Hi All,

We hope you had a fantastic 2024!

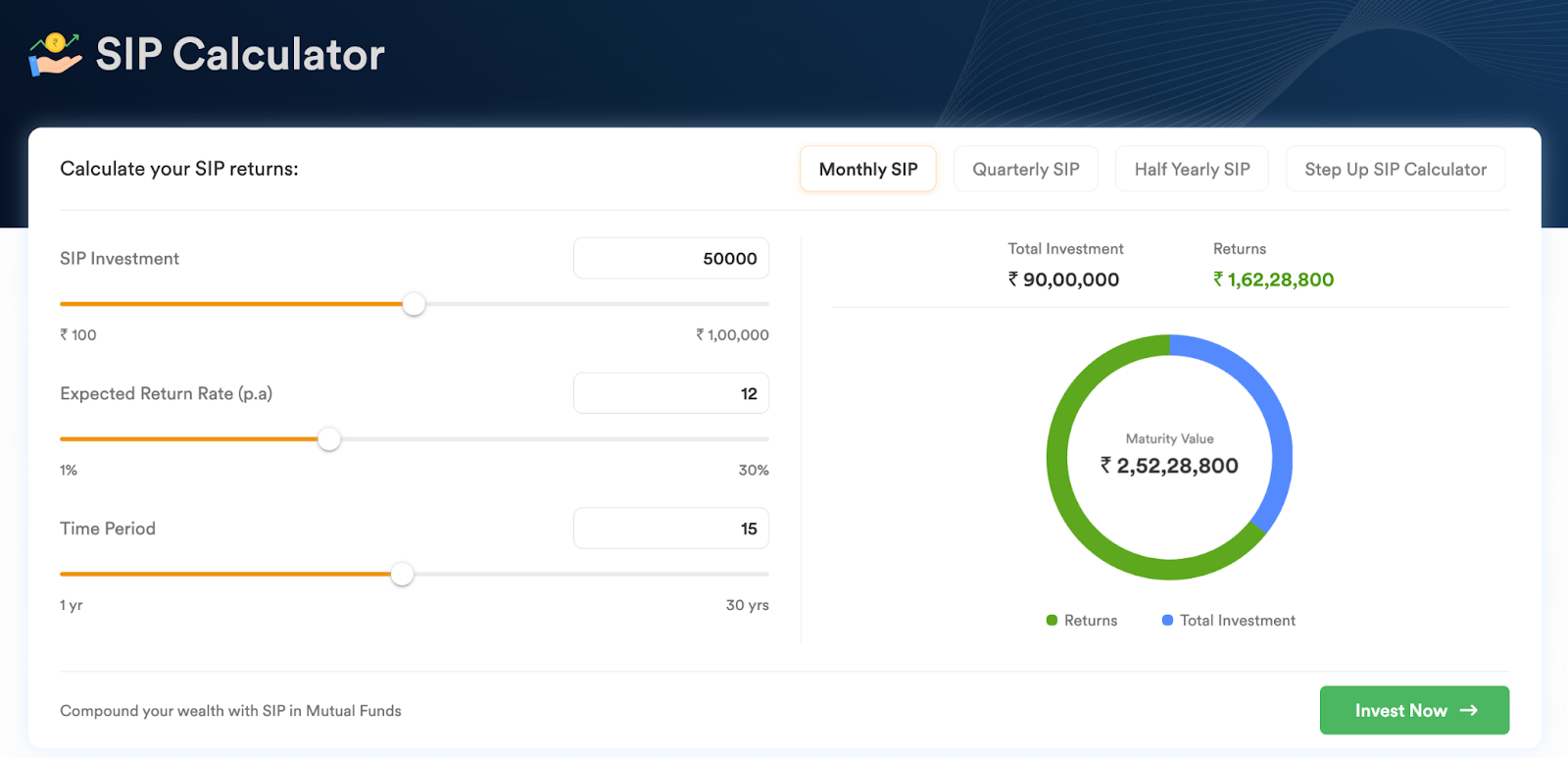

To make 2025 even more interesting, we have brought some engaging additions to our new SIP Calculator.

