Hi Investor,

Back in April, we Introduced Demat Mutual Funds on Dhan - and the response was phenomenal. With just a few taps, investors could start pledging their Mutual Fund units to get margin benefits - a smarter way to make the most of their holdings.

Naturally, this led to a common question from many of you:

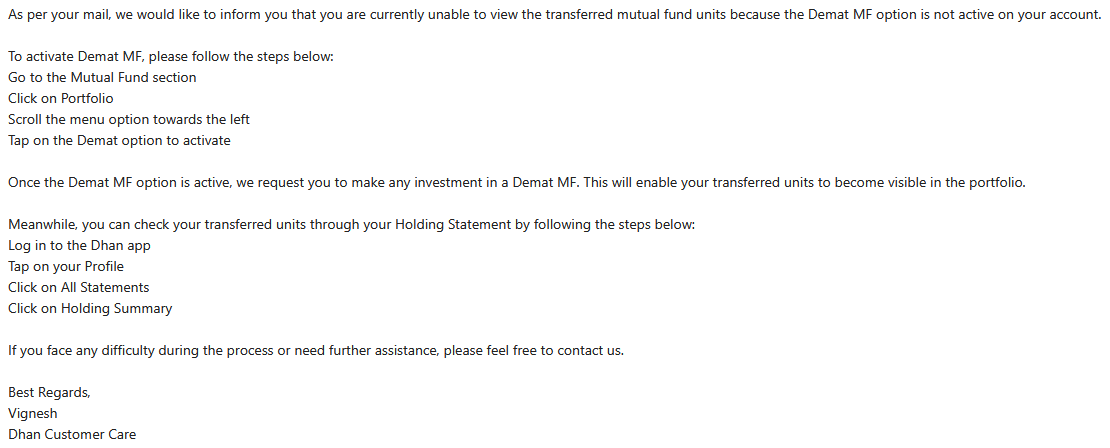

Why aren’t my transferred Mutual Funds showing in my portfolio?

Transfered my demat Mutual Funds not reflecting in my portfolio

Will these work like any other investment - can I redeem, invest more, or pledge them too?

We heard you and we’re excited to share that the answer to all of the above is YES.

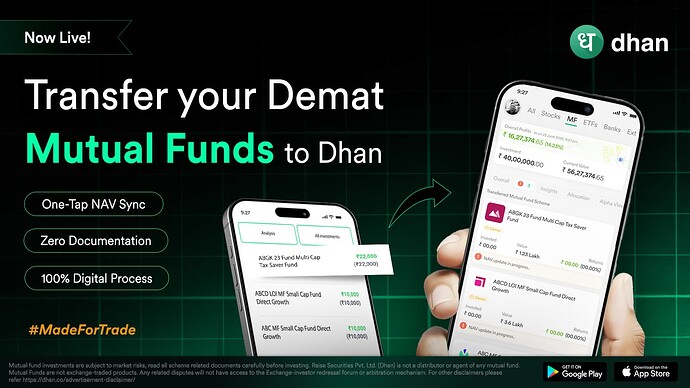

You can now digitally transfer, track, and pledge your existing Demat Mutual Funds from any broker to Dhan - completely paperless, with no follow-ups, and with full access the moment they reflect in your account. Make the switch & take full control.

But before we dive deeper, let’s take a look at the traditional vs digital process which completely eliminates the need for any physical to & fro.

We’ve built this ability with three clear goals in mind: simplicity, speed, and control.

-

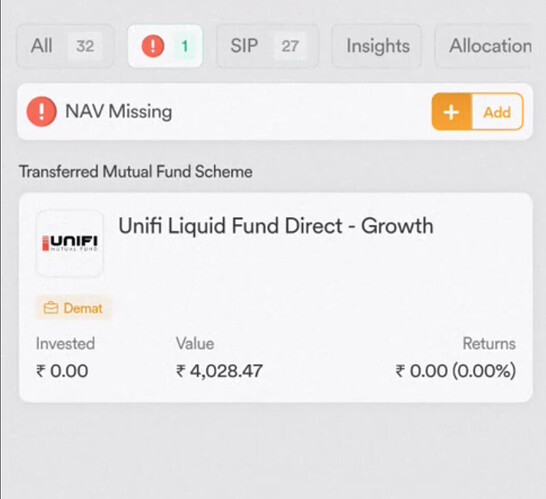

Real-Time Portfolio Update: Once transferred, units automatically appear under the “Transferred” section in your Mutual Fund portfolio, as soon as they land in your Dhan Demat.

-

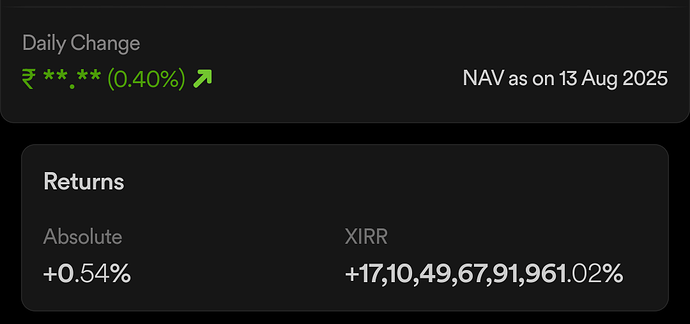

One-Tap NAV Sync: So, when Transferred Mutual fund units arrive without historical buy NAV from CDSL. That means your portfolio shows no invested value, no P&L, and no % returns - and your capital gain reports remain incomplete.

- While most platforms nudge users to manually input the NAV, the process is tedious, prone to errors, and often skipped.

- Dhan removes the guesswork. With just one tap, your NAV is auto-synced and updated, giving you complete visibility of your investment performance. Just clean and accurate data.

-

Full control: Top-up or start SIPs, or even pledge them for margin - your transferred units are fully usable from Day 1.

Getting Started is Easy

-

Update to the latest Dhan app

-

Go to Mutual Fund Portfolio → Activate Demat Mutual Funds

-

Initiate the transfer via CDSL Easiest (just like transferring stocks) note : process usually takes 1–2 working days

-

Once your units arrive on Dhan MF portfolio, tap on ‘+NAV’ button

-

Complete a quick OTP verification via MF Central to continue investing

-

That’s it - start using them like any other Mutual Fund on Dhan.

Tried transferring your funds already? Tell us how it went - we’d love to hear your experience.

Raise the bar,

Saurav Parui