Less liquidity, lower volatility in stock price movement very much possible if institutional money is sucked out from day trading IMO.

Can we(retail) short stock in intraday and square-off at EOD? What are the implications? I was thinking to create a new intraday shorting strategy but now I am unsure if I can do that and is there something which is needed to be kept in mind? @iamshrimohan

@iamshrimohan bumping this again in case you missed

@GalaticX yes agree to that! Short selling is a way to of clean up but unfortunately in a developing market like India, if not regulated can bring in disasters! Not every company can have an AJ to fight against the bear cartel (Those who know, know! ![]() )

)

However the implication of this is just reporting from the Broker’s perspective, one additional step. Nothing impacting the client. Institutions were using this when there was T+2 settlement in place. Short on Monday, Borrow from SLBM on Tuesday (SLBM has T+1 settlement) and Wednesday, fulfil the obligation. This is not the case now!

@t7support yes, post sept 2020, PDs mainly do arbitrage of Cash and Future, its them who provide a liquidity in the market.

@sv28 Apologies, for missing out on this. Yes u can, no major from the client perspective. Its mainly on broker, who needs to report any naked short positions (which by default gets reported to them via auction but they are planning to introduce a new reporting for this as well).

Thanks for clarity here @iamshrimohan .

For confirmation, auction will happen ONLY if the short is not covered by 15:20 the same day. Is this correct?

@sv28 Yes. However, an edge case here it may also happen if the security hit circuit. For example you short ABC and the security gets locked in upper circuit.

@PravinJ @iamshrimohan can you supplement with some data to help us understand how it will impact liquidity?

“No institutional investor shall be allowed to do day trading i.e., square-offtheir transactions intra-day. In other words, all transactions would begrossed for institutional investors at the custodians’ level and the institutions would be required to fulfill their obligations on a gross basis.The custodians, however, would continue to settle their deliveries on a netbasis with the stock exchanges” Line item 4.

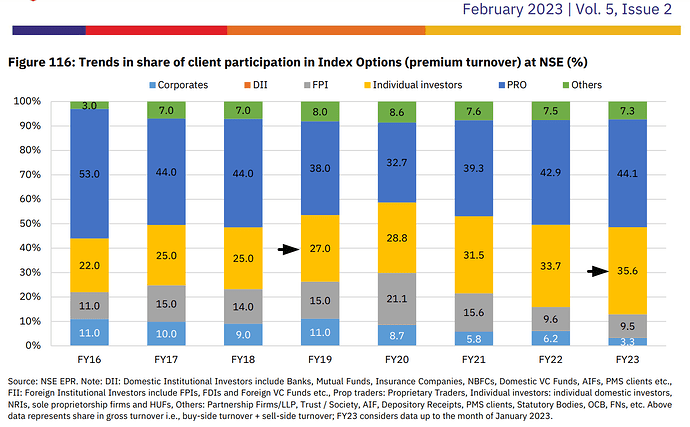

Before this circular - what percentage of DII or FII were doing intraday trading? Of the total volumes we see in FnO - what % comes from institutions?

Hi @viswaram NSE keeps sharing detailed reports on their website every quarter. Recently @KirubakaranRajendran posted some insights based on it - https://twitter.com/kirubaakaran/status/1746793396084338838

He did not mention Institutional DII, FII speculation. The current SEBI circular does not affect the prop desk and PMS services - please correct me if I am wrong.

This is excellent. I think this will eliminate unwanted spikes or injections which we’ve been seeing a lot in the market lately.

I do not subscribe to this view.

The spikes you see are due to a lack of liquidity not due to the abundance. If the volume of speculation goes down - the freak trades will go up.

Also the bid/ask spread will go up if liquidity goes down - hence more slippage.

I requested data from @PravinJ to understand on a percentage level how much of the FnO volume comes from the institutional desk. If It is more than 30%, then even the backtest data for the last 5 years will become useless.

@t7support - what do you think?

The circular says about banning cash market intraday short selling for institutions only. FnO is out of picture.

Agree

If you are backtesting theta decay strategies with historical option data the dynamics could change with nature of orders (manual to algo), participant change (retail or institutional) etc. If you are backtesting on spot based on some math model it is unlikely to be affected.

The report is here: https://nsearchives.nseindia.com/web/sites/default/files/inline-files/Market%20Pulse_December%202023.pdf

Let us try to brainstorm and explore the possibilities here.

Assume there is an Indian listed company “ADN” that trades at 4200 rupees. And then there is a US-based research company “HIN” that feels ADN has done stock manipulations or fraud.

HIN would like to go short on ADN, the available choices with them are

- Buy any PUT options below 4200.

- Sell any call options (ITM, ATM or OTM) based on their confidence.

- Get into a short position of ADN by SLBM (intraday or positional).

- Short sell ADN ADR in US.

Depending on the credibility of the research firm or the public’s awareness of the fraud done by ADN, there is a high possibility that the share price could fall from 4200 to say 1000.

If SEBI intends to restrict further activities like these, they have to work on points 1 & 2. If the current scope of the document is just on EQ short-selling ban (intraday of point 3) - it will not have real impact.

Point 4, I believe is above SEBI’s jurisdiction.

I think in a free market the regulator will just ensure a level playing field for everyone. They are unlikely to do anything on 1 and 2.