import time

import threading

from datetime import datetime

import requests

from Dhan_Tradehull import Tradehull

import pandas as pd

import pandas_ta as ta

import warnings

warnings.filterwarnings(“ignore”)

--------------- Dhan API Login ----------------

client_code = “1100831340”

token_id = “eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzUxMiJ9.eyJpc3MiOiJkaGFuIiwicGFydG5lcklkIjoiIiwiZXhwIjoxNzQyNzM1NDQ4LCJ0b2tlbkNvbnN1bWVyVHlwZSI6IlNFTEYiLCJ3ZWJob29rVXJsIjoiIiwiZGhhbkNsaWVudElkIjoiMTEwMDgzMTM0MCJ9.ogVriI_5qgqy_wISSyBhOVpCk_f2Wlfz9gXgXTVxIUPZD0eQYbi0LyDs4i5fXLLWXT6fcxOrn0eJt1VQF-ZsYQ”

Initialize Dhan API

tsl = Tradehull(client_code, token_id)

--------------- Telegram Setup ----------------

TELEGRAM_BOT_TOKEN = “7868471377:AAHzwNyk36k0_S5oz9SUWjFXA1owGlh8hXw”

TELEGRAM_CHAT_ID = “5325847532”

def send_telegram_alert(message):

url = f"https://api.telegram.org/bot{TELEGRAM_BOT_TOKEN}/sendMessage"

payload = {“chat_id”: TELEGRAM_CHAT_ID, “text”: message}

requests.post(url, data=payload)

#---------------- Parameter ---------------------

max_trade = 1 # Restrict to 1 trade at a time

entry_orderid = {}

Trade Info Dictionary

trade_info = {}

traded = “no”

Define SL & Profit Lock Parameters

profit_lock = 15 # Initial profit lock in points

initial_sl_buffer = 10 # Initial SL below entry price

trailing_sl_step = 5 # Move SL up by 5 points for every 10 points gain

Function to fetch historical data and generate signals

def fetch_data_and_generate_signals():

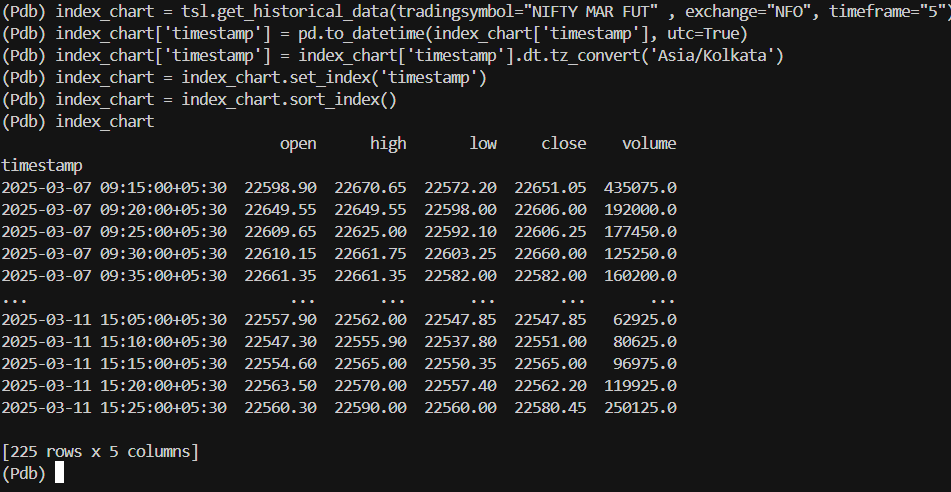

index_chart = tsl.get_historical_data(tradingsymbol=‘NIFTY MAR FUT’, exchange=‘NFO’, timeframe=“5”) # historical data fetching

index_chart[‘timestamp’] = pd.to_datetime(index_chart[‘timestamp’], utc=True) # Convert to UTC

index_chart[‘timestamp’] = index_chart[‘timestamp’].dt.tz_convert(‘Asia/Kolkata’) # Convert to IST

index_chart = index_chart.set_index(‘timestamp’) # Set as index

index_chart = index_chart.sort_index() # Ensure it is sorted in ascending order

# Indicator Config

bbw = index_chart.ta.bbands(close='close', length=20, std=2, append=True)

rsi = index_chart.ta.rsi(close='close', length=14, append=True)

vwap = index_chart.ta.vwap(high='high', low='low', close='close', volume='volume', append=True)

