Dear All,

From the day we went live, our teams have strived to ensure your trading & investing experience on Dhan gets better every day. We have continued to constantly work towards simplifying and enhancing your trading and investing experience on Dhan - via products, features, enhancements, and capabilities that we have added for the past 3 years.

One thing that we have realised is that our users have always wanted more. And more importantly, they need a lot more than just placing orders, managing positions and building portfolios. A lot of market participants, be it traders or investors - they want to analyse performance, tracking progress and managing their finances effortlessly.

At Dhan, our approach had always been about providing an integrated experience for the same - let’s agree here that many of our users were not happy about this. We have also stated that more than 85% of our users move from other trading & investing platforms to Dhan. On many of these platforms, they had a dedicated back-office largely because such platforms had integrated third party vendor softwares for enabling the same.

After considering the numerous requests from our traders & investors, we decided to build an in-house reporting platform, which today we are excited to announce as live for all, we call this - Journal by Dhan.

Journal will cover all your reporting needs, and also provide you with analytics later we will also move user and account management to Journal. With this new tool, you can enjoy a seamless experience, get access to all possible reports and also manage your portfolio with ease.

Journal by Dhan is designed to offer complete transparency and control over your trading and investment activities, giving you detailed insights into every aspect of your portfolio, trades, and finances - whether its portfolio tracking, analysing trade performance, or reports that are essential for filing taxes, enhanced reporting ensures you have all the tools you need in one place.

Journal: Trading & Investing Reports on Dhan

We understand that reports are essential & play a vital role in trading journeys. They provide clarity on how your investments are performing, help you make data-driven decisions, and simplify tax filing by consolidating critical information. Additionally, they play a critical role in keeping track of your profits and losses. Proper reporting helps you maintain transparency, avoid compliance issues, and plan for the future without the stress of missing details.

For now, the Journal can be accessed only via Dhan Web. Once you log in, here’s how you can find it:

- Click on your Profile in the top-right corner, and from the dropdown menu, select Journal by Dhan.

- Alternatively, go to My Profile and click on Journal by Dhan.

- You can also navigate to the Money Section and select Journal by Dhan there.

Here’s a breakdown of what Journal offers and how it can help you manage your trading and investing journey:

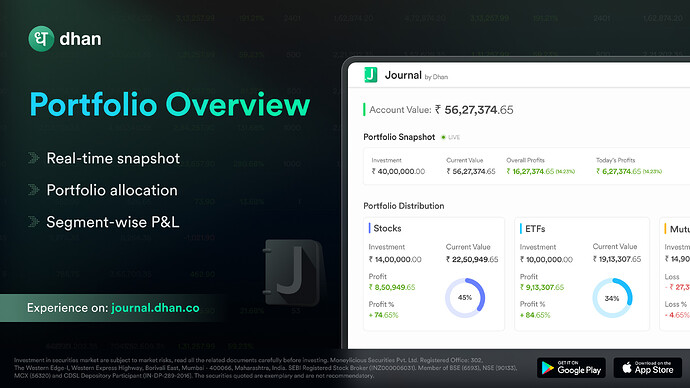

1. Portfolio Overview

The portfolio overview provides a snapshot of your investments. You can see the current market value of your holdings, total investments, and overall returns at a glance. Yes - unlike most back office platforms, this is real-time! So in market hours you see your portfolio on a real-time basis.

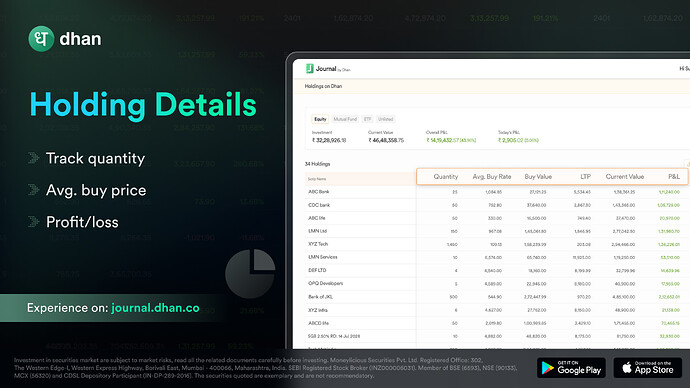

2. Holding Details

Dive deeper into your portfolio with detailed information on each holding, including quantity, average buy price, current value, and profit/loss. This provides a clear view of your active positions, enabling real-time tracking and performance evaluation.

