While the world has admired China’s rapid economic transformation — its high-speed trains, sprawling infrastructure, and dominant tech firms — the stock market has told a very different story.

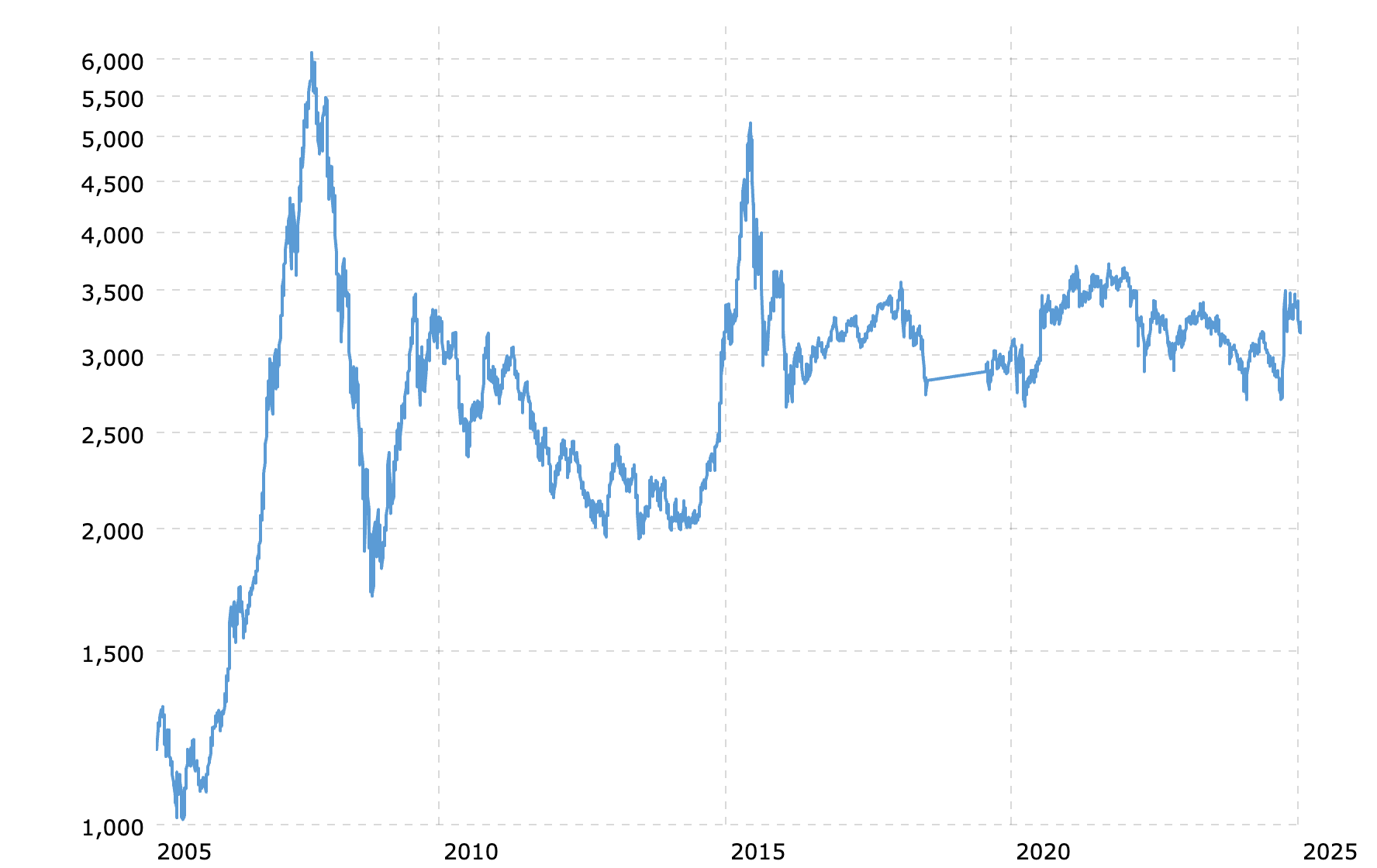

Despite becoming the second-largest economy globally, China’s stock market has delivered nearly zero returns to investors since 2007.

