sir @Tradehull_Imran

Thank you very much for your very quick response sir.

VBR Prasad

use this file : Dhan_Tradehull_V2.py - Google Drive

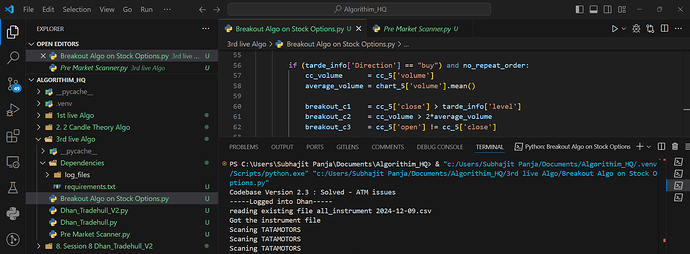

also for TATAMOTORS use expiry as 26-12-2024

Hi @Subhajitpanja

Also for instrument file issue, update the login code to

import pdb

from Dhan_Tradehull_V2 import Tradehull

import pandas as pd

import talib

import time

import datetime

import os

client_code = ""

token_id = ""

tsl = Tradehull(client_code,token_id)

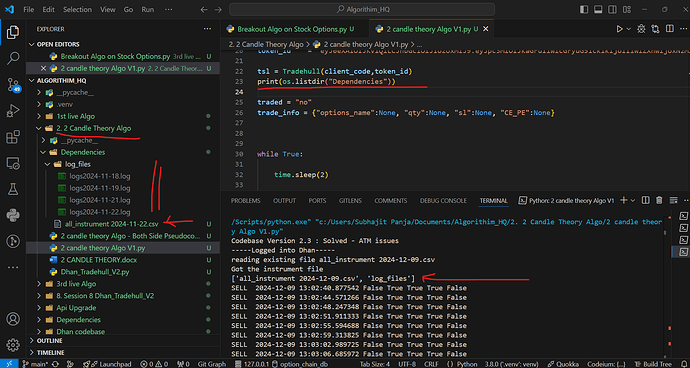

print(os.listdir("Dependencies"))

and send the output

Hi @vinay_kumaar

Send complete code you are using

@Tradehull_Imran sir now it is working fine.

but just informing

all_instrument 2024-12-09.csv

file is not there

old one I deleted no new one generated.(although it is not required)

Output:

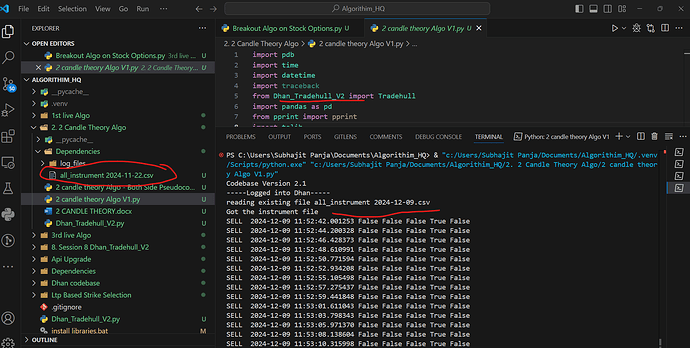

Codebase Version 2.3 : Solved - ATM issues

-----Logged into Dhan-----

reading existing file all_instrument 2024-12-09.csv

Got the instrument file

[‘all_instrument 2024-12-09.csv’, ‘log_files’]

@Tradehull_Imran sir

import pdb

import time

import datetime

import traceback

from Dhan_Tradehull_V2 import Tradehull

import pandas as pd

from pprint import pprint

import talib

import pandas_ta as pta

import pandas_ta as ta

import warnings

warnings.filterwarnings(“ignore”)

---------------for dhan login ----------------

tsl = Tradehull(client_code,token_id)

traded = “no”

trade_info = {“options_name”:None, “qty”:None, “sl”:None, “CE_PE”:None}

while True:

live_pnl = tsl.get_live_pnl()

current_time = datetime.datetime.now().time()