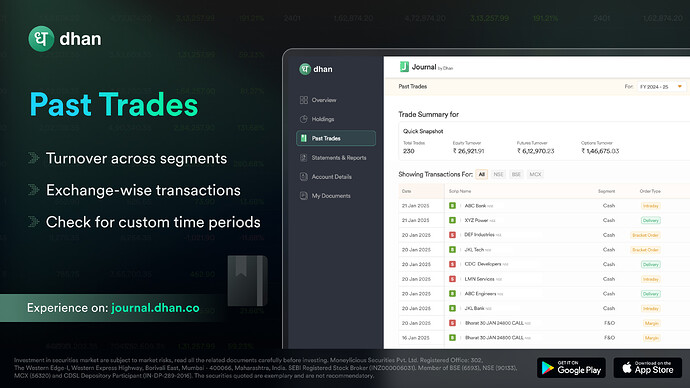

3. Past Trades

The Past Trades section records every buy and sell transaction you’ve executed across all segments and order types across all Stock Exchanges. Having all trade details in one place simplifies your evaluation process and ensures transparency.

4. Statements & Reports

A comprehensive suite of reports to give you an organised view of your trading activity:

-

Ledger: This detailed financial record tracks all the transactions in your account, including deposits, withdrawals, transfers, and trade executions. It helps you monitor account balance movements and understand the inflow and outflow of funds. MTF funding entries displays the net amount funded after deducting cash collateral. The ledger is meant for viewing cash flow and cannot be used to compare your P&L unless there are no open positions.

Note - Call & Trade Narration reflect charges for Call & Trade services or Auto Square-Off. -

Contract Note: An e-signed, detailed record of every trade executed in your account, including stock name, trade price, quantity, brokerage fees, and more and it is available up to T-1.

-

Fund Summary: An overview of your fund deposits, withdrawals, and balances. This statement shows how much you’ve added or withdrawn from your trading account, making it easier to track fund movements over time.

-

Realised Profit & Loss: This report calculates the profit or loss for positions that have been sold, exited or squared - off. It provides the gross p&l - both overall and at the scrip level, excluding trade-related costs like brokerage, taxes, and transaction fees.

-

Profit & Loss Report: This consolidated report provides an overall view of your profits and losses across all trades, including both realised and unrealised P&L. It helps you evaluate the performance of your portfolio. For better clarity, subsections are provided for different segments such as Equity, F&O, Currency, and Commodity.

Please note: If you have an open position, the P&L may not match the Web/App with the journal due to differences in calculation methods.

-

Tax Report: This report provides a detailed breakdown of all transactions/trades which helps in evaluating your taxable income, capital gains, and other relevant financial information, making it essential for tax filing. It offers a clear picture of your earnings and ensures compliance with tax regulations. For scrips still available in your portfolio, instead of a specific date, it will be mentioned as Open Holding.

-

Holding Summary: This report provides a summary of all your holdings, detailing the quantities that are Free, Locked-in, Safekeep, MTF Pledge, Margin Pledge, and CUSA Pledge. It also includes the closing price for each to help you assess their valuation.

-

Global Transactions: This report provides a comprehensive record of all your transactions, including bill numbers, security-wise details, and associated charges.

Note: All reports will be available for download & e-mail, except for Past Trades

5. Account Details

Easily access all your account-related information, including your Demat account details & personal information.

6. My Documents

All your important documents, such as KYC forms, PAN card details, CMR and more, are stored securely in one place. This feature eliminates the hassle of searching for critical documents, giving you easy access whenever you need them.

This is just the first phase of Journal. We aim to make it your complete reporting platform, offering a comprehensive suite for reporting, tracking, and managing your investments. With time, we plan to add even more features to help you stay on top of your financial journey, making Dhan your ultimate partner for trading and investing.

What’s Coming Soon?

We’re working on additional features to make the Reporting even more powerful:

- Equity Curve

- Mutual Fund Reports

- KYC on Journal

We’re excited to bring you this new feature and are eager to hear your feedback as we continue to enhance your experience. Stay tuned for more updates and improvements coming soon!

Best Regards,

Mahima Shah