Dear Traders & Investors,

At Dhan, we have introduced many industry first and innovative features and capabilities for Traders, Investors and Market Enthusiasts ever since we have launched. We continue that innovation everyday, as we go through thousands of suggestions and feedback we get from everyone.

By now you know this - Dhan is built for Super Traders and Long Term investors who have been in markets for a while and appreciate the ups & downs that come with it. We have also mentioned this a couple of times that 85% of our users - Traders or Investors, move from other platforms to Dhan for its incredible features, products and services that are built with our customer centric approach, focused on product & technology.

Dhan has built most of its technology and engineering capabilities in-house more importantly, from the scratch. Most of our users, and this community members are well aware that Dhan’s core technology system - DEXT provides us a significant edge in two key areas - Speed and Innovation. We have often discussed the speed of order execution and how it helps traders minimise slippages and impact costs associated.

Note: If you have not read about DEXT, you can read it in detail here. We intend to write more about DEXT soon, in particular about how we built this grounds up and the architecture behind it.

Coming back, as you know that Trading and Investing are subjective. Each one of you approaches the market with a unique mindset, interprets trends differently, and responds to the markets in your own way. Your trading style & strategies are distinct, based on your own learnings, experiences and risk appetite.

As every trader has a unique approach to trading, why should a single trading tool work for everyone? Which is why at Dhan we offer a diverse suite of trading tools built to complement different trading styles. We can name a few for you..

- Scalpers can execute fast trades with Scalping Mode

- Technical analysts can do based on Support and Resistances

- Chart lovers, can Trade directly from Charts

- Swing Traders can leverage Forever Orders with OCO

- High-volume trades benefit from Instant Slicing with Iceberg orders

- Intraday traders optimise strategies with Bracket & Cover order

- Analytical mindsets on Options Trading to build their Custom Strategies

- Few manage risks with Trailing Stop Loss

- For pine-script coders, we provide Webhook for TradingView for effortless strategy execution.

And so many more on Dhan with Draft, Basket, Reverse Order and with the incredible Positions Management capabilities tagged alongside with risk management via Trader Controls. At Dhan, we truly make it an incredible trading experience for these different trading styles.

All innovation on Dhan is possible via DEXT - our powerful, high-performance trade execution engine. DEXT serves as the backbone of these innovations that come to you via products, features and capabilities. With its state-of-the-art architecture, DEXT ensures that traders experience minimal latency, optimal order flow, and a frictionless trading experience. By continuously evolving and adapting to market demands, DEXT empowers traders with the right tools to evolve their strategies and stay ahead in the ever changing world of trading.

Today, we are excited to announce the new order type, built on top of DEXT.

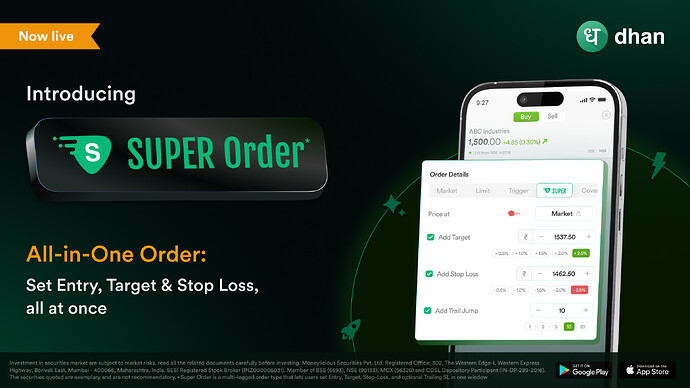

Introducing Super Order: Incredible new All-in-One Order from Dhan that serves everyone.

A Super Order on Dhan is a multi-legged order type that allows traders to simultaneously place an Entry Price, Target Price, and Stop-Loss Price within a single order window. It includes an optional Trailing Stop-Loss (TSL) facility to trail the stop loss in the favourable direction of trade with LTP.

The Target & Stop Loss in Super Order follow an OCO (one cancels other) mechanism, meaning if either the target or stop-loss order triggers, the other legs will get canceled automatically. The main order (entry leg) is sent to the exchange immediately, while the target and stop-loss legs are stored in Dhan’s system and are triggered when market price meets predefined price level in Super Order.

Super Orders works in all scenarios, which is why it is super:

- works across all products - Intraday, Delivery and Normal

- works across segments- Equity, Futures, Options and Commodities

- works across exchanges - NSE, BSE and MCX

- works also on Pay Later / MTF

- works with all combinations for Target, StopLoss and with Trailing SL

- works across all Dhan platforms, specially Charts

With Super Order, you get the best of four different order types - Bracket, Cover, Trailing Stop-Loss, and Forever Order; all in one place in a Single Order? You can place it right from the order window. But it is much more than the combination of these order types. While keeping the core functionality of these orders, the limitations has been removed in Super Orders.