# if current_time < datetime.time(9,30):

# print("wait for market to start",current_time)

# continue

# if current_time > datetime.time(15, 15):

# print("market is close",current_time)

# break

print("Algo Bot is working",current_time)

index_chart = tsl.get_historical_data(tradingsymbol='NIFTY DEC FUT', exchange='NFO', timeframe="1")

index_chart_1 = tsl.get_historical_data(tradingsymbol='NIFTY DEC FUT', exchange='NFO', timeframe="5")

index_chart_2 = tsl.get_historical_data(tradingsymbol='NIFTY DEC FUT', exchange='NFO', timeframe="15")

time.sleep(3)

index_ltp = tsl.get_ltp_data(names = ['NIFTY DEC FUT'])['NIFTY DEC FUT']

if (index_chart.empty):

time.sleep(60)

continue

# Conditions that are on 1 minute timeframe

# Supertrend

indi = ta.supertrend(index_chart ['high'], index_chart ['low'], index_chart ['close'], 10, 2)

index_chart = pd.concat([index_chart , indi], axis=1, join='inner')

# mom

index_chart['mom'] =talib.MOM(index_chart['close'], timeperiod=10)

# Conditions that are on 5 minute timeframe

# rsi ------------------------ apply indicators

index_chart_1['rsi'] = talib.RSI(index_chart_1['close'], timeperiod=14)

# mom

index_chart_1['mom'] =talib.MOM(index_chart_1['close'], timeperiod=10)

# vwap

index_chart_1.set_index(pd.DatetimeIndex(index_chart_1['timestamp']), inplace=True)

index_chart_1 ['vwap'] = pta.vwap(index_chart_1 ['high'] , index_chart_1 ['low'], index_chart_1 ['close'] , index_chart_1 ['volume'])

# Supertrend

indi = ta.supertrend(index_chart_1 ['high'], index_chart_1 ['low'], index_chart_1 ['close'], 10, 2)

index_chart_1 = pd.concat([index_chart_1 , indi], axis=1, join='inner')

# vwma

index_chart_1 ['pv'] = index_chart_1 ['close'] * index_chart_1 ['volume']

index_chart_1 ['vwma'] = index_chart_1 ['pv'].rolling(20).mean() / index_chart_1 ['volume'].rolling(20).mean()

