Key Measures Proposed by SEBI to Curb Derivatives

-

Objective

- Enhance investor protection and promote market stability in derivatives markets while ensuring sustained capital formation.

-

Changing Market Dynamics

- Introduction of weekly index options contracts and increased speculative trading volumes on expiry dates.

- Significant trading activity and volatility observed on expiry days.

-

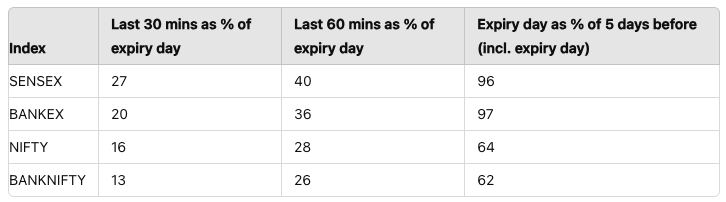

Key Data Points

-

Measures Proposed

-

Rationalization of Strike Price for Options

- Introduce a uniform strike interval around the prevailing index price.

- Limit the number of strikes to not more than 50 at the time of contract launch.

- New strikes are to be introduced daily as per the defined intervals.

-

Upfront Collection of Options Premium

- Mandate upfront collection of options premium from buyers to avoid undue intraday leverage.

-

Removal of Calendar Spread Benefit on Expiry Day

- Remove margin benefit for calendar spread positions involving contracts expiring on the same day.

-

Intraday Monitoring of Position Limits

- Implement intraday monitoring of position limits for index derivative contracts by clearing corporations/stock exchanges.

-

Minimum Contract Size

- Phase 1: Minimum value of derivatives contract at the time of introduction to be between ₹15 lakhs to ₹20 lakhs.

- Phase 2: After 6 months, minimum value to be between ₹20 lakhs to ₹30 lakhs.

-

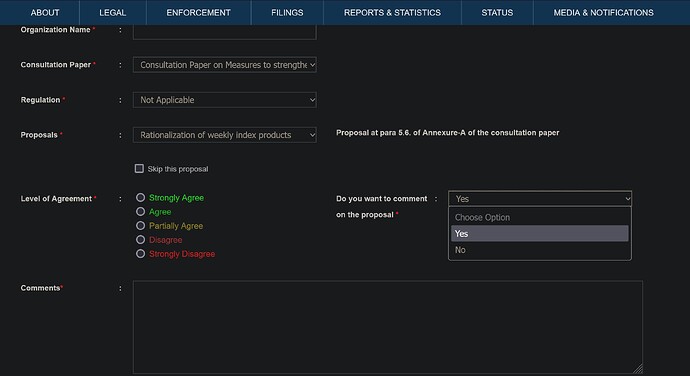

Rationalization of Weekly Index Products

- Provide weekly options contracts on a single benchmark index of an exchange to reduce speculative trading.

-

Increase in Margin Near Contract Expiry

- Increase Extreme Loss Margin (ELM) by 3% on the day before expiry and an additional 5% on expiry day.

-

Rationale Behind the Measures

- High speculative activity, particularly on expiry days, poses risks to market stability and investor protection.

- Most individual investors incur losses, highlighting the need for enhanced regulatory measures.

-

Expected Implementation

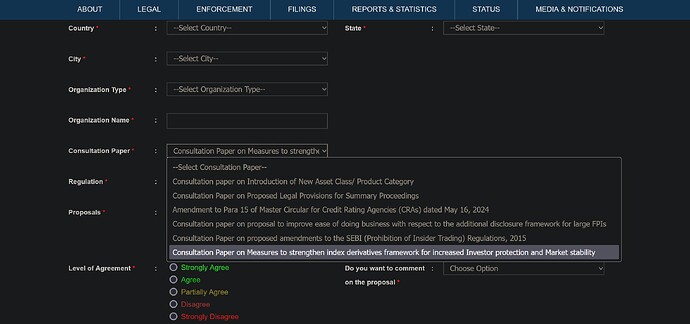

- Public comments and suggestions are invited until August 20, 2024.

- Measures to be implemented in a phased manner to ensure smooth transition and compliance.

These measures aim to strengthen the derivatives framework, ensuring a more stable and investor-friendly market environment.

Here’s the full link to the consultation paper.

What do you think? Will the measures help in curbing derivatives trading?

2 Likes

This total restriction are for only index derivatives or for stock derivatives too?

Compulsive F&O traders will shift to Cash-Intraday. There’s no stopping them! But those that play with low capital will find themselves in a bind!

