First of all understand what’s Liquidity?

Pending orders and open SL orders available on the chart whether Buy or Sell orders.

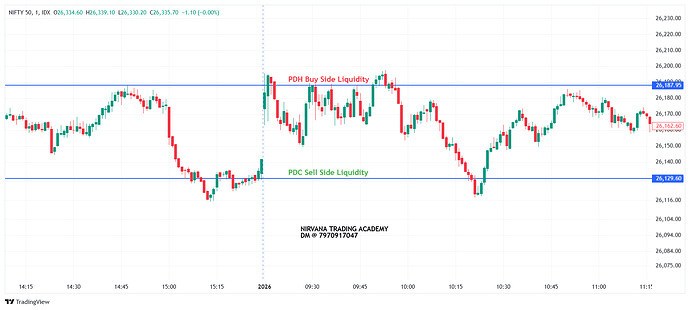

Liquidity pool will be created nearby any important premium or discount zones. i.e Previous Day High, Previous Day Low, Previous Day Close or at strong Resistances and Supports.

On 1st Jan’26, Buy orders were available above the PDH but the orders wasn’t sufficient for the Institutions to punch their big quantities. They showed some artificial bullishness and invited new buyers along with triggering old sellers Stop-Losses placed above PDH and induced the retails to buy and then Institutions started slowly punching their sell orders.

Now, Question arises why not to sell at the breakout of Previous Session High?

The answer, Is there was any supporting candle or sustainability?

No, There was no sustainability and supportive candle means it was not a real buying pressure, It was just inducement.

Same process happened at Previous Day Close

On 1st Jan’26, Sell orders were available below the PDC but the orders wasn’t sufficient for the Institutions to punch their big quantities. They showed some artificial bearishness below PDC and invited new sellers along with triggering old buyers Stop-Losses placed below PDC and induced the retails to short and then Institutions started slowly punching their buy orders.

Now, Question arises why not to sell at the breakout of Previous Session Close?

The answer, Is there was any supporting candle or sustainability?

No, There was no sustainability and supportive candle means it was not a real selling move below PDC, It was just inducement.