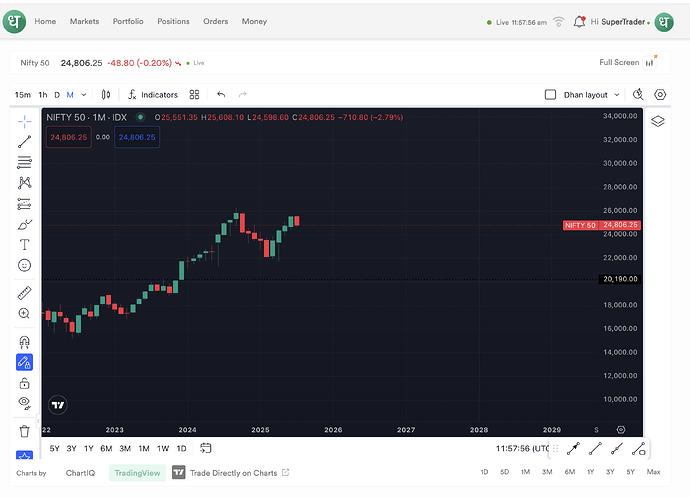

Markets haven’t reacted significantly to the tariff announcement — the Nifty is down just 0.2%, which is hardly out of the ordinary. It feels like major news events no longer carry the same weight in market movements as they once did.

Have we already priced in everything? Or are we in a phase where sentiment, liquidity, and structural resilience matter more than temporary headlines?

Also, the narrative of calling India a “dead economy” reflects a profound misunderstanding of where we’re headed. When the entire world is eyeing a slice of Indian markets, and when global tech giants are lining up billion-dollar investments here, it’s not a sign of stagnation, it’s a signal of long-term belief in our growth story.

Take Google’s recent announcement of a $6 billion investment in data centers in India. It’s more than just a capital infusion — it’s a vote of confidence in India’s digital and economic future.

So, if global investors are bullish on India, are the skeptics simply digging their own grave?

Let’s open this up

Is the market becoming immune to noise, or are we underestimating the real undercurrents that drive it today?