A wave of deep red swept across global equity markets today, with many major indices falling sharply:

Hong Kong: -13.2%

Taiwan: -9.7%

Japan: -8.3%

Singapore: -7.4%

China: -7.3%

Italy: -6.9%

Sweden: -6.2%

Netherlands: -6.1%

Australia: -6.1%

France: -6%

Spain: -5.7%

Germany: -5.6%

Switzerland: -5.5%

UK: -4.6%

Philippines: -4.3%

Malaysia: -4%

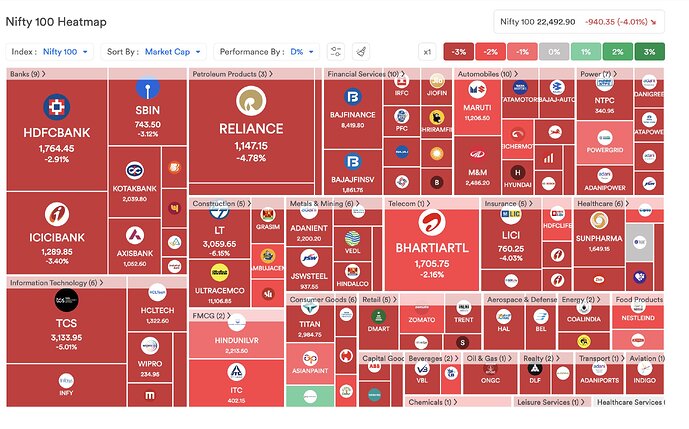

India: -3.8%

Russia: -3.1%

Turkey: -2.5%

Saudi Arabia: +0.5%

Is a Recession Looming?

Markets don’t fall like this without sending a signal. While this doesn’t automatically mean a global recession is guaranteed, the breadth and depth of the decline suggests:

- Investor confidence is rapidly deteriorating

- Flight to safety is intensifying (expect movement into gold, bonds, and USD)

- Demand destruction may be more severe than anticipated, especially in consumer-led economies

If trade tensions escalate and corporate profits shrink further, the odds of a global slowdown or mild recession in the next 6–12 months rise sharply.

![]() Do you think tariffs help or hurt economies in today’s globalized world?

Do you think tariffs help or hurt economies in today’s globalized world?