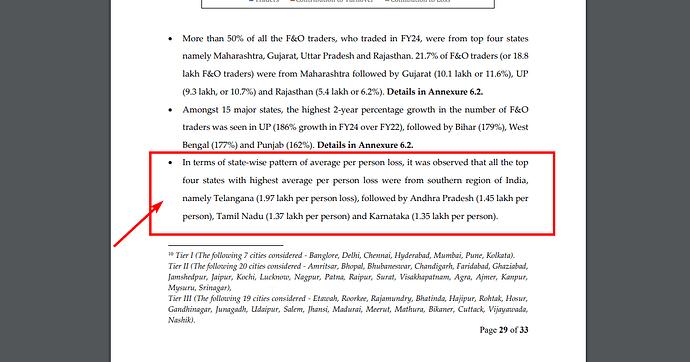

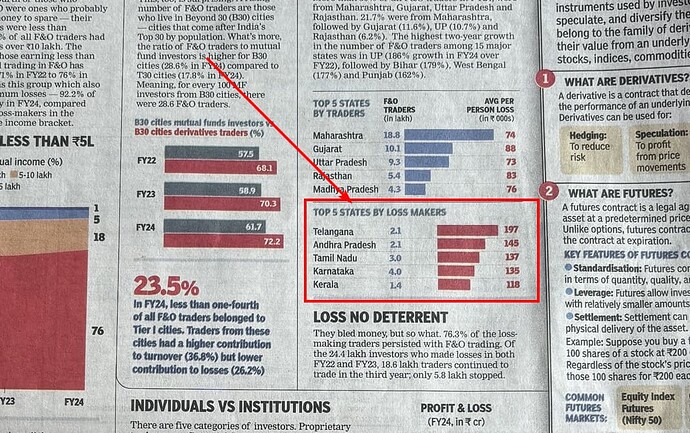

The article discusses the growing trend of young and less wealthy individuals in India losing significant money by trading in Futures and Options (F&O) markets. It highlights statistics showing that 9 out of 10 traders are not very rich, with 76% earning less than ₹5 lakh annually. Many come from small towns, and states like Uttar Pradesh are seeing a surge in new F&O traders. Despite mounting losses, many continue trading, driven by hope, greed, and a lack of deterrence. Real-life stories of individuals, from homemakers to vegetable sellers, emphasize the emotional and financial toll of these high-risk investments.

Traders will stop if they don’t find success trading in the market and if they don’t have any other source to refund their trading account.

The fact is that be it investing or trading the stock market is subject to market risk and personal skill and discipline.

Also people spend their money on different ways to get rich - business, lottery, casino, dabba trading, horse racing, online gaming etc. Focus is on the FnO segment because there is some data here and it has got some bad press. The rate of success in other avenues and loss incurred is also significantly high.

Why repost all these discouraging narratives that spoil the day? Without disclosing the sources and the breadth of their data samples from the world’s most populous country, these articles can be assumed to be published with inherent biases. There are biases in the selection of names for real-life examples, as well as biases in portraying particular geographical regions of the country as less intelligent in money-making decisions. This does not do any good for anyone.

Reposting such articles can only inject biased narratives into the minds of unsuspecting readers.