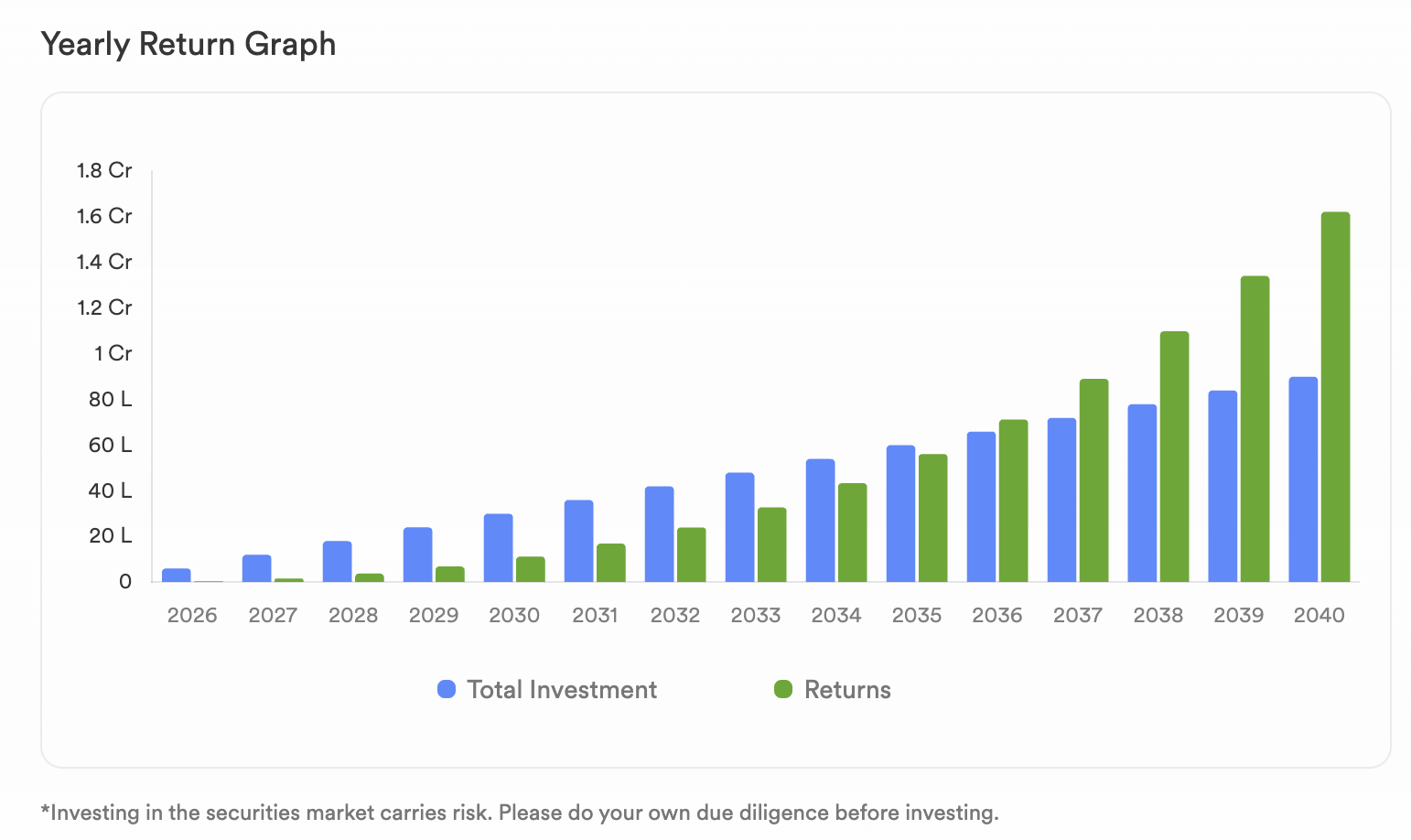

- Graph for Visualization of SIP Growth

Visualize the YoY growth of your Investments and Returns through graphs based on your period.

Snippet straight from Dhan’s SIP Calculator

Here you can experience the Magic of SIP that investors always speak about. This usually happens after 10-12 years (if the returns are good) of SIP investments. After a point, your returns will exceed the investment value - truly a financial triumph, right?