1 Like

Very good decision by SEBI, we welcome the decision. People will less capital enters in market without risk management and doing losses it will restrict those people who are just speculating, only experienced trader will take risk in index option, brokers are also earning huge brokerages on frequent trading by novice traders.

So very good decision.

Dont know what sebi is thinking,these changes will only help to keep low capital traders out of the market…so does it means only people with small capital are the speculators??.. This will only help increase the risk for option buyers… …somebody whoes losing few thousands now, will be loosing in lakhs due to increased lot size… Now any body can learn options trading with small capital… But if these changes are implimented only the rich will trade… Very Dissapointing…

2 Likes

what do mean by experienced? in any market no one is experienced. do u know that even HNI, FII & DII has losses? & how do u mean that some would get experience in “options trading” with doing actual trading?

government just want to earn free money, if they don’t allow low capital that mean u should bring large capital & loose ur money so that broker & goverment is in profit…

so u r wrong

3 Likes

Experienced means those who know the maths of option, do you know lots of novice traders are just option buying very frequently and making losses in my neighborhood a person lost 40 lacs in index and got suicide. There are lots of students in 12th class, graduation from villages or small towns they don’t know anything about options but doing trading because of quick rich mindset and unemployment and there focus shifted from study and job preparations.

And by doing this step it’s loss of taxes to government obviously.

So just shared my view not a point of right or wrong.

1 Like

Speculative information from Twitter community.

✓Weekly expiry:

Nifty: Every Thursday

Sensex: Every Friday

✓Monthly expiry:

Midcap: 1st Monday

Bankex: 2nd Monday

Finnifty: 3nd Tuesday

Banknifty: 3rd Wednesday

1 Like

If this is the move. I don’t understand rationale behind different days. Why can’t they have uniform expiry day either on thursday or friday ?

SEBI and exchanges know that having uniform expiry day means most volumes are confined to nifty and bank nifty other will may not see volumes during the expiry day.

Just around 43 lakh active retail option traders…ones who trades everyday may be 25% of that. How putting hurdles before them will affect market stability am yet to fathom. Is retail affecting market stability or the HFTs in collocated space pumping in money at high frequency and with faster, deeper insight into price and order flow affecting the stability ?

Speculation will simply move to cash market, online gaming, dabba trading and crypto. People are losing more money in some of these segments already than in the option trading segment. Delta Exchange is also in India offering daily expiry crypto option contracts. Trading and speculation keep the whole ecosystem liquid. I would have let the market filter out the right products. Also, very few people invest in to stocks for life. Mostly so-called investors are swing trading stocks even in delivery mode. The time frame may vary that’s all.

Also, increasing the margin will take away small-cap retail from the market. When I started in 2007 the talk was to boost retail participation. There were mini Nifty contracts for ease of entry. So this is a regressive move to keep away small-time players. Trading is a game of chance and skill. The market will easily filter out those who can make their way around the market from those who cannot. We don’t need externally induced barriers for the same.

If the goal is to push more money to SIPs with 76% of MFs underperforming the benchmark index and benchmark index on an average giving 14.8% TR (after suffering through bear market drawdowns which can be as much as 60% ) by riding down trading activity am not in sync with it. Note that a risky corporate bond may give a rate of return like this (Less risk than equity and fixed income). One puts money in G-sec, pledges it and plays low-risk far OTM intraday Option selling on expiry days may do better than this.

But what I say doesn’t matter  What SEBI says matter

What SEBI says matter

On a personal front, none of this is going to affect me. I have the capital to navigate around the proposed regulations if it is enforced. But I feel for the small guy who wants to make it big. Unfortunately, it is not going to be the market who will judge your merit to be in the market.

2 Likes

Are bhai aap bhi kabhi fresher the na. Aapko achanak se experience agaya. Aaj jab middle class people ko stock market ki value samaj aayi toh participation bada hai. Slowly and steadily sikhe jayenge dheere dheere. But agar seedha restrictions he daal deng then i can say pehle angrejo ne hume daba k rakha aur aaj khud humare bade leaders he hume daba rahe hai

1 Like

It is retrogressive step. Trading, by nature, is a speculative activity and it doesn’t help saying it should be discouraged.

In my opinion, people don’t hold positions over few days and instead indulge in too much intra- day trading, which in my opinion is not a healthy scenario. While speculation is not bad in itself, it’s the approach to trading, that needs to change. SEBI should take some measures to discourage intra- day trading.

I’m not for SEBI policing and eliminating play of individual players, that’s a retrograde measure.