Hello Traders!

We understand that as Traders it means a lot more for you to have as much lower capital requirements as possible. In our many interactions with traders, many have emphasised that having lower capital at trading, also means lower capital at risk when trades go against you.

At Dhan we have constantly evolved with time to meet your needs and exceed your expectations. Given the significant presence of proficient traders on our platform, we recognize the pivotal role that margins and leverages play in shaping their trading journey.

Over time, we have built an best-in-class experience when it comes to available margin benefits for traders including Option Buyers (Full post: Margin Benefits & Pledge Shares Experience for Trading on Dhan), extended the seamless experience to Commodity Trading (Commodity Trading Experience on Dhan - Simple, Smooth, & Seamless!), introduced MTF or Margin Trading Facility for swing traders (Introducing Margin Trading Facility (MTF) on Dhan: Now Trade with Less 💰), brought in pledge of Government Securities (Live: Now you can Pledge Government Securities on Dhan) and among many, also recently improved the discoverability of high margin Cash & Cash Equivalents (Now Live: An All New & Improved Pledge Experience on Dhan)

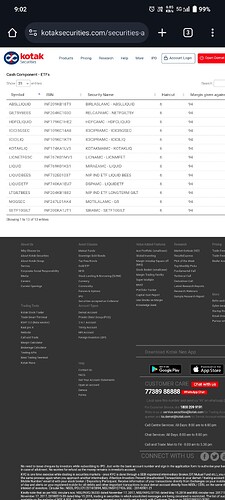

In our continued pursuit of enhancing your trading experience, we have now revised our stock list to provide traders with access to extending margins to more Stocks for Intraday, MTF and Pledging on Dhan:

-

You can now get MTF on 1000+ stocks. This makes us one of the top brokers in India to extend the Margin Trading Facility to one of the highest number of stocks on its platform. You can check the updated list of stocks on which we provide MTF here.

-

Intraday Trading is now extended from 850+ stocks to 1600+ stocks. This is almost double the number on which we used to provide intraday leverages earlier. Not just that, we have also improved the margins on many of our existing scrips so that you can make the best out of these scrips while trading in them just for the day. The updated list of MIS stocks can be viewed here.

-

Better Pledge benefits: We have increased the pledge benefits that you can get from pledging bluechip / NIFTY 50 stocks. This will help you get more margins if you have any NIFTY 50 stocks in your portfolio and decide to use them as collateral & optimise your trading experience. To view scrips that can be pledged for collateral benefit, tap here.

With the recent updates to our stock list, we have significantly expanded the opportunities for our traders.

We invite you to explore the updated lists of stocks eligible for MTF and intraday margins, as well as those suitable for collateral benefits. Happy Trading!

Kuldeep