We started our journey of building DhanHQ in November 2021 and are now ranked among the Top 10 Stock Brokers by active user base in Aug 2024, entering the same position at 10th position. Our gratitude and thanks to everyone who has helped us in our journey of the past 3 years ![]()

![]()

Many folks in the startup space including investors don’t really understand the dynamics of this industry. In the next 12-24 months the list of Top 10 Stock Brokers may look very different from now and Dhan may not be there at all.

In fact Dhan being in top 10 platforms is itself incidental. Let me explain why ![]()

For this, it is important to understand how this list works and what’s happening in the Stock Broking industry.

Here is the list of Top 10 Stock Brokers by active clients on NSE as on Aug 24. Definition of active clients is where users have made at least one-trade on stock exchanges in the last 12 months. Yes, if you are a long-term investor and also have an active portfolio, but have not made any trade in the past 12 months - the users will not be counted in this list.

img credit: moneycontrol

Dhan is very very small and the large players are 10-15X bigger than us, and are also growing significantly faster.

Lets understand the Indian Stock Broking Industry. Every now and then I speak with VCs who tell me they are evaluating yet another startup in this space - I say don’t. Me saying don’t - would not help! Every year our friends at Zerodha continue to publish fascinating revenues and profits, and it attracts more competition to the broking Industry.

Startups in other domains usually compete with incumbents who are slow, but not in the Stock Broking industry. Everyone from new age brokers, bank-led brokers and the traditional players who have been around for decades are super aggressive and very very competitive here.

Dhan is just very lucky to survive here ![]()

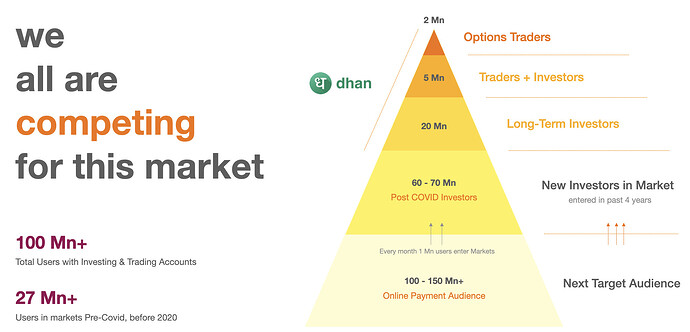

Now let’s look at how the users in the Stock Broking industry are stacked-up.

There are over 100+ Mn active unique demat accounts in India, of which > 75% users entered the markets Post-Covid which is after March 2020. Every month nearly 1 Mn new users enter the Stock Markets directly, there are also users who invest via Mutual Funds.

Most Stock Broking platforms focus on bringing in these new investors to Stock Markets. TAM (Total Addressable Market) for such platforms is the 100 to 150 Mn+ online transactors who are making all sorts of payments online or offline. These users are largely in the age-group of 22 to 30 (may even just above 18) and are from urban India as well as Tier 2 & Tier 3 towns & villages; and are doing their online KYC for the first time in life. NSE publishes detailed reports on market adoption from time to time.

Unlike these, Dhan is focussed on users that have been in markets for a while.

Dhan is built and focussed only for Super Traders (those you have been trading in stock markets for more than 2-5 years or aspire for this) and Long-Term Investors (who have been invested in markets for more than 3-5 years or aspire for this).

Our features, capabilities and product roadmap is built for them; 9 of 10 features we ship on Dhan come from feedback and suggestions we get from our users.

At Dhan we look for users who know the Stock Markets, who are sophisticated traders or are invested in markets and have decided to make stock markets their primary or secondary source of income. Over 85% of our users have shifted from other platforms to Dhan and most of our users come from just the top 20 cities and towns.

Our addressable market is limited to just 25 Mn+ users and we have to demonstrate significantly higher value to these users to convince them to shift to Dhan. And we still have to figure out our product strategy and roadmap for first time investors and traders which is the largest pool of users out there.

We move 50,000 to 60,000 traders and investors to Dhan every month, while large platforms add upwards of 250,000 users in this same time.

In the next 18-24 months, not just existing top 3 players will become significantly larger from where they are now, the industry will also add new investors in the market with significantly large platforms launching and getting more aggressive in user acquisition - we already have few scaling up and more players lined up!

One thing that is different for India is, there will be no single winner in the long term. India will have 5 large platforms who will own a significantly higher share of users than the rest.

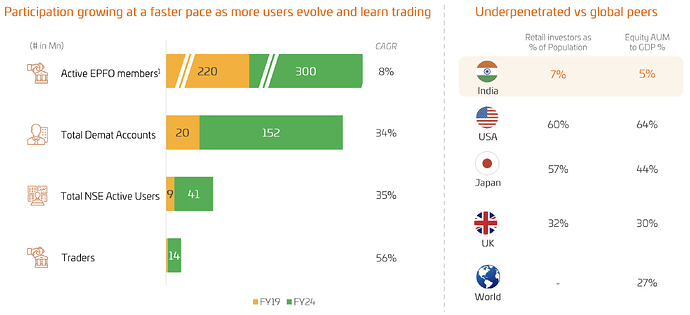

India is just taking off when it comes to adoption of Stock Markets in every aspect of it - Mutual Funds, Direct Investing, Trading, Portfolio Management, Wealth, Alternate Investing or any form.

Interesting times ahead for everyone in this space!