Hello everyone,

Hope the year 2024 has started well for you. At the end of last year, we had already published our focus for 2024 for you and we are starting our year by delivering on the promises made.

From the time we launched Track all your Portfolio Holdings three months ago, we’ve had over 10,000+ investors actively using it to view their Portfolio across Stock Brokers. We loved the fact that our users have been super happy with this integration and moreover, many users even transferred their shares after they experienced the real-time insights that we offer on stock holdings or portfolios that are exclusively available on Dhan.

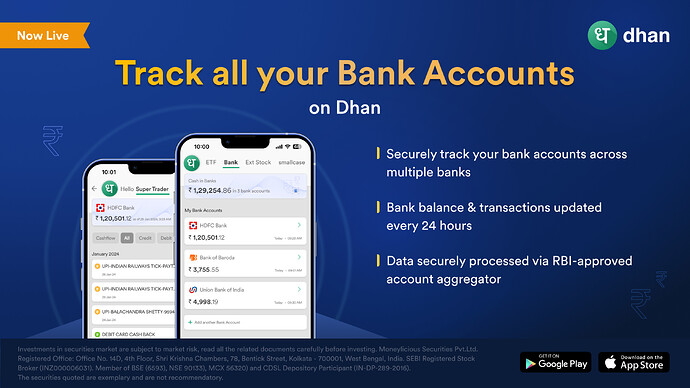

Investors and Traders, both are very sharp on their finances and financial decisions. More than often we have heard investors talking about allocation, diversification, money management and more; all these conversations start from the basic tenet of - ideal cash that is available in their Bank Accounts. Building on these insights, and the fact that at Dhan we are always building our platform for Long-Term Investors and Super Traders - we are now introducing the capability to track all your Bank Accounts on Dhan!

We’re powering this via Account Aggregator, a technology marvel (part of India’s Digital Public Infrastructure) that allows us to fetch data from any financial information provider (FIP) and present it to you in an easy-to-understand format post your consent, so that you can track all the things that you care about, right here on Dhan.

Enabling this and tracking all your banks on Dhan is extremely simple and fast to do, with just a one time set-up which will take you less than a minute.

- On the Dhan app, simply tap on Portfolio - you will find the option in the “All” tab (scroll down to find “Cash in Bank Accounts”) or in the “All Banks” tab at the end

- Tap on it, and you will first be asked to choose the banks that you want to connect on Dhan - you can choose one or multiple banks at the same time

- You will then be prompted for an OTP to register you with our partner Account Aggregator. We will now securely discover all your bank accounts linked with the selected banks

- Once your accounts are discovered, you need to provide a consent to track them. We will notify you as soon as the details of your accounts are fetched.

Although we aim for you to access all your financial information through Dhan, we also strive to enhance your investment experience through this.

For example, once you connect your bank account, we will show you insights on this information, just like we do for your Stocks and Mutual Funds. We’re starting with showing your monthly cash flow, where you can quickly view the movement of your funds. To understand how this functions, you can watch this video as well!

Do experience this today by tracking all your Banks on Dhan now and let us know how you like the experience! As always, drop in your suggestions at feedback@dhan.co.

Thank you,

-Anirudha Basak

Product at Dhan

Frequently Asked Questions:

Q1: I don’t see my bank in the list provided. What should I do?

A1: This list has been curated based on the banks which are technologically ready or stable on the Account Aggregator platform. While the full list is available at this site, please note that some banks may be live on the platform, yet have stability issues (such as SBI).

Q2: I have already done this process to track all my stocks. Do I need to do it again for banks?

A2: Yes, we’ve established distinct consent processes for both banking and stock-related activities. When we introduce mutual fund tracking in the future, you’ll need to provide separate consent for that as well. This decision is mainly driven by two factors: firstly, due to the sensitive nature of this information, we want users to clearly understand why they are granting consent for us to retrieve and furnish such data. Secondly, our user base is diverse, and preferences may vary; for instance, someone interested in tracking stocks might not necessarily want to monitor their banks or mutual funds on our platform.

Q3: I got an error message “No accounts found”.

A3: This could happen under the following scenarios:

(a) The bank is temporarily unavailable and is unable to provide a response

(b) The bank account is a joint account (joint accounts are currently not supported on the Account Aggregator platform)

(c) The mobile number registered in the bank should be same as on Dhan

(d) You only have fixed deposits in the bank (we only support savings and current accounts)

(e) You have already linked your bank accounts on another app which uses the same partner account aggregator as we do. Kindly contact us to know how to troubleshoot this.

Q4: I am able to see my bank, but it is showing “Syncing” or “Fetching your bank details”.

A4: Sometimes, we are able to successfully discover and link your bank account immediately, however the related data (account balance and transactions) may take some time to fetch or sync (depends on the bank and account aggregator). In this case, you may see this tag associated with the respective bank account. Do not worry, we will update you via notification and email when we have successfully fetched all your details.

Q5: Is my data secure? How can I remove it?

A5: Yes, 100%. Your transactions and balances are not visible to anyone on Dhan - we will only fetch and display information as and when you request for it. As of now, you can send us a request at help@dhan.co and we will provide you with the steps to revoke your consent and delete all data with us.