# Conditions that are on 15 minute timeframe

# rsi ------------------------ apply indicators

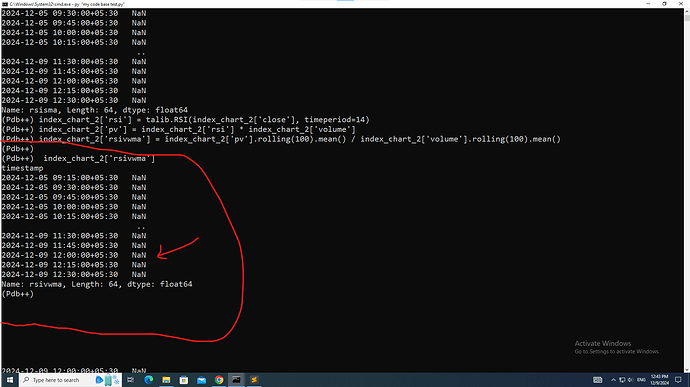

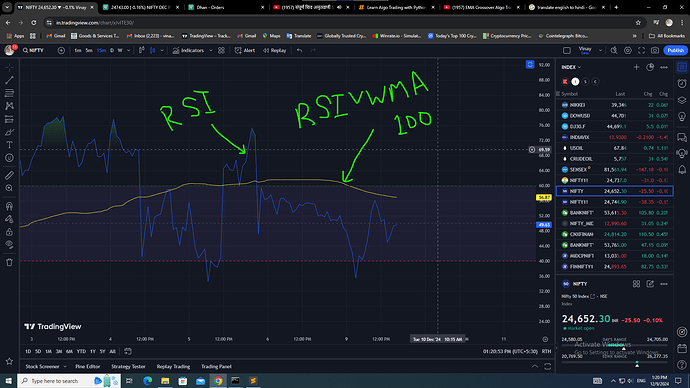

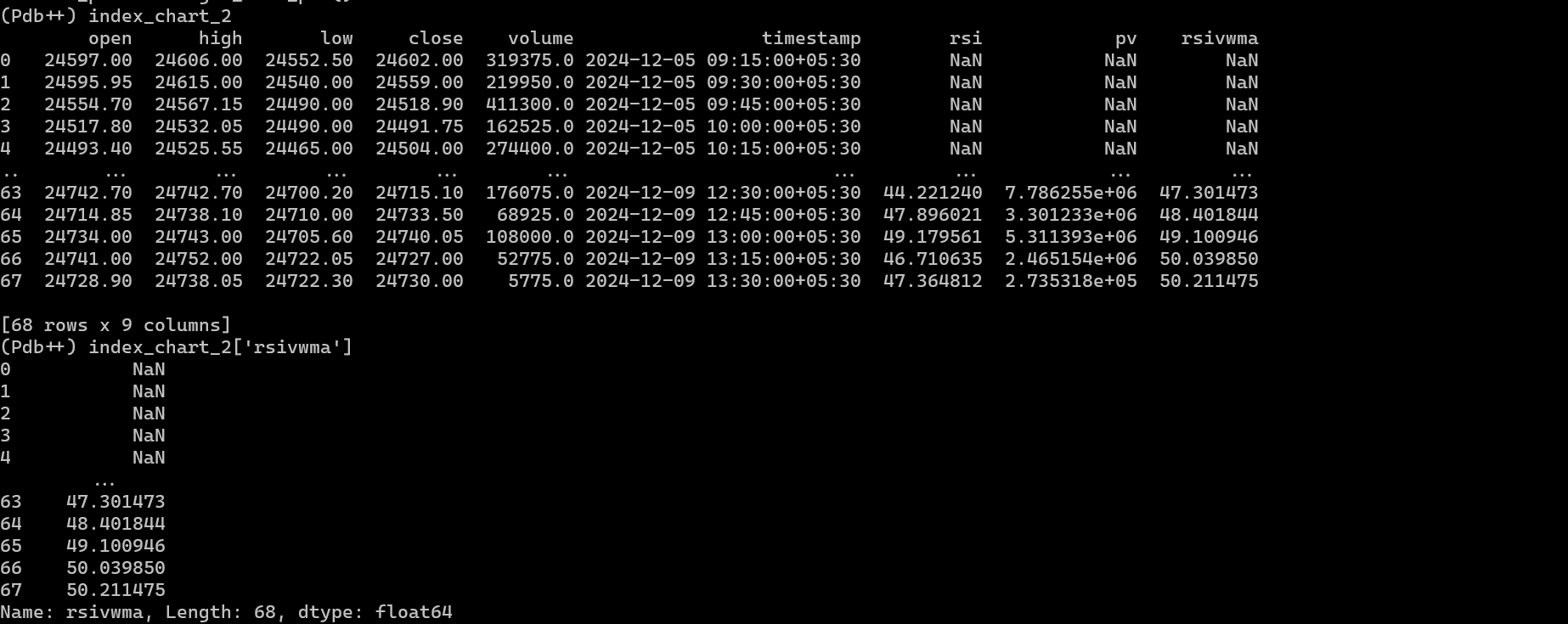

index_chart_2['rsi'] = talib.RSI(index_chart_2['close'], timeperiod=14)

index_chart_2['pv'] = index_chart_2['rsi'] * index_chart_2['volume']

index_chart_2['rsivwma'] = index_chart_2['pv'].rolling(10).mean() / index_chart_2['volume'].rolling(10).mean()

# mom

index_chart_2['mom'] =talib.MOM(index_chart_2['close'], timeperiod=10)

# vwap

index_chart_2.set_index(pd.DatetimeIndex(index_chart_2['timestamp']), inplace=True)

index_chart_2['vwap'] = pta.vwap(index_chart_2['high'] , index_chart_2['low'], index_chart_2['close'] , index_chart_2['volume'])

