While the new regime is the default tax regime, you can still opt for old regime if that saves you more taxes.

However, switching your tax regime isn’t as simple as ticking a box, especially for some of us as you might be required to make a separate declaration called Form 10-IEA.

So, what is Form 10-IEA?

Think of it as your official declaration to switch your tax regime from new to old, or vice versa. But it’s not for everyone, it’s mainly for taxpayers with business or professional income.

Who actually needs to file it?

Here’s the quick rule:

- ITR-3 or ITR-4 filers (with business/professional income) → Must file Form 10-IEA to opt for the old regime.

- ITR-1 or ITR-2 filers (salary, house property, capital gains, etc.) → Can choose between regimes directly in the ITR, no extra form needed.

What’s changed this year (AY 2025-26)?

Your ITR will now straight-up ask:

- Did you opt out of the new regime in earlier years?

- What’s your choice this year?

Depending on your answer, you might either file Form 10-IEA again, or just enter last year’s acknowledgement details.

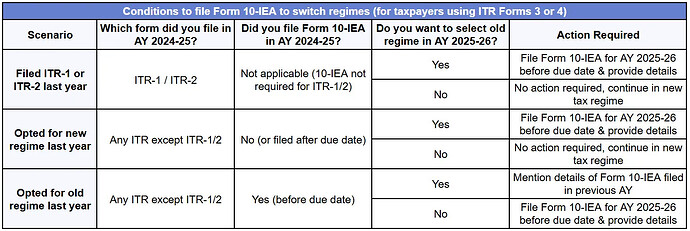

Here’s a table to help you understand better.

As mentioned in the table, you don’t have to file Form 10-IEA if you plan to continue in the same regime as opted last year.

When & where to file Form 10-IEA?

You’ll need to file it online on the income tax e-filing portal before your ITR due date:

- 31 July – If audit not applicable

- 31 Oct – If audit applicable

For AY 2025-26 the deadline is extended to 15 September 2025.

Once submitted, you’ll get an acknowledgement number. Keep it handy, you’ll need to enter it (along with the filing date) while filing your ITR.

Note: Once filed, Form 10-IEA cannot be reverted.

Can you switch back to the new regime later?

Yes, but with a catch. If you have business/professional income, you can only switch twice in your lifetime:

- Once to move from new → old regime

- Once to move back from old → new regime

After that, you’re locked in unless your income type changes and you no longer have business/professional income.

Note: This rule applies to ITR-3 and ITR-4 filers with business/professional income. Others can switch every year without Form 10-IEA.

Have any other questions, ask us in the comments!