In this post, we’re excited to compile and showcase the top stock screeners crafted by our talented community members using ScanX. Dive in to explore these powerful tools and strategies that can enhance your trading and investment decisions. Plus, feel free to share your screeners! By contributing, you can help others understand the reasoning behind your screens and foster a collaborative learning environment within our community.

Disclaimer: While these screeners are created by members, it is crucial to conduct your research before making any investment decisions. Do not invest blindly based on these screeners alone.

3 Likes

Here are a few of them that users have been sharing with us on social media

Joydeep Bhar : Intraday Bullish Volume and EMA Screener | ScanX

Priyansu Prasad Bisoi : kitu | ScanX

Aryan Thakkar: Intraday Bullish trading | ScanX

Looking forward to all of your screeners as well!

2 Likes

Soon to Take Off Stocks

Link: Soon to Take Off | ScanX

Aims to achieve:

This is a fundamental research screener, named “Soon to Take Off,” aims to identify companies potentially transitioning to the growth stage in their business lifecycle. It focuses on finding firms showing signs of accelerating growth and improving financials in the recent past.

Parameters used:

-

YOY last quarterly sales growth > 15%: Captures latest revenue acceleration.

-

YOY last quarter profit growth > 20%: Identifies improving profitability.

-

Revenue growth 3Y CAGR % > 16%: Ensures sustained historical growth.

-

Revenue growth 1Y CAGR % > 18%: Indicates recent growth acceleration.

-

Net income quarterly > net income Yearly: Shows improving profit trends in the TTM compared to the last annual result.

-

Debt to equity < 1.25: Ensures affordable financial leverage.

-

Increase in capex % > 10%: Indicates investment in future growth.

-

1Y operating cashflow growth > 10%: Demonstrates improving operational efficiency that the business is able to convert the profits to actual cash.

-

PE/Sector PE between 0.7 to 1.2: Targets companies valued close to sector average, suggesting potential for valuation reassessment as growth is recognized.

Note: Make sure to do your own research before taking any decision. While analysing the companies listed with this screener, focus on the latest quarters and annual results only..

Did I miss any filter that helps us achieving the aim ? Let me know…

4 Likes

VIRAJ: Value In Rising, Accelerating, and Judicious companies

Link: VIRAJ | ScanX

Aims to achieve:

This fundamental research screener, named “VIRAJ,” aims to identify companies with strongest fundamentals, accelerating growth, and increasing market interest. It focuses on finding high-quality stocks that are outperforming their industry while still being reasonably valued.

Parameters used:

- Revenue 3Y CAGR > Revenue 5Y CAGR: Indicates accelerating growth trajectory in recent financials.

- ROE > 12% and ROCE > 12%: Ensures strong and efficient capital use.

- FII Holding change > 0.5%: Captures increasing foreign institutional interest.

- Industry EPS < EPS Annual: Identifies companies outperforming their sector.

- PE/Sector PE between 0.7 & 1.2: Targets reasonably valued companies relative to their sector.

- Increase in capex > 5%: Shows investment in future growth.

- Volume 1W Avg > 100000: Ensures sufficient liquidity for trading.

Note: Always conduct your own thorough research before making any investment decisions.

Did I miss any filter that helps us achieve the aim? Let me know your thoughts or if you’d like to discuss any specific aspect of this screener!

3 Likes

Quarterly  Price

Price

Link: Quarterly Price | ScanX

Thought process: Companies which posted good results this quarter YOY (no option for QOQ), and YET after good results, price is going down for last 2 months.

Q1 was slow overall. If some companies have done well this quarter, will probably continue to do well in upcoming quarters and year.

Exceptions to consider: Cyclical companies for whose Q1 is always/only good results. So further fundamental analysis is much needed.

Missing in ScanX: I wanted to compare QoQ performance as well, but didn’t find filter on scanx. Only YOY quarterly result filter available. @Naman @RahulDeshpande

2 Likes

Here’s one more screener shared by our user:

Vibhit

: SHORT-LONGTERM VIEW | ScanX

Hello @RahulDeshpande,

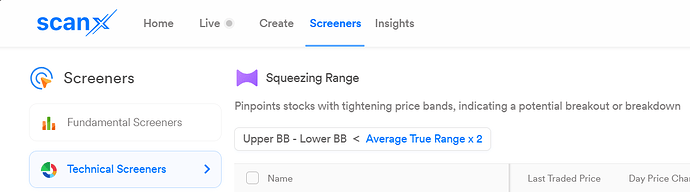

I need your help to understand how I can create condition the way it is created in Technical Screeners → Squeezing Range.

As per the logic it has combined 4 conditions: Upper BB - Lower BB < Average True Range x 2

Please provide the steps how I can create similar screener:

1 Like

I want screener 5 min timeframe inside candel high break

1 Like

![]()