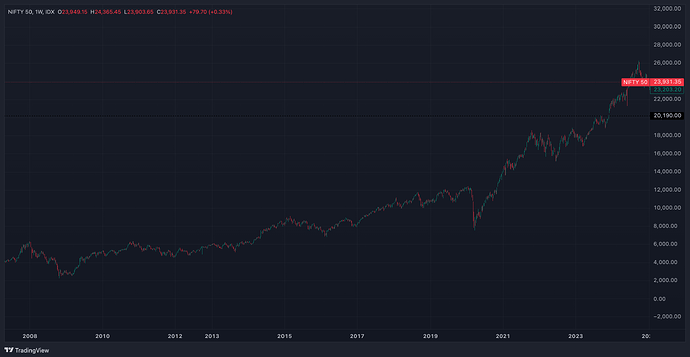

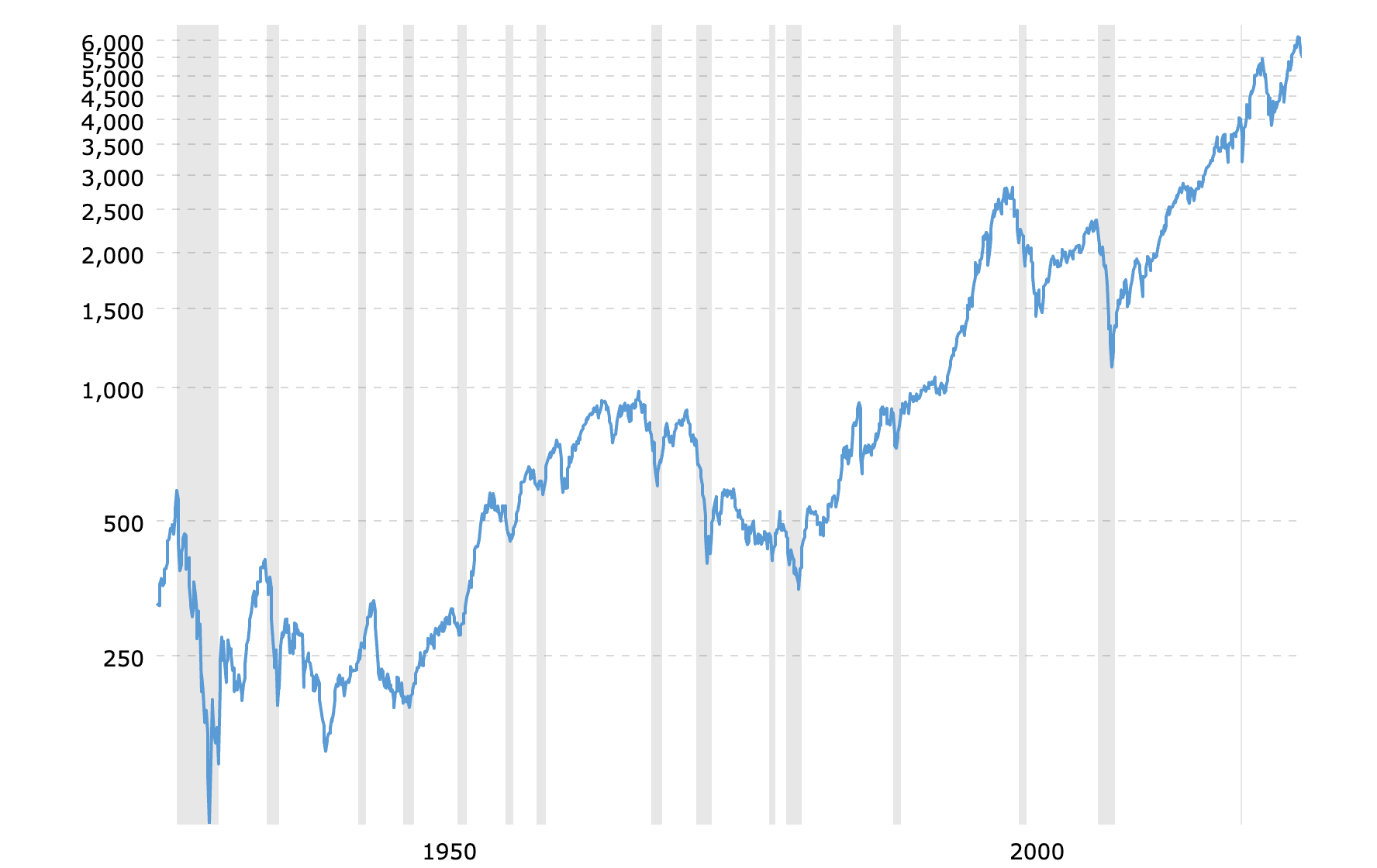

Meanwhile, the US S&P 500 has surged over 250%, and India’s Nifty 50 has risen nearly 500% during the same period.

| Index | Returns Since 2007 |

|---|---|

| 0% | |

| ~0% | |

| +250% | |

| +500% |

Nifty’s Growth from 2007 to 2025:

Shangai Composite Index Chart:

S&P 500 Index:

Source: MacroTrends

GDP Growth Without Wealth Creation?

GDP Growth Without Wealth Creation?

China’s GDP more than doubled from 2008 to 2024. It built world-class cities, emerged as a global export powerhouse, and pioneered electric vehicles and 5G technology.

But why didn’t that translate to wealth for shareholders?

Why China’s Markets Underperformed

1. State-Owned Dominance Hurts Efficiency

Many of China’s publicly listed companies are state-owned enterprises (SOEs), which often prioritize political or national objectives over profit.

This leads to:

- Poor capital allocation

- Inefficiencies

- Lower returns on equity

2. Regulatory Crackdowns

Sudden government crackdowns — especially on tech and education sectors — spooked both domestic and international investors.

For instance:

- Alibaba’s IPO freeze in 2020

- Wipeout of EdTech in 2021

- Heavy fines on Tencent and Meituan

“Shareholders never know when the axe might fall” — Morgan Stanley Asia

3. Property Crisis & Debt Overhang

