About Company’s Business:

They engage in the design, development, manufacturing, and sale of a diverse array of stationery and art products, predominantly marketed under their flagship brand ‘DOMS’. This business operates both within the domestic market and internationally, spanning over 45 countries as of September 30, 2023. As of Fiscal 2023, they hold the position of the second-largest player in India’s branded ‘stationery and art’ products sector, commanding a market share of approximately 12% by value, according to the Technopak Report. Their strategic emphasis on research and development (R&D), product engineering, and vertically integrated manufacturing operations, coupled with a comprehensive multichannel distribution network across India, has facilitated the establishment of a strong brand recall among consumers. Notably, their key products, such as ‘pencils’ and ‘mathematical instrument boxes,’ have achieved significant market shares, boasting 29% and 30% market share by value in Fiscal 2023, respectively.

About the Industry:

The global market for scholastic stationery products reached a valuation of USD 61 billion in CY 22. Projections indicate a compound annual growth rate (CAGR) of 2.2% from CY 22 to CY 27, with an anticipated market size of around USD 68 billion by CY 27. In the Indian context, the stationery and art materials market has demonstrated consistent expansion, estimated at INR 38,500 crore by value in FY 23. Forecasts suggest a CAGR of approximately 13% for the FY 23-28 period, aiming to achieve a market value of INR 71,600 crore by FY 28. The upswing in this market can be attributed to various factors such as the escalating population, educational advancements, government initiatives in the education sector, and the evolving trend of digitalization, which has contributed to the growth of traditional stationery and art materials. Students’ increased engagement in self-study, drawing, coloring, and other hands-on activities has further fueled this expansion. India boasts a flourishing stationery and art materials industry, presenting numerous opportunities for the country to emerge as an export hub for these products. Projections indicate that the Indian stationery and art materials export market is poised to grow at a CAGR of approximately 6% in the FY 23-28 period, reaching a market value of INR 7,500 crore by FY 28.

Key Financial Information (₹ in million):

| Particulars | As of March 31, 2021 | As of March 31, 2022 | As of March 31, 2023 | As of September 30, 2023 |

|---|---|---|---|---|

| Equity share capital | 3.73 | 3.73 | 3.73 | 562.50 |

| Net worth | 2,336.11 | 2,472.47 | 3,374.32 | 3,976.13 |

| Revenue from operations | 4,028.17 | 6,836.01 | 12,118.90 | 7,617.98 |

| EBITDA | 300.25 | 697.13 | 1,866.60 | 1,274.45 |

| EBITDA Margin (%) | 7.45 | 10.20 | 15.40 | 16.73 |

| Profit/(Loss) for the year/period | (60.26) | 171.40 | 1,028.71 | 739.06 |

| PAT Margin (%) | (1.50) | 2.51 | 8.49 | 9.70 |

| Earnings/(Loss) per Equity Share - Basic | (1.07) | 3.05 | 18.29 | 13.14^ |

| Earnings/(Loss) per Equity Share - Diluted | (1.07) | 3.05 | 18.29 | 13.14^ |

| Net Asset Value per Equity Share | 41.53 | 43.95 | 59.99 | 70.69 |

| Total borrowings | 972.74 | 849.04 | 1,000.65 | 1,763.79 |

| Current Borrowings | 943.75 | 820.52 | 849.10 | 908.12 |

| Non-Current Borrowings | 28.99 | 28.52 | 151.55 | 855.67 |

^Not annualized.

Objective of the Issue:

-

Proposing to part finance the cost of establishing a new manufacturing facility to expand its production capabilities for a wide range of writing instruments, water colour pens, markers and highlighters

-

General corporate purposes.

For more detailed information, you can refer to the IPO Prospectus (RHP) filed by the company.

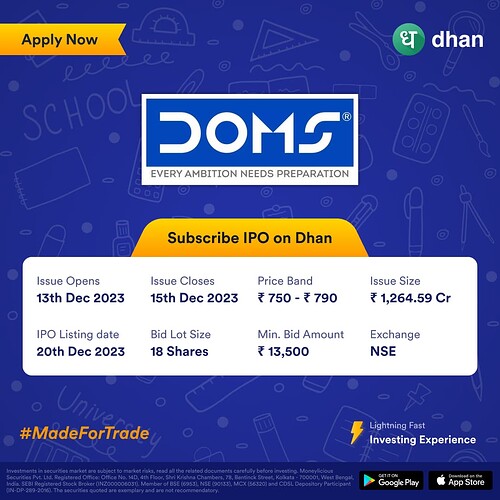

| Important information regarding the IPO | |

|---|---|

| Open Date | Wednesday, December 13, 2023 |

| Close Date | Friday, December 15, 2023 |

| Issue Size | ₹1,200.00 Crores |

| Price | ₹750 to ₹790 per share |

| Lot Size | 18 Shares |

| Basis of Allotment | Monday, December 18, 2023 |

| Initiation of Refunds | Tuesday, December 19, 2023 |

| Credit of Shares to Demat | Tuesday, December 19, 2023 |

| Listing Date | Wednesday, December 20, 2023 |

How to apply for this IPO?

You can locate the redirection link to the IPO on the home screen of the Dhan App. Alternatively, you can access it by navigating to the “Money” Section at the bottom right and swiping right to reach the “IPO” Tab.

Do let us know your thoughts on this IPO.