# Generating Signal

index_chart['Buy_Signal'] = (index_chart['close'] < index_chart['BBL_20_2.0']) & (index_chart['RSI_14'] < 30) & (index_chart['close'] > index_chart['VWAP_D'])

index_chart['Sell_Signal'] = (index_chart['close'] > index_chart['BBU_20_2.0']) & (index_chart['RSI_14'] > 70) & (index_chart['close'] < index_chart['VWAP_D'])

return index_chart

def get_real_time_ltp(symbol_name):

“”“Fetch real-time LTP of the given symbol.”“”

return tsl.get_ltp_data(names=[symbol_name])[symbol_name]

def check_and_execute_trades():

global traded, trade_info

index_chart = fetch_data_and_generate_signals()

# **Order Management for Buy Signal**

if index_chart['Buy_Signal'].any() and traded == "no":

CE_symbol_name, PE_symbol_name, strike_price = tsl.ATM_Strike_Selection(Underlying='NIFTY', Expiry=0)

lot_size = tsl.get_lot_size(CE_symbol_name) * 1

entry_orderid = tsl.order_placement(CE_symbol_name, 'NFO', lot_size, 0, 0, 'MARKET', 'BUY', 'MIS')

entry_price = tsl.get_executed_price(orderid=entry_orderid)

trade_info.update({

'entry_orderid': entry_orderid,

'options_name': CE_symbol_name,

'qty': lot_size,

'CE_PE': "CE",

'entry_price': entry_price,

'sl': entry_price - initial_sl_buffer, # Initial SL

'profit_lock': entry_price + profit_lock # Profit lock level

})

traded = "yes"

# **Order Management for Sell Signal**

if index_chart['Sell_Signal'].any() and traded == "no":

CE_symbol_name, PE_symbol_name, strike_price = tsl.ATM_Strike_Selection(Underlying='NIFTY', Expiry=0)

lot_size = tsl.get_lot_size(PE_symbol_name) * 1

entry_orderid = tsl.order_placement(PE_symbol_name, 'NFO', lot_size, 0, 0, 'MARKET', 'BUY', 'MIS')

entry_price = tsl.get_executed_price(orderid=entry_orderid)

trade_info.update({

'entry_orderid': entry_orderid,

'options_name': PE_symbol_name,

'qty': lot_size,

'CE_PE': "PE",

'entry_price': entry_price,

'sl': entry_price - initial_sl_buffer, # Initial SL

'profit_lock': entry_price + profit_lock # Profit lock level

})

traded = "yes"

def monitor_and_exit_trades():

global traded, trade_info

if traded == “yes”:

ltp = get_real_time_ltp(trade_info[‘options_name’]) # Fetch real-time LTP

entry_price = trade_info[‘entry_price’]

price_diff = ltp - entry_price

# **Exit if LTP Falls Below Profit Lock**

if ltp <= trade_info['profit_lock']:

tsl.order_placement(trade_info['options_name'], 'NFO', trade_info['qty'], 0, 0, 'MARKET', 'SELL', 'MIS')

traded = "no"

# **Trailing Stop-Loss Adjustment**

if price_diff >= trailing_sl_step:

new_sl = max(trade_info['sl'], ltp - trailing_sl_step)

trade_info['sl'] = new_sl

trade_info['profit_lock'] = new_sl # Move profit lock up with SL

# **Stop-Loss Exit**

if ltp <= trade_info['sl']:

tsl.order_placement(trade_info['options_name'], 'NFO', trade_info['qty'], 0, 0, 'MARKET', 'SELL', 'MIS')

traded = "no"

def main_loop():

while True:

if traded == “yes”:

monitor_and_exit_trades()

time.sleep(1) # Check every second for real-time monitoring

else:

check_and_execute_trades()

time.sleep(300) # Check every 5 minutes for new trade signals

Start the main loop in a separate thread

thread = threading.Thread(target=main_loop)

thread.start()