The Evergrande collapse in 2021 triggered a debt domino across China’s property sector — a pillar of its economy. This sapped investor confidence and left banks exposed.

4. Capital Controls & Foreign Access Limits

Unlike US or Indian markets, China has strict capital controls that limit foreign investor participation, restrict currency outflows, and introduce friction.

5. No Culture of Shareholder Return

Dividends, buybacks, and profit-sharing are not common practice among Chinese firms. Investors don’t see consistent rewards for their risk.

The Contrasting Case of India

India has created a vibrant equity culture driven by:

- Domestic retail participation

- Institutional reforms (like SEBI & IBC)

- Policy continuity

- A tech-first financial ecosystem (UPI, Demat, Mutual Funds)

While China’s GDP was growing, India quietly created long-term shareholder value.

Visual: The Diverging Markets

Visual: The Diverging Markets

| Year | Shanghai Composite | Nifty 50 |

|---|---|---|

| 2007 | ~6,100 | ~3,500 |

| 2025 | ~3,000 | ~24,000 |

China is attempting to revive sentiment through:

- 3 trillion yuan infrastructure stimulus

- Lower interest rates

- Policy reforms and tech innovation incentives

But unless it prioritizes capital markets reform, ensures policy consistency, and protects investor interests, global capital may remain cautious.

Do you think the growth of GDP should be directly proportional to the stock market returns?