# Supertrend

indi = ta.supertrend(index_chart_2['high'], index_chart_2['low'], index_chart_2['close'], 10, 2)

index_chart_2 = pd.concat([index_chart_2, indi], axis=1, join='inner')

# vwma

index_chart_2['pv'] = index_chart_2['close'] * index_chart_2['volume']

index_chart_2['vwma'] = index_chart_2['pv'].rolling(20).mean() / index_chart_2['volume'].rolling(20).mean()

# volume

volume = 50000

# Conditions that are on 1 minute timeframe

first_candle = index_chart.iloc[-3]

second_candle = index_chart.iloc[-2]

running_candle = index_chart.iloc[-1]

# Conditions that are on 5 minute timeframe

first_candle_1 = index_chart_1.iloc[-3]

second_candle_1 = index_chart_1.iloc[-2]

running_candle_1 = index_chart_1.iloc[-1]

# Conditions that are on 15 minute timeframe

first_candle_2 = index_chart_2.iloc[-3]

second_candle_2 = index_chart_2.iloc[-2]

running_candle_2 = index_chart_2.iloc[-1]

pdb.set_trace()

# ---------------------------- BUY ENTRY CONDITIONS 1 MINUTE TIMEFRAME ----------------------------

bc1 = first_candle['close'] > first_candle['SUPERT_10_2.0'] # first_candle close is above Supertrend

bc2 = second_candle['mom'] > 25 # first_candle MOM > 25

# ---------------------------- BUY ENTRY CONDITIONS 5 MINUTE TIMEFRAME ----------------------------

bc3 = first_candle_1['close'] > first_candle_1['vwap'] # first_candle_1 close is above VWAP

bc4 = first_candle_1['close'] > first_candle_1['SUPERT_10_2.0'] # first_candle_1 close is above Supertrend

bc5 = first_candle_1['close'] > first_candle_1['vwma'] # first_candle_1 close is above VWMA

bc6 = first_candle_1['mom'] > 25 # first_candle_1 MOM > 25

bc7 = first_candle_1['rsi'] < 80 # first_candle_1 RSI < 80

bc8 = second_candle_1['volume'] > 50000 # second_candle_1 Volume should be greater than 50,000 for Nifty and above 125,000 for Bank Nifty

bc9 = traded == "no"

bc10 = index_ltp > first_candle_1['low']

# ---------------------------- BUY ENTRY CONDITIONS 15 MINUTE TIMEFRAME ----------------------------

bc11 = first_candle_2['close'] > first_candle_2['vwap'] # first_candle_2 close is above VWAP

bc12 = first_candle_2['close'] > first_candle_2['SUPERT_10_2.0'] # first_candle_2 close is above Supertrend

bc13 = first_candle_2['close'] > first_candle_2['vwma'] # first_candle_2 close is above VWMA

bc14 = first_candle_2['rsi'] > index_chart_2['rsivwma'] # first_candle_2 rsi is above rsivwma (timeperiod=100)

bc15 = first_candle_2['mom'] > 25 # first_candle_2 MOM > 25

bc16 = first_candle_2['rsi'] > 50 # first_candle_2 RSI > 50

bc17 = traded == "no"

bc18 = index_ltp > first_candle_2['low']

print(f"BUY \t {current_time} \t {bc1} \t {bc2} \t {bc3} \t {bc4} \t {bc5} \t {bc6} \t {bc7} \t {bc8} \t {bc9} \t {bc10} \t {bc11} \t {bc12} \t {bc13} \t {bc14} \t {bc15} \t {bc16} \t {bc17} \t {bc18} \t first_candle_1 {str(first_candle_1['timestamp'].time())} \n")

