Hi All

We recently mentioned that Dhan has begun working on introducing BSE F&O segments with the aim of bringing it to our users soon. Yes, we are aware of the increasing number of trades on BSE Sensex for F&O and as expected, we continue to get multiple requests from our users.

Our product development for the F&O segment is nearly complete, we will get started with mock trading on BSE F&O soon as well as initiate the process of certifications for this segment across our platforms. We expect to bring BSE F&O soon to our users, with the complete experience of Trade on Charts, Option Chain, Strategy Builder, Flash Orders, Option Snapshots, Options Summary, and more.

While we are doing this, we also want to ensure our users get familiar with the proposed Risk Management Policy for BSE F&O in advance as it will differ from the existing risk policy and controls for NSE F&O.

Who can trade on BSE F&O:

Dhan users with an activated Futures & Options segment will be able to participate in BSE derivatives trading as well - no need to upload new documents or separately activate this segment.

What can you trade in BSE F&O:

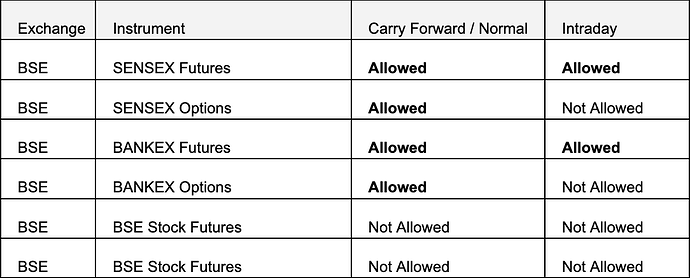

At Dhan, you will be allowed to trade both futures & options in these indices. The Futures are allowed for both Intraday & Carry Forward (Normal) positions & Options are allowed only for Carry Forward positions i.e. Normal or Margin product types. The Open Interest (OI) in the contracts should be atleast 10. This is done keeping the low liquidity and other risk factors in consideration.

The same is summarised in the below table.

Which Contracts can be traded in BSE F&O:

For now, to start with on Dhan you will be able to trade all contracts available serially for the first two months (Current Month and Near Month). The SENSEX & BANKEX derivatives contract specifications are mentioned in detail here. A few important specifications are:

- The lot size of Sensex is 10 & Bankex is 15.

- The expiry day for weekly contracts is Friday.

- For monthly contracts, the expiry will happen on the last Friday of each month.

- The Options are European style.

- The final settlement will be cash settled based on the closing price of the underlying index on the day of expiry.

What are the charges for the BSE F&O segment:

The exchange transaction cost for Futures is 0 & for Options it is 0.005% of the premium value. Rest all charges & brokerage remain the same. More detail here.

More Information:

Little more about these Indices. The SENSEX, short for the S&P BSE Sensex, is a benchmark index representing the overall performance of the BSE (earlier Bombay Stock Exchange). It comprises the top 30 companies in terms of market capitalization and represents various sectors of the economy.

The SENSEX serves as a key indicator of the Indian stock market’s health and investor sentiment. On the other hand, BANKEX is an index that specifically tracks the performance of top 10 banking stocks listed on the BSE. It includes major public and private sector banks, offering a snapshot of the banking industry’s performance.

Risks Associated with Trading:

As derivatives of Sensex & Bankex are newly introduced to the market, it is prudent to gather more knowledge before subjecting yourself to potential risks. We would urge only experienced traders to evaluate trading on BSE F&O and start with smaller capital allocations to get familiar with this segment.

When will BSE F&O go live on Dhan:

We expect the same to go live in August 2023. We hope to ensure we complete all product development and required testing and certifications to go live on time. The same will go live across all Dhan platforms - Dhan (App & Web), TradingView by Dhan (tv.dhan.co), and also Options Trader (App & Web).

Get ready for BSE F&O on Dhan. We will keep you posted on the updates on the Dhan community.

Thanks,

Kuldeep Mathur

Risk Team