Hi Traders,

We know that in fast-moving markets, timing and the right information are super important. That is why we bring you features such as Live Market Scanner, Trending On Dhan, Market Actions, Outperformers, Movers & Gainers, and much more that help you get the right data at the right time.

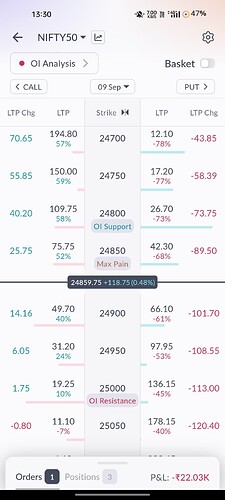

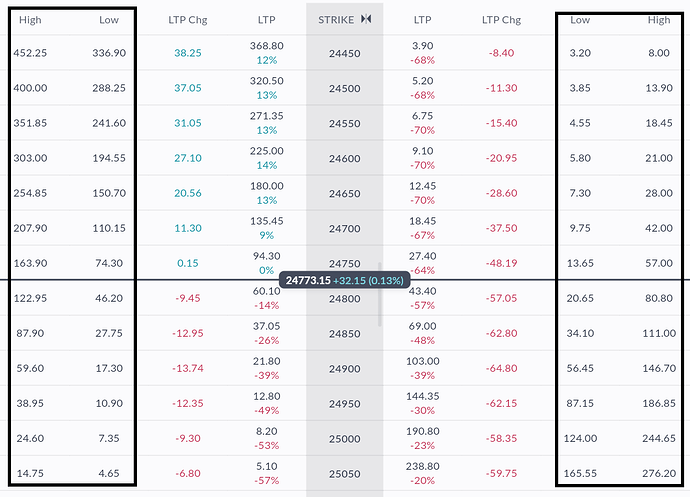

Amongst all real-time market analysis on Dhan, the Option Chain is one of the most powerful and popular among traders. Many traders depend on it to track market trends, analyse data, and take action quickly. However, we noticed that traders often have to do extra calculations or manual efforts to understand strike-wise sentiment or market movement shifts. This slows down decision-making and order placement.

We understand the importance of Insights on essential data with less effort, and faster execution, all from a single view. Therefore, here we are with a very powerful upgrade on Dhan Web.

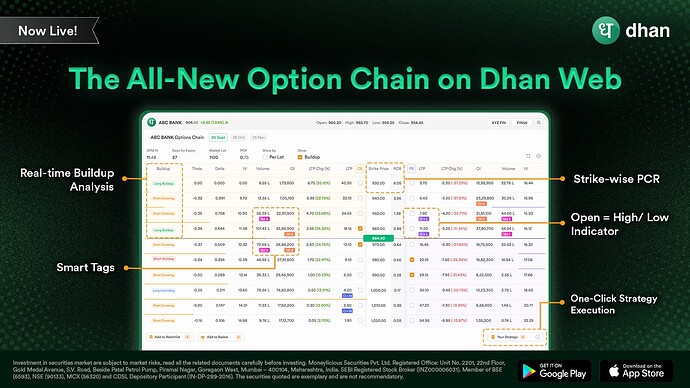

Introducing the All-New Option Chain on Dhan Web: Now Smarter & More Insightful

We have added new features that bring the most critical market movements to the forefront, allowing you to spot key market actions quickly and trade with more confidence.

These features include:

-

Smart Tags: We now show smart tags on the top 5 strikes with the Highest OI, Volume, and IV. This helps you quickly see where the market action is happening.

-

Open = High/Low Indicator: If a strike’s opening price is equal to its day high or low, we mark it for you. This shows strong momentum either upward or downward.

-

Strike-wise PCR: We’ve gone beyond the single index PCR. You can now analyze the Put-Call Ratio for each individual strike, giving you a detailed view of sentiment at every level

-

Real-time Buildup Analysis: A new Buildup column shows if a strike is seeing Long Buildup, Short Buildup, Long Unwinding or Short Covering – all in real time.

-

One-Click Strategy Execution: This is designed for speed. You can now choose your strikes directly from the Option Chain and place multi-leg strategies instantly. No extra steps, just quick execution.

We also understood that every trader has their own unique style, strategy, and data preferences. That’s why we’ve made the Option Chain more flexible than ever. You have the power to customise what you see by toggling specific data sets on or off from the settings menu. Whether you prefer a clean, minimal view or want all the data at your fingertips, the new Option Chain adapts as per the preferences you set.

We believe these enhancements will give you even greater control and clarity, helping you trade smarter, every day. Jump into web.dhan.co and try the new option chain today.

Tell us how you like the new Option Chain, we’re always listening and building with you.

Happy Trading,

Jai