About Scoda Tubes:

Scoda Tubes Limited, based in India, is a stainless-steel tubes and pipes manufacturer with over 14 years of experience. It offers seamless and welded products across five categories, including “U” tubes and instrumentation tubes. Serving industries like oil and gas, chemicals, and power, the company operates a 20,000 MT per annum hot piercing mill for backward integration. It also generates revenue through job work services such as annealing, pickling, and marking, enhancing production efficiency and reducing reliance on external suppliers.

About the Industry in which Scoda Tubes operates:

Global demand for stainless steel tubes and pipes rose from 2.7 million tonnes in 2019 to 3.1 million tonnes in 2023, growing at a CAGR of 3%. Of this, 80–85% was for welded variants, and 15–20% for seamless ones. In India, demand grew from 0.23 million tonnes in FY20 to 0.32 million tonnes in FY24, with a CAGR of 9%. It is projected to reach 0.45–0.47 million tonnes by FY29, driven by growth in construction, automotive, oil and gas, and chemical industries.

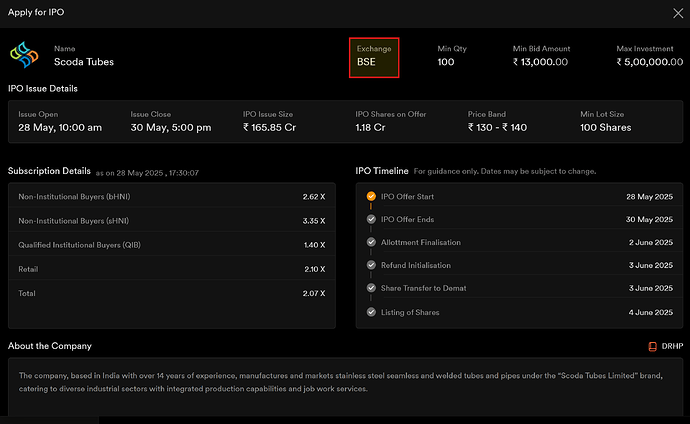

| Important Information and Timelines of the IPO of Scoda Tubes: | |

|---|---|

| Open Date | 28 May 2025 |

| Close Date | 30 May 2025 |

| Total Issue Size – Number of Shares | 15714286 |

| Minimum Bid Price | 130 |

| Maximum Bid Price | 140 |

| Lot Size | 100 |

| Basis of Allotment | 2 June 2025 |

| Initiation of Refunds and Credit of Shares to Demat | 3 June 2025 |

| Listing Date | 4 June 2025 |

| Listing Exchange(s) | NSE and BSE |

Minimum and Maximum Lot Sizes for the IPO of Scoda Tubes:

| Category | Lots | Shares | Amount (in ₹) |

|---|---|---|---|

| Retail – Minimum | 1 | 100 | 14000 |

| Retail – Maximum | 14 | 1400 | 196000 |

| sHNI – Minimum | 15 | 1500 | 210000 |

| sHNI – Maximum | 71 | 7100 | 994000 |

| bHNI – Minimum | 72 | 7200 | 1008000 |

Objective of the IPO of Scoda Tubes:

The company intends to utilize the net proceeds for the following purposes:

-

Capital expenditure to expand production capacity of seamless and welded tubes and pipes

-

Funding part of the incremental working capital requirements

-

General corporate purposes

Financials of Scoda Tubes:

| Particulars | 9M Ended Dec 31, 2024 | FY Ended Mar 31, 2024 | FY Ended Mar 31, 2023 | FY Ended Mar 31, 2022 |

|---|---|---|---|---|

| Equity Share Capital | 441.95 | 12.84 | 12.84 | 12.84 |

| Net Worth | 1,435.46 | 636.12 | 453.11 | 349.78 |

| Revenue from Operations | 3,611.71 | 3,998.61 | 3,051.28 | 1,940.28 |

| Total Borrowings | 2,021.64 | 2,026.63 | 1,393.08 | 1,098.95 |

| PAT | 249.14 | 183.00 | 103.36 | 16.36 |

| EPS (Basic & Diluted) | 6.08 | 4.60 | 2.60 | 0.72 |

| NAV per Equity Share | 32.48 | 15.99 | 11.39 | 8.79 |

For more details on the IPO, refer to the DRHP here.

Did you know that you can now Pre-Apply for an IPO on Dhan? You can place your IPO Bid on Dhan and the order will be pushed to the Exchange as soon as the Bidding starts for Scoda Tubes. You will receive a UPI mandate after 10:00 AM on 28 May 2025.

###1. How to apply for the IPO of Scoda Tubes on Dhan?

You can apply for the IPO of Scoda Tubes from either Dhan Mobile App or Web

On Dhan Mobile App you can find the IPO under the Money Section > IPO Tab

On Dhan Web you can find the IPO under Markets Tab > IPOs

###2. In case of successful allotment, when the IPO shares of Scoda Tubes be visible on Dhan?

The CDSL will intimate you regarding the credit of shares into your Demat account by 3 June 2025. However, you will be able to see the shares of Scoda Tubes on Dhan before the market starts on the listing date which is 4 June 2025.