July to Dec 2024: Upcoming Features on Dhan for Traders & Investors

Dear Traders & Investors,

As I write this, I am also astonished that we will be completing 3 years in a few months by November 2024. We have come this far, and it wouldn’t have been possible without the love, trust and support of our users. We still are way too small, still early in the industry and have a long journey ahead, looking back at the past 3 years - we all have enjoyed building Dhan for you. Dhan gets better every day, and it gets better with your suggestions, feedback and notes that come our way via multiple channels.

Our investments continue in Technology and Infrastructure, we continue to build and optimise DEXT (Dhan Exchange Trading System); and we also continue to enhance our Customer Service & Experience as we scale. Yes, we acknowledge that we also are far from perfect and have not met expectations of many who have asked us to ship their most requested features, products and capabilities. With all that we also continue our journey towards building an incredible experience for traders and investors in India.

We are happy and humbled that even by being an early and very small player, we have been able to set many new benchmarks in the industry by continuing shipping many innovative and industry-first features and products.

Here is a glimpse of what’s coming your way in rest of the 2024:-

1. ScanX : Find Investing & Trading Opportunities in Markets

Yes, we already announced ScanX just a few days back and we are overwhelmed by the response to it as well as flooded with many requests and suggestions to make them better. We already are at work and we expect to start shipping many of your asks and features within the next few weeks.

For now, ScanX is live for all on scanx.trade - we already have witnessed hundreds of custom scanners & screeners made and saved, and also thousands of orders executed already from the new platform. Try it, if you have not - many many exciting updates coming your way on ScanX.

2. The Journal by Dhan : A New BackOffice for all Reporting, Account Management, KYC & More

Yes, you see this right. We plan to introduce a completely new reporting system - The Journal which shall be the place to view all your Reports, Statements and Insights on your Trading & Investing activities. We don’t just stop here, but also bring comprehensive account management capabilities, your KYC and many more functionalities. This will make Dhan Web platforms lighter and faster as we move many things from here to The Journal.

3. Price Alerts on TradingView Charts

If you are lucky, we may have enabled this for you already and you haven’t realised this yet. We have started rolling out the newest updates to our Alerting systems, and the first feature that we are building on top of this is Price Alerts on TradingView Charts on Dhan’s TV console (tv.dhan.co) which is also deeply integrated and available across all our platforms. This is just the start of it, we have lined up extremely sophisticated capabilities on Alerts and we can’t wait to roll them out to you.

4. Mutual Funds in Demat Format

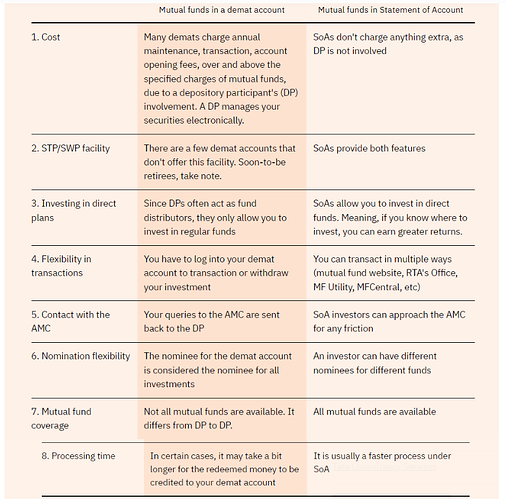

We have started with Mutual Funds in SOA format for wider acceptance and we are also glad to see the adoption so far. We have rolled out a few feature enhancements over the past few months and will continue to ensure you have a great investment experience on Dhan.

While we did that, we understand that many of our existing traders are disappointed that we do not offer Mutual Funds in Demat format for them to pledge the MF units for additional margins. We have heard from you - and we are evaluating introducing Mutual Funds in demat format, that said this is as good as rebuilding the entire stack of Mutual Funds and will take time for us to ship, but yes - this is on cards.

5. Enhanced User Experience on Dhan App

It’s been nearly 18 months now that Dhan has launched its Glass Version and it has been widely accepted and loved by many of our users. While the product and offering on Dhan has increased, we as a team feel there is a lot to do towards simplifying the experience on the Dhan App which is in the works as we write this post.

Unlike last time where we changed the user experience at one go, this time we will start shipping it from the month of September 2024 and continue to enhance the same over 3-6 months as we want our users to get comfortable with the changes and enhancements over time.

6. Super Trader Mode for Dhan Web platforms

Web experiences on Dhan have improved a lot since the start, however this year we have made things faster, better and lighter. The journey continues as our Web platforms will become more and more trader centric; we have already shippined enhancements across Web and also Charts continues as an area of focus. For the web particularly, we are experimenting with the introduction of a super trade mode (this is an internal name for this project) where we are building an integrated experience to make trading on web platforms - incredible!

Some of the recent updates to TradingView Charts like Scalper mode, Price Alerts on Charts, Enhanced watchlists, Instant Orders on Web, Dhan WiFi and more are part of the Super Trader project.

7. All New Forever Order Experience

We have always ensured we work towards providing most comprehensive order types on Dhan beyond the usual Market, Limit and Trigger orders - to start with, Dhan introduced Scalping on Charts, Iceberg Orders, Draft Orders, DDPI enabled with Forever Orders, and also Bracket, Cover and Trailing Stop Loss orders.

We have continued receiving feedback on Forever Orders by Dhan and are now working on an newer version of Forever Orders that is done grounds up and will be loved by both Investors & Traders. Coming soon your way!

8. Tracking All Mutual Funds on Dhan

We are early adopters and big believers of the Account Aggregator framework which now enables you to track all Stocks across multiple Stock Brokers on Dhan, and now also enables you to Track your Bank Balances on Dhan. We are evaluating to bring Mutual Funds as well via the Account Aggregator on Dhan which will enable you to track all your Mutual Fund investments on Dhan.

More to come…

As always, these are just a few large features and offerings that are being actively evaluated by all of us at Dhan and we expect to ship them to you in time by the end of 2024. Along with this there are many more small and medium features and capabilities that we are bringing on to you across all Dhan products & platforms - and many of them we expected to be industry first innovations.

Like we have said, our aim at Dhan is to provide you with an incredible Investing & Trading experience. All of us are working hard towards ensuring we bring to you Lightning-Fast Investing & Trading experience every day and at all times. Keep Investing & Trading on Dhan, and help us build an incredible platform for you.

Thank you,

pj