Hello everyone,

At Dhan, we’ve always believed in user convenience and transparency while we are building our products & experiences. These are principles with which we’ve built so many features for our Super Traders and Investors in our short journey of a year.

Some of them were even industry-first, like our Transaction Estimator, which allows you to view the break-up of your charges even before you place your first trade. A few months later, India’s largest exchange issued a circular mandating brokers to show the charges levied on a trade at the order placement window.

With this philosophy embedded in the way we build products, I am happy to announce today that Dhan has launched an online DDPI facility for all our users starting with the Dhan app.

What is Demat Debit Pledge Instruction?

I’m sure most of you reading this would be familiar with PoA (power of attorney). Even though it was optional, brokers used to collect PoA from their clients to debit the shares from their account. However, this was always prone to misuse, with instances of brokers debiting shares without a sell trade from the client or just breaking the clause in general.

This was aggravated by the fact that PoA gave the brokers a lot of rights, most of which the client was unaware of. So last year, SEBI introduced DDPI, which stands for Demat Debit and Pledge Instruction.

How is DDPI different from PoA?

DDPI not only limits the debit of shares to instances of a sell trade initiated by the user, SEBI has also restricted the use of DDPI for limited purposes only, the entirety of which include (as of now):

- Transfer of Securities

- Pledging/re-pledging of Securities

- Mutual fund transactions through Demat Account

- Tendering shares in an open offer

DDPI essentially replaces PoA effective from 19th November, 2022. While all of the above features may take time for the depositories to roll-out (and we will keep you posted), for now we are excited to introduce DDPI for selling of stocks from your demat account, post which transfer of securities on selling for settlement will happen with DDPI.

How to activate DDPI on Dhan?

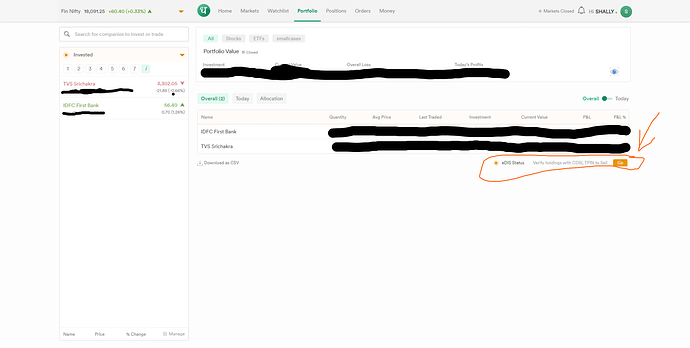

- Go to your Portfolio section in your Dhan App

- Head to Manage Portfolio

- Click on “DDPI for Fast Sell”

- Follow the on-screen instructions, which would require you to eSign using the Aadhaar-based OTP validation (this ensures security of your account)*

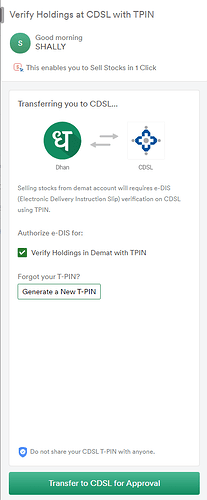

Of course, we have made the process very simple and intuitive; we understand a lot of our users do not want to go through CDSL’s OTP or T-PIN based e-DIS process every time they wish to sell their holdings.

So whenever you decide to sell your holding, you will be prompted with two options:

- Sell via the usual route, entering the OTP and T-PIN when we transfer you to CDSL screen

- Opt for “Fast-Sell via DDPI”, where you would be prompted to complete the eSign process and opt-in for this service.*

The next time you decide to sell your holding (once DDPI is activated), you will be able to instantly sell, without the need to go through CDSL flow for EDIS / TPIN verification.

Why is DDPI chargeable?

Dhan is possibly the first Stock Broking platform in India to introduce an online DDPI facility for its users. This has required us to invest significantly in the infrastructure to support this, including procuring stamp papers, handling and transportation charges, then scanning and digitising the entire process as well. We also support Aadhaar-based eSign to ensure security, where we incur some cost as well.

Our goal remains to provide user convenience, for which we are providing this service at cost, at ₹100. We believe that this is going to help a lot of our Super Traders and Investors. A gentle reminder to our users that Dhan does not charge any brokerage for Delivery transactions or any AMC for Demat Account, and with that we are offering DDPI at cost itself. This is also one time charge for DDPI to set up, post that the service continues to be free for Lifetime.

In fact, selling stocks without a T-PIN based e-DIS process is only one of the benefits of opting for DDPI. Going forward, you would also be able to:

- Sell MTF (Margin Trading Facility) holdings with ease

- Unlock Forever Sell orders for Equity (coming soon)

- Unlock Forever Sell orders for MTF (coming soon)

- Unlock OCO orders for Equity / MTF (coming soon)

A few important things to note:

- Kindly enter the same Aadhaar number which you had used while onboarding on Dhan.

- It usually takes 24 hours for DDPI to get activated after you complete the e-Sign process. We will send you an email when it is activated successfully.

We would love for you to try this out and experience it for yourself. Do let us know in case of any feedback at feedback@dhan.co

– Hardik,

Product at Dhan.