Dear Investors,

At Dhan, we are building for the long-term and over a period of nearly two years we have built and introduced incredible features for Long-Term Investors.

We can name a few of them - starting with ability to marking stocks for long-term, offering investing in Smallcase for free, Dividend Income tracking, real-time portfolio analytics, dedicated view for ETFs, daily / weekly or monthly SIPs in Stocks, tracking multi-baggers separately, automatic tracking of portfolio stocks via Invested watchlist; and many more like these.

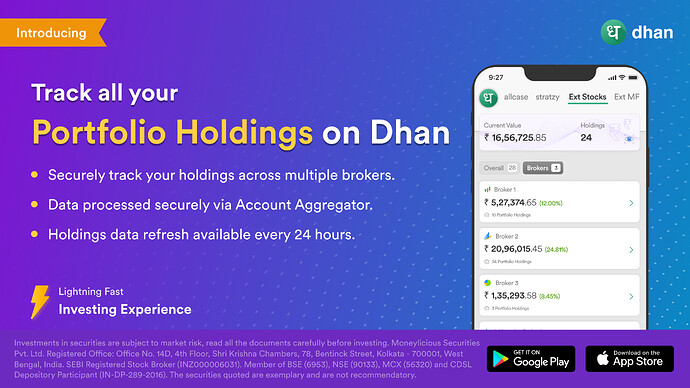

Today, I’m extremely glad to announce that from now you will be able to track your Portfolio Holdings or Shares across all Stock Brokers on Dhan. You can have a consolidated view of all the stocks across all Stock Brokers, view them by individual Stock Broker and most importantly track Current Value of these holdings in real-time.

This is powered by the Account Aggregator (AA) framework, making Dhan once again one of the first Stock Trading & Investing platforms to introduce this to its users via AA. This is fully digital, takes less than a minute and no more need to add data manually, upload any statements or provide access to your email. It is completely digital, real-time and only available for Investors & Traders on Dhan.

Enabling this and tracking all your stocks on Dhan is extremely simple and fast to do, with just a one time set-up which will take you less than a minute.

- On the Dhan app, simply tap on Portfolio - you will find the option in “All” (at the bottom) or in the “Ext Stocks” tab.

- Tap on Start Tracking!

- Once you start this journey, you will be prompted for an OTP to register you with our partner Account Aggregator!

- We will now securely discover all your accounts linked with depositories (CDSL or NSDL or both)*

- Once your accounts are discovered, you need to provide a consent to track them!

- We will notify you as soon as the details of your accounts are fetched.

Here’s a detailed video on how to track your external stocks:

While we’re one of the first brokers to launch this, we’ve also made sure to enable some industry-first capabilities on top of just viewing your external portfolio:

View your consolidated Stock / Portfolio holdings in one place:

Let’s say you love ABC Bank stock and you’ve bought different quantities of the same stock across multiple brokers. You can now view the total value of this stock in one place, at a consolidated level or also in the individual Stock Broker.

Invest more directly from your External Portfolio:

If you want to buy more of ABC Bank stock right on Dhan, simply click on the stock and the company page will open up with more details. Use our powerful “Insights” section to unlock more details of your Portfolio.

All Data in Real-time and Lightning-Fast:

During market hours when we receive exchange feed, your external portfolio valuation will be updated in real-time to reflect current market prices, at lightning-fast speeds.

This is just the first phase of what we’re planning to achieve via Account Aggregator on Dhan and we have much more incredible features lined up in the coming days.

…

Learn more on Account Aggregator Framework:

While we are on this topic and introduce one of the most powerful features on Dhan via the AA (Account Aggregator) Framework, let’s talk a bit more about this. As you all might be aware, India has been making some massive strides with its Digital Public Infrastructure or DPI or India Stack as it is called now. This serves as a vehicle for financial and social inclusion and includes solutions across Identity (Digilocker, Aadhaar, eSign), Payments (UPI), Data (Account Aggregator) and other Open Networks (OCEN, NDHM).

As a user, you must have already experienced how our onboarding and fund transfer processes leverage the “identity” and “payments” infrastructure of India Stack. Majority of our payments are made via UPI; when you are on-boarded, your KYC is authenticated using DigiLocker, your onboarding documents are e-Signed using Aadhaar authentication, your Bank Accounts are verified via UPI and more such use cases. These integrations make your journey - simple, fast, 100% digital and more importantly safe and secure.

The next phase of using India Stack is to provide you greater access to your own data. This is possible through Account Aggregator. For the uninitiated, an Account Aggregator (AA) is a type of RBI regulated entity that helps YOU securely and digitally access and share information from one financial institution to any other regulated financial institution in the AA network… and this is done only with YOUR consent!

Do experience this today by tracking all your Stocks on Dhan now and let us know if you’ve discovered any forgotten gems in your portfolio!

Download the latest app of Dhan, and get started with your journey with us. As always, drop in your suggestions at feedback@dhan.co

Thank you

-Anirudha Basak

Product at Dhan

FAQ:

Q1. I completed the entire process but it says “No accounts found”!

A1: If you have portfolio in another broker but you’re receiving this message, please verify the following:

(a) The broker should be using CDSL as a depository.

(b) The mobile number registered in the other broker should be same as on Dhan

(c) The other demat account should contain portfolio (and not ETF)

If you continue to face issues, please reach out to us.

Q2: When can I start tracking NSDL accounts?

A2: Support for NDSL accounts will be coming soon. Here’s a quick way to check your depository: If it starts with “IN”, the broker is registered with NSDL. CDSL demat ID (or BO ID) is a 16 digit number, with no alphabets.

Q3: I can view all my brokers, but I’m unable to view some of my stocks.

A3: While this is a rare scenario, we’ve often observed that some unlisted stocks or REITs may not appear on your external portfolio. We get this information directly from your depository and if you feel it is incorrect, please reach out to us and we will promptly raise a ticket with them.

Q4: How can I delete or remove my external portfolio?

A4: While we provide an option to deny consent before you start tracking your external portfolio, we will soon provide support for revoking your “consent” after you’ve completed the process as well. Meanwhile, kindly reach out to customer support if you have any specific concerns about sharing this information.