Hi @Sameet @iamshrimohan ,

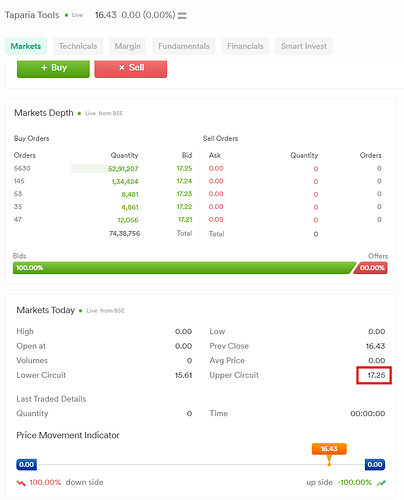

Just a question out of curiosity that whenever an interim or final dividend is declared on the ex date the stock price gets adjusted as per the dividend amount declared but in case of special dividend like in case of taparia tools wherein 70 rupees dividend was declared with share price around rupees 15 then in this scenario will the stock price be adjusted…

Any one from dhan team please reply on the query @Sameet @iamshrimohan

@ARVIND1 In the case of equity, there is no impact on the scrip value, as the dividend is directly credited to your registered bank account. However, incase of F&O, the special dividend also get’s adjusted. You can also refer NSE CA adjustements.

I hope this information is sufficient and aligns with your query. If anything is unclear, please let us know, and we will be happy to provide further clarification or connect with you for more details.

Hi @sheetal ,

You can check the image shared wherein I’ve read in zerodha that the equity scrip price also drops to the extent of the dividend declared on the ex date so need clarification on this matter @Sameet @iamshrimohan

Here’s how it goes: when a company announces a dividend, the value of each share usually falls by that dividend amount. This happens because once the company pays out its cash reserves as dividends, the overall value on the balance sheet changes from what it was before.

You’ve asked a great question in this discussion that caught my attention, too. Let’s say a company’s share is priced at 15 rupees and it declares a dividend of 70 rupees. Normally, we would expect the share price to drop by that same amount. But since a share can’t go below zero, how does that really work?

These are the kinds of questions that someone with real investing experience can answer. I think the best person to help us here is @iamshrimohan, who seems to have a good grasp on this.

I’ve also brought up some real-life questions about fundamental variables before, but not all of them have received clear answers. I believe @dhan should try to attract / invite more knowledgeable contributors with real-life experience in market fundamentals, so that everyone can benefit from this knowledge.

@Brishide @ARVIND1 The dividend effect is valid only in a very high liquid stock where the participation is more. More participation leads to maintaining the demand and supply. So basically the price does not fall, its the buyers who quote less price and sellers also comfortable at that price as they have already been eligible for the dividend.

@iamshrimohan Then why aren’t buyers quoting such rates for stocks like Taparia tools where the final dividend was declared 70 rupees which was way higher than CMP

@ARVIND1 Its because of the circuit filters rule at the exchanges.

Thanks @iamshrimohan for the clarification