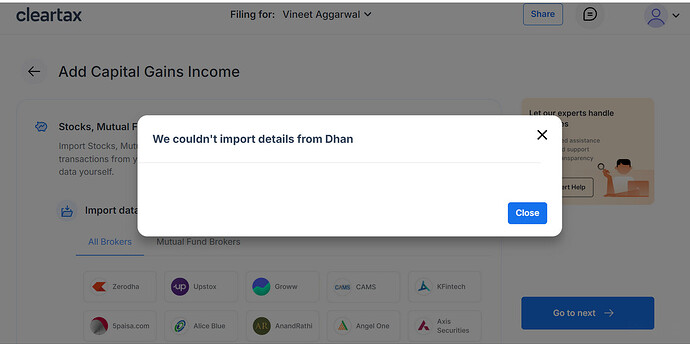

And error comes when trying to import data from dhan into cleartax to the file ITR

So issue of – unable to file the ITR – is still PENDING resolution by you

@iamshrimohan - For last financial year STCG showing wrong.

Hi,

Quicko is now connecting with Dhan but calculations are wrong for STCG/LTCG.

Cleartax is still having issue in importing the data.

@PravinJ @iamshrimohan @t7support please URGENTLY intervene and coordinate to resolve this recurrent issue of tax filing using dhan

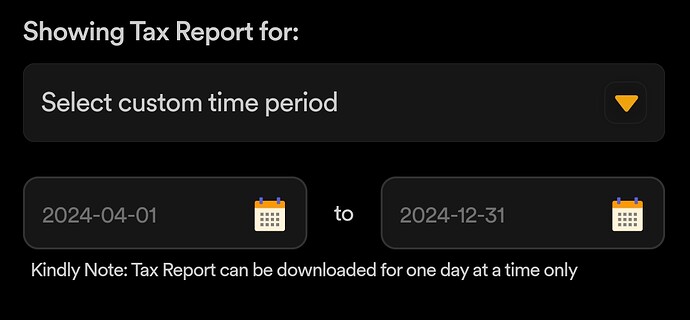

@vishaln the line means that you can download once in a day.

The time period you have chosen the data will be for the same. Just you can download one file in a day.

@iamshrimohan this restriction should not be there, if someone intends to compare their reports with previous FY or current CY then that’s not possible with this restriction.

@PankajJ Data is accurate at our end, I’ll get this checked internally with Quicko and ClearTax both.

@vishaln @Pradumya We have moved all the Reports and Statements to a new Product, Journal by Dhan which will have all the reports. There would be some download restrictions to reduce load on the servers as the data is heavy. I’ll get this checked in terms of number of downloads and update

@PankajJ Do send me your UCC over DM, ill get your case checked

Hey @PankajJ

Could you please share your tax pnl on help@quicko.com from your registered email ID, so our team can look into the issue and help you resolve the same at earliest?

We understand today is the due date to file belated / revised ITR, thus we assure you to provide a resolution at earliest once you share the tax pnl.

Thank you

@iamshrimohan please also share the link to this journal which you are referring

Go to Dhan web > Money > Left hand side 3rd option > Journal by Dhan.

P.S. - Not all users have received the access, check if you see the option then you have received the access.