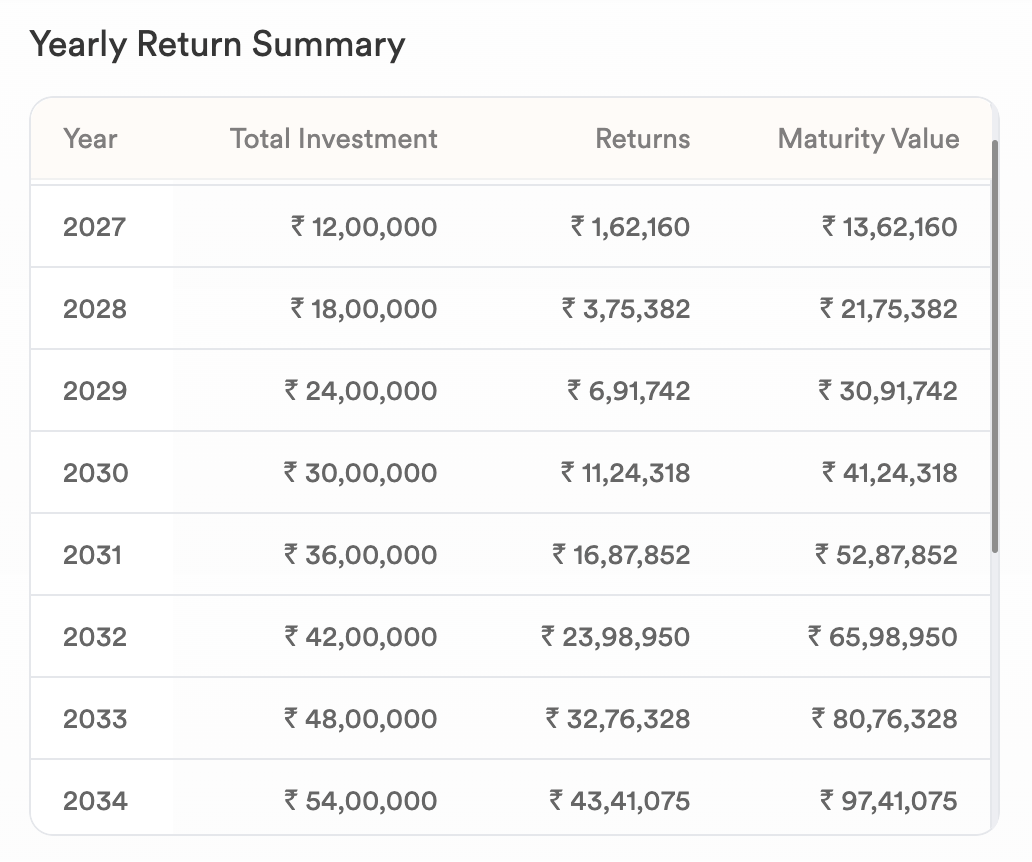

- Yearly Insights with Detailed Breakdown

Want something more than a graph? We heard you! This table breaks down SIP investments, returns, and maturity cumulatively over time.

We have taken ₹50,000 as monthly SIP at 12% growth p.a. for 15 years

Want to see how your investments would look halfway through the period? Halt in between, check your figures, and you are good to go!

Planning to invest in 2025? Do use our SIP Calculator.

Let us know what you think! Happy Investing

3 Likes

Great work @SuketuGala !

The chart and table breakdown is helpful to visualize the returns.

Feedback:

It would be even great if you could add “Inflation” as a parameter in the configuration section and set it’s default value to 6%. May be you can also add a toggle to enable/disable the calculation of “Inflation adjusted returns”.

In the yearly returns table, you can add a column for inflation adjusted maturity value. This way people can know the real “present value” of their future returns.

I completely understand that having this inflation adjustment can be discouraging to a lot of investors as the inflation adjusted “present value” will show lower values.

However, I am giving this suggestion here because I believe unlike other brokers and banks, Dhan really cares about spreading investor education initiatives with their userbase and having these “inflation adjusted” values will definitely help retail investors to know the real worth of their money in the future. Traditional brokers and banks will always advertise mutual fund SIPs with catchy slogans like “Crorepati bano 15 saal me” but they won’t tell you the inflation part as that’ll hurt their sales.

Reference: https://sipcalculator.in/

@PravinJ I am sure you’ll agree but whether to implement this or not is totally your call.

The Yearly Return Graph seems to confuse some people, likely because the labels don’t make the information clear. I spent 5 minutes trying to understand it and still couldn’t. Could you ask 5 random coworkers if they can explain the graph to you?

Hi Shashank,

Thank you for your valuable feedback.

We will incorporate it in the coming days.

Hello,

I am very sorry to hear that you faced this problem. Allow us some time to re-run it through our team members. In case of any discrepancies, we will get them corrected.

We heard you

You can check our newly launched SIP Calculator with Inflation on Dhan.

Please do let us know your valuable feedback. Happy Investing!

2 Likes

![]()

![]()

![]()

![]()

![]()