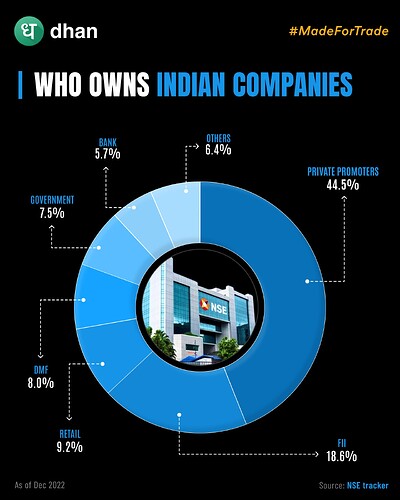

One of the crucial aspects of any listed company on the NSE is the shareholding pattern, which gives us a clear picture of who owns the company. As per the data, the shareholding pattern in listed Indian companies on the NSE is as follows: private promoters hold 18.6%, Foreign Institutional Investors (FIIs) hold 18.6%, Retail holds 9.2%, Domestic Mutual Fund (DMF) holds 8%, Government holds 7.5%, Banks hold 5.7%, and others hold 6.4%.

Private promoters play a crucial role in the growth of Indian companies, and their stake indicates their confidence in the company’s prospects. Similarly, retail investors have also started investing in the stock market, which is a positive sign for the Indian economy.

We deep dived into the NSE report on the shareholding patterns. Do check out the infographic which provides a detailed bifurcation.

Also, what do you think the behaviour of the companies are going to be in the coming period. Are the patterns going to significantly change? Do let us know your views.