Zomato released its shareholders results for Q42025.

Key Outcomes on Growth and Profitability

-

Business Growth: The company reported significant growth across its core businesses:

- Food Delivery: Grew steadily despite softness in the restaurant industry, indicating strong consumer preference for the convenience and reliability provided by the platform.

- Quick Commerce (Blinkit): Achieved exceptional growth (97% YoY) and turned profitable on an Adjusted EBITDA basis in March 2024. This marks a critical milestone for a highly competitive and resource-intensive segment.

- Going-Out Services: Experienced explosive growth (207% YoY), reflecting a post-pandemic resurgence in dining out and social activities.

- B2B Hyperpure: With nearly doubled revenue, it indicates a growing demand for quality sourcing among restaurants.

-

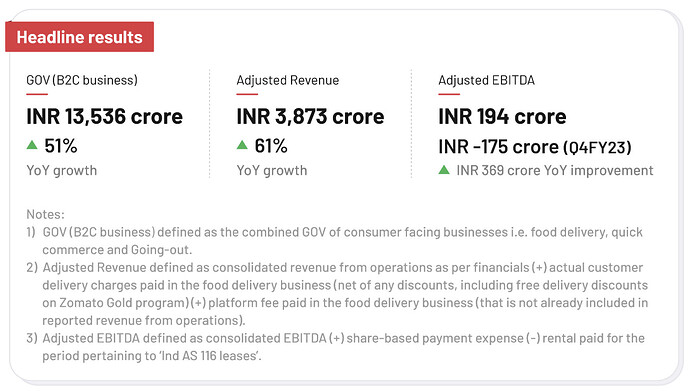

Profitability Improvement: Adjusted EBITDA surged to ₹194 crore, with significant reductions in losses in key segments like Hyperpure and quick commerce. This suggests the company is striking a balance between growth investments and operational efficiency.

Food Delivery Resilience

- The 28% YoY growth in food delivery GOV is a testament to the platform’s ability to innovate and remain relevant in a highly saturated market.

- A 5% YoY rise in Average Order Value (AOV) and 23% order growth reflect increasing customer trust and frequency of usage.

- The company leverages its ecosystem of restaurants, customers, and delivery partners to drive growth while adding value for all stakeholders.

Though the growth does look promising, why did the profits take a hit?

The answer is Blinkit.

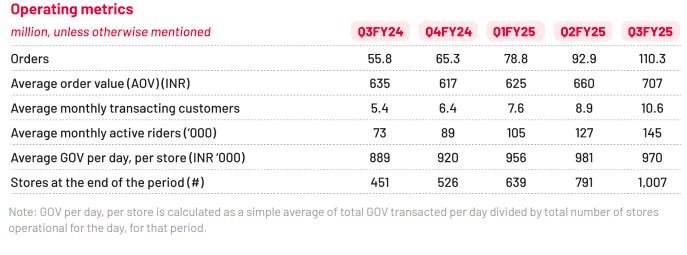

Blinkit’s aggressive expansion strategy impacted its margins as the company invested heavily in opening 368 new dark stores, increasing its total store count to 1,007.

Opening more stores comes with its share of challenges—higher upfront costs like rent, salaries, and operational expenses that take time to break even.

But it’s not just about dark stores. Zomato is also investing in larger warehouses, which serve as central hubs to stock bulk inventory before distributing it to dark stores. As Akshant Goyal explained, “Warehouses take longer to ramp up compared to new stores, making them even more margin-dilutive in the short term.” Translation: warehouses are expensive and hurt profits more, so losses aren’t going away anytime soon.

Blinkit now leads the race with 1,007 dark stores, ahead of Zepto’s 700–750 and Swiggy Instamart’s ~600 stores. But the competition isn’t slowing down—Zepto is eyeing 1,200 stores by March 2025, and Swiggy Instamart is targeting 1,000.

On the brighter side, Blinkit’s average order value (AOV) is ₹707 this quarter—way ahead of Swiggy Instamart’s ₹499 and Zepto’s ₹550.

Customer retention is solid too. Around 40% of customers from December 2022 are still active, and Gross Order Value retention has crossed 100%. In simpler terms, Blinkit’s loyal customers are spending more, which is a big win for the business.

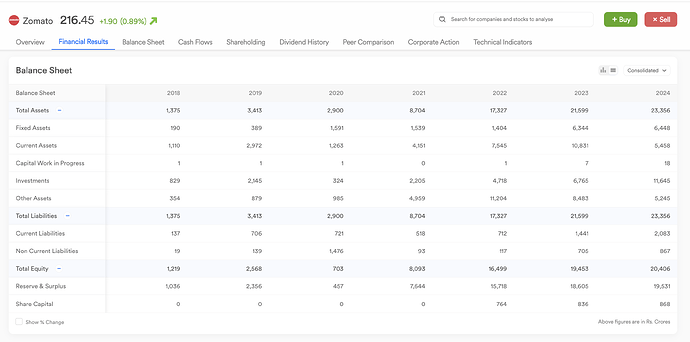

Overall balance sheet of Zomato looks healthy:

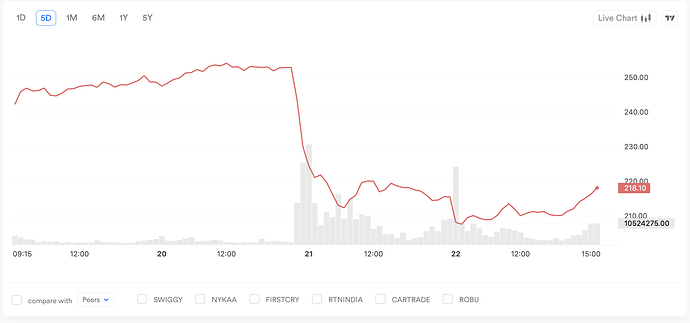

the new wasn’t well received by the shareholders though and zomato saw a significant dip. It crashed 18% in the last 3 days.

Do you think is the worse behind for Zomato or there’s a huge potential upside in the coming months and years for zomato?