# ---------------------------- SELL ENTRY CONDITIONS 1 MINUTE TIMEFRAME ----------------------------

sc1 = first_candle['close'] < first_candle['SUPERT_10_2.0'] # first_candle close is below Supertrend

sc2 = second_candle['mom'] < -25 # first_candle MOM > -25

# ---------------------------- SELL ENTRY CONDITIONS 5 MINUTE TIMEFRAME ----------------------------

sc3 = first_candle_1['close'] < first_candle_1['vwap'] # first_candle_1 close is below VWAP

sc4 = first_candle_1['close'] < first_candle_1['SUPERT_10_2.0'] # first_candle_1 close is below Supertrend

sc5= first_candle_1['close'] < first_candle_1['vwma'] # first_candle_1 close is below VWMA

sc6 = first_candle_2['mom'] < -25 # first_candle_1 MOM < -25

sc7 = first_candle_1['rsi'] < 80 # first_candle_1 RSI < 80

sc8 = second_candle_2['volume'] > 50000 # Second candle Volume should be greater than 50,000 for Nifty and above 125,000 for Bank Nifty

sc9 = traded == "no"

sc10 = index_ltp < first_candle_1['high']

# ---------------------------- SELL ENTRY CONDITIONS 15 MINUTE TIMEFRAME----------------------------

sc11 = first_candle_2['close'] < first_candle_2['vwap'] # first_candle_2 close is below VWAP

sc12 = first_candle_2['close'] < first_candle_2['SUPERT_10_2.0'] # first_candle_2 close is below Supertrend

sc13 = first_candle_2['close'] < first_candle_2['vwma'] # first_candle_2 close is below VWMA

bc14 = first_candle_2['rsi'] < index_chart_2['rsivwma'] # first_candle_2 rsi is below rsivwma (timeperiod=100)

sc15 = first_candle_2['mom'] < -25 # first_candle_2 MOM < -25

sc16 = first_candle_2['rsi'] < 50 # first_candle_2 RSI < 50

sc17 = traded == "no"

sc18 = index_ltp < first_candle_2['high']

print(f"SELL \t {current_time} \t {sc1} \t {sc2} \t {sc3} \t {sc4} \t {sc5} \t {sc6} \t {sc7} \t {sc8} \t {sc9} \t {sc10} \t {sc11} \t {sc12} \t {sc13} \t {sc14} \t {sc15} \t {sc16} \t {bc17} \t {bc18} \t first_candle_1 {str(first_candle_1['timestamp'].time())} \n")

if bc1 and bc2 and bc3 and bc4 and bc5 and bc6 and bc7 and bc8 and bc9 and bc10 and bc11 and bc12 and bc13 and bc14 and bc15 and bc16 and bc17 and bc18:

print("Buy Signal Formed Order Is Fired")

ce_name, pe_name, strike = tsl.ATM_Strike_Selection(Underlying ='NIFTY',Expiry ='12-12-2024')

ce_ltp = tsl.get_ltp_data(names = [ce_name])[ce_name]

lot_size = tsl.get_lot_size(ce_name)*1

entry_orderid = tsl.order_placement(ce_name,'NFO', lot_size, 0, 0, 'MARKET', 'BUY', 'MIS')

traded = "yes"

trade_info['options_name'] = ce_name

trade_info['qty'] = lot_size

trade_info['sl'] = first_candle_1['low']

trade_info['CE_PE'] = "CE"

trade_info['tg_hit'] = tg_hit

exit_processed = False

if sc1 and sc2 and sc3 and sc4 and sc5 and sc6 and sc7 and sc8 and sc9 and sc10 and sc11 and sc12 and sc13 and sc14 and sc15 and sc16 and sc17 and sc18:

print("Sell Signal Formed Order Is Fired")

ce_name, pe_name, strike = tsl.ATM_Strike_Selection(Underlying ='NIFTY',Expiry ='12-12-2024')

pe_ltp = tsl.get_ltp_data(names = [pe_name])[pe_name]

lot_size = tsl.get_lot_size(pe_name)*1

entry_orderid = tsl.order_placement(pe_name,'NFO', lot_size, 0, 0, 'MARKET', 'BUY', 'MIS')

traded = "yes"