To enhance your Super Orders experience further, we have also introduced an all new Super Order book & Position management that is combined into one and also available to you both on the app and web. This helps you provide a position view of all Super Orders, and in a single toggle gives you an Order-Book view of the same with linked-orders.

While all orders sent to the exchange, including Super Orders, are visible in the Main Orderbook, the Super Orderbook provides a focused view of only Super Orders. In Super Orderbook, the status of each Super Order is determined by the state of its main leg (entry order) and falls into one of the following five categories:

- Pending: The main leg is awaiting execution at the exchange, and the target and stop-loss legs remain inactive.

- Active: The main leg has been successfully executed, activating the target and stop-loss legs, but they are not yet triggered.

- Closed: Either the target or stop-loss leg has been triggered and executed, closing the position.

- Failed: The main leg was rejected or failed to execute, leading to the failure of the entire Super Order.

- Cancelled: The main leg or both the target and stop-loss legs have been cancelled before execution.

In the main orderbook, you will find the Super Order and its associated legs with the ![]() icon.

icon.

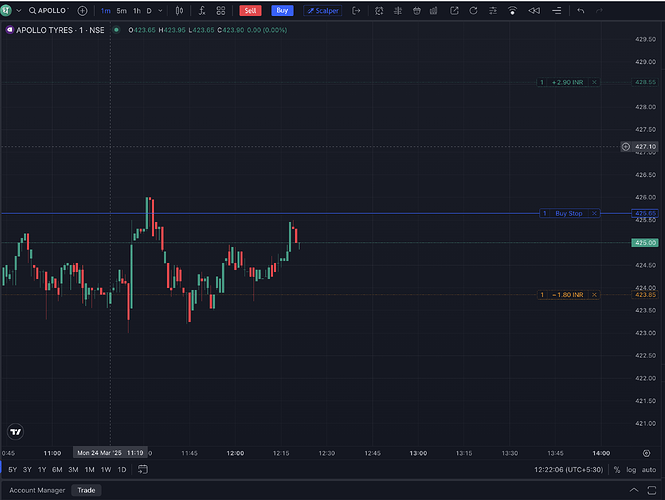

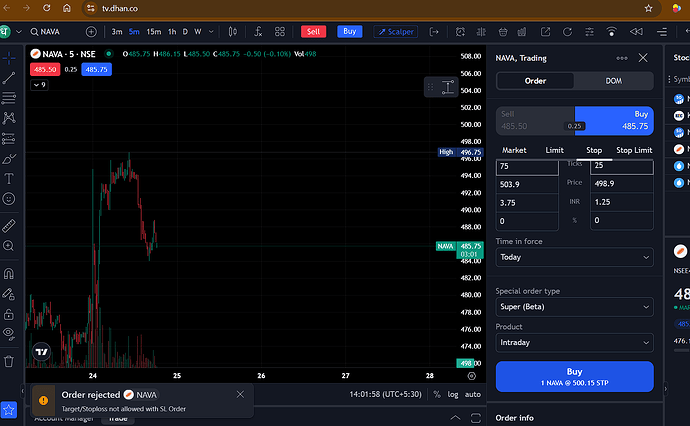

The Super Orders are available on all Dhan platforms, this includes - Dhan App & Web, Options Trader App & Web, ScanX, DhanHQ Trading API & most importantly on Dhan’s TradingView Charting Console. Yes, as mentioned earlier you can apply Super Orders on Chart as well. All your super orders are going to be visible on the TradingView Charts.

You can apply Super Orders on Charts using three ways -

a) Dhan Standard Order Window;

b) TradingView Native Order Window;

c) Drag & Drop TP/SL from order line

Here is the simple GIF for your reference:

All these enhancements in order placement are based on your valuable feedback and suggestions that we get from time to time. With DEXT, we are able to bring them to reality along with incredibly fast execution experience.

To begin with, the beta version of Super Orders will be available across all products. As the feature evolves, we will gradually transition from the beta phase to a full-fledged production release. We would request you to please go through the important terms and conditions before you proceed with the Super Orders. Please try & let us know below in the thread your initial feedback for the new order type on Dhan.

We have created a detailed video on how you can use Super Orders, check out now ![]()

Here’s how you can place Super Orders on Dhan Charts ( tv.dhan.co) ![]()

Super Orders marks a significant revamp of our order placement system and we believe this is going to help and empower Dhan traders for better trading decisions.

Happy Trading on Dhan,

Naman