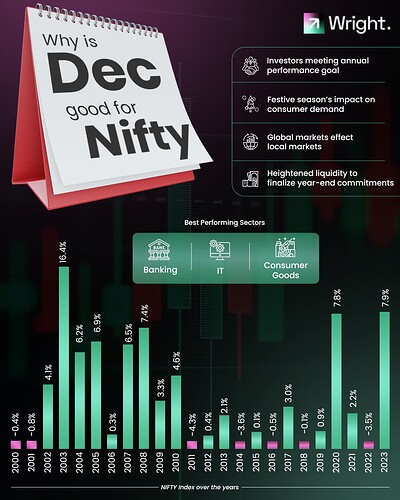

December has historically been a great month for the Nifty Index, and here’s why:

- Portfolio Rebalancing: Institutional investors align with annual performance goals.

- Festive Season Boost: Increased consumer demand fuels market momentum.

- Global Market Trends: Positive global cues often ripple into Indian markets.

- Year-End Liquidity: Investors finalize financial commitments, creating market activity.

![]() Top-Performing Sectors:

Top-Performing Sectors:

![]() Banking: Benefits from year-end lending and spending.

Banking: Benefits from year-end lending and spending.

![]() IT: Gains from global contract renewals and budgeting.

IT: Gains from global contract renewals and budgeting.

![]() Consumer Goods: Festive demand drives growth.

Consumer Goods: Festive demand drives growth.

There have been negative years too. Global crises, policy uncertainties, and domestic challenges like 2008’s financial crisis have caused rare dips in December returns. At the moment - strong economic indicators, a stable RBI policy, and festive-driven demand, December 2024 looks promising for Nifty.

![]() What’s your investment strategy this December?

What’s your investment strategy this December?