trade_info['options_name'] = pe_name

trade_info['qty'] = lot_size

trade_info['sl'] = first_candle_1['high']

trade_info['CE_PE'] = "PE"

trade_info['tg_hit'] = tg_hit

exit_processed = False

# ---------------------------- check for exit SL/TG -----------------------------------------------------

if traded == "yes":

long_position = trade_info['CE_PE'] == "CE"

short_position = trade_info['CE_PE'] == "PE"

if long_position:

sl_hit = index_ltp < trade_info['sl']

tg_hit = index_ltp < running_candle_1['SUPERT_10_2.0']

if sl_hit or tg_hit:

print("Order Exited", trade_info)

exit_orderid = tsl.order_placement(trade_info['options_name'],'NFO', trade_info['qty'], 0, 0, 'MARKET', 'SELL', 'MIS')

traded = "no"

if short_position:

sl_hit = index_ltp > trade_info['sl']

tg_hit = index_ltp > running_candle_1['SUPERT_10_2.0']

if sl_hit or tg_hit:

print("Order Exited", trade_info)

exit_orderid = tsl.order_placement(trade_info['options_name'],'NFO', trade_info['qty'], 0, 0, 'MARKET', 'SELL', 'MIS')

traded = "no"

order_details = tsl.cancel_all_orders()

pdb.set_trace()

sir check this line

bc14 = first_candle_2[‘rsi’] > index_chart_2[‘rsivwma’] # first_candle_2 rsi is above rsivwma (timeperiod=100)

sir

is code me daily pivot or weekly pivot add karna chahta hu…

I am using this code,

index_chart_2 = tsl.get_historical_data(tradingsymbol='NIFTY DEC FUT', exchange='NFO', timeframe="15")

index_chart_2['rsi'] = talib.RSI(index_chart_2['close'], timeperiod=14)

index_chart_2['pv'] = index_chart_2['rsi'] * index_chart_2['volume']

index_chart_2['rsivwma'] = index_chart_2['pv'].rolling(10).mean() / index_chart_2['volume'].rolling(10).mean()

this shows correct values for rsivwma

Also, do apply this indicator on NIFTY DEC FUT, in tradingview it has been applied on nifty

use below pseudocode

def get_pivot_point(chart):

chart = chart.iloc[-1]

PP = (chart['high'].max() + chart['low'].min() + chart["close"].iloc[-1])/3

R1 = 2 * PP - chart['low'].min()

R2 = PP + (chart['high'].max() - chart['low'].min())

R3 = PP + 2 * (chart['high'].max() - chart['low'].min())

S1 = 2 * PP - chart['high'].max()

S2 = PP - (chart['high'].max() - chart['low'].min())

S3 = PP - 2 * (chart['high'].max() - chart['low'].min())

Hi @Subhajitpanja

all_instrument 2024-12-09.csv is present in Dependencies folder, but somehow on vscode it does not shows up,

now since all_instrument 2024-12-09.csv is present , the lots sizes, and step values that the codebase reads are correct, so no issue. we can safely ignore the vscode issue.

day or weekly ke liye iloc[ ?]

The issue still persist

Exception in Getting OHLC data as {‘status’: ‘failure’, ‘remarks’: {‘error_code’: ‘DH-904’, ‘error_type’: ‘Rate_Limit’, ‘error_message’: ‘Too many requests on server from single user breaching rate limits. Try throttling API calls.’}, ‘data’: {‘errorType’: ‘Rate_Limit’, ‘errorCode’: ‘DH-904’, ‘errorMessage’: ‘Too many requests on server from single user breaching rate limits. Try throttling API calls.’}}

I have updated the Dhan_Tradehull_V2 as you have replied.

It had worked for sometime and after that issue re-started.

But I have checked in folder also by the windows explorer

I couldn’t find that file

I will try to send you screenshot also

But not occuring any problem ![]()

We can ignore now.I think we will modify many things in next version

Dhan api also introducing Option chain very soon @Tradehull_Imran sir

Today am facing same issue, Data not fetching

previous day ka data nhi mil pa rha