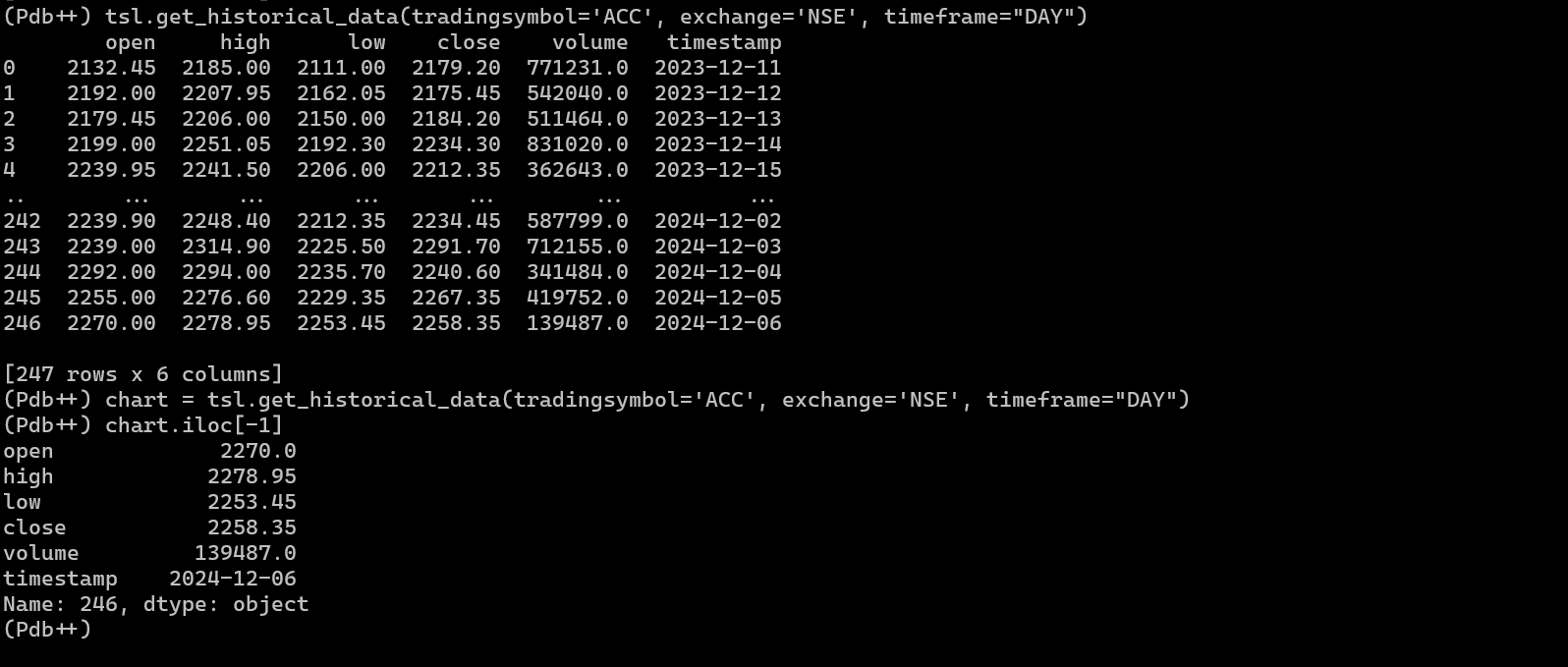

we can use chart.iloc[-1], this will give us candle data for last day

Do upload the zip of the complete folder and share the access to tradehull_mentorship@tradehull.com

We will need to check it in live market

Yes, Option Chain access with Greeks via Api is game changer feature,

We will soon see how to implement it in live option chain, and historical option chain replay.

Thanks, @Hardik @RahulDeshpande @Dhan for implementing it.

In Historical data use “DAY” as parameter in timeframe

Example : tsl.get_historical_data(tradingsymbol='ACC', exchange='NSE', timeframe="DAY")

Good Evening Sir.

I could make out a keyboard shortcut to transpose options (CE & PE) from vertical to Horizontal by using:

ctrl + shift = j

But I am not getting to place - ’ ', - for each of them. Please guide me sir.

VBR Prasad

@Tradehull_Imran @Tradehull @RahulDeshpande I am stuck here. I am trying to setup the websocket.

- I have set the tokens.

- I have removed the expired instruments

When I run the websocket file, it gets stuck here and LTP is not fetched!

Please guide

Update Tradehull V2

I have already used the Tradehull V2. Also, Tradehull is not being used in the websocket python file.

Sir ![]()

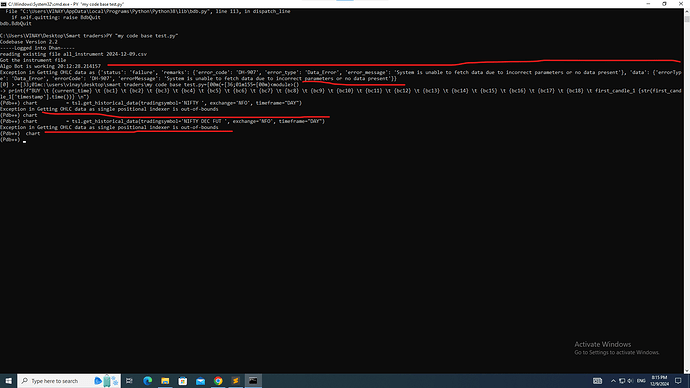

chart = tsl.get_historical_data(tradingsymbol='NIFTY DEC FUT ', exchange=‘NFO’, timeframe=“DAY”)

code ye hi de rha hu fir bhi data nhi aarha hai…(Dhan_Tradehull_V2 me error hai kya )

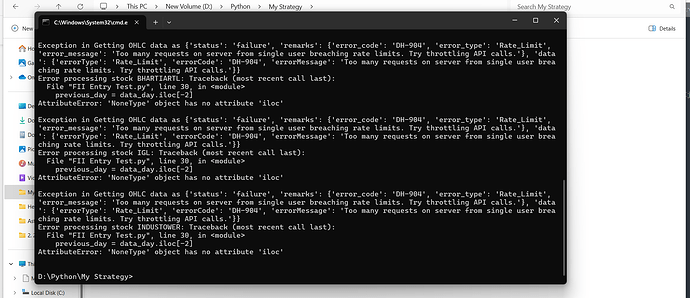

afternoon se yahi issue hai… not fetching data, mera algo to beech me error dene laga

Hello @babji3 Ji

this problem is Rate limit issue hai …

han, but morning me acha chal raha tha, abhi bhi try karraha hun, any solution

Han vinay kumar ji, jaisa maine kaha, morning me acha chalraha tha…

hello sir @Tradehull_Imran , lastly i used it on friday and it was working great suddenly this error is coming

solution i have tried is:

- re installed all files like python, libraries, vs code

- also dowloaded new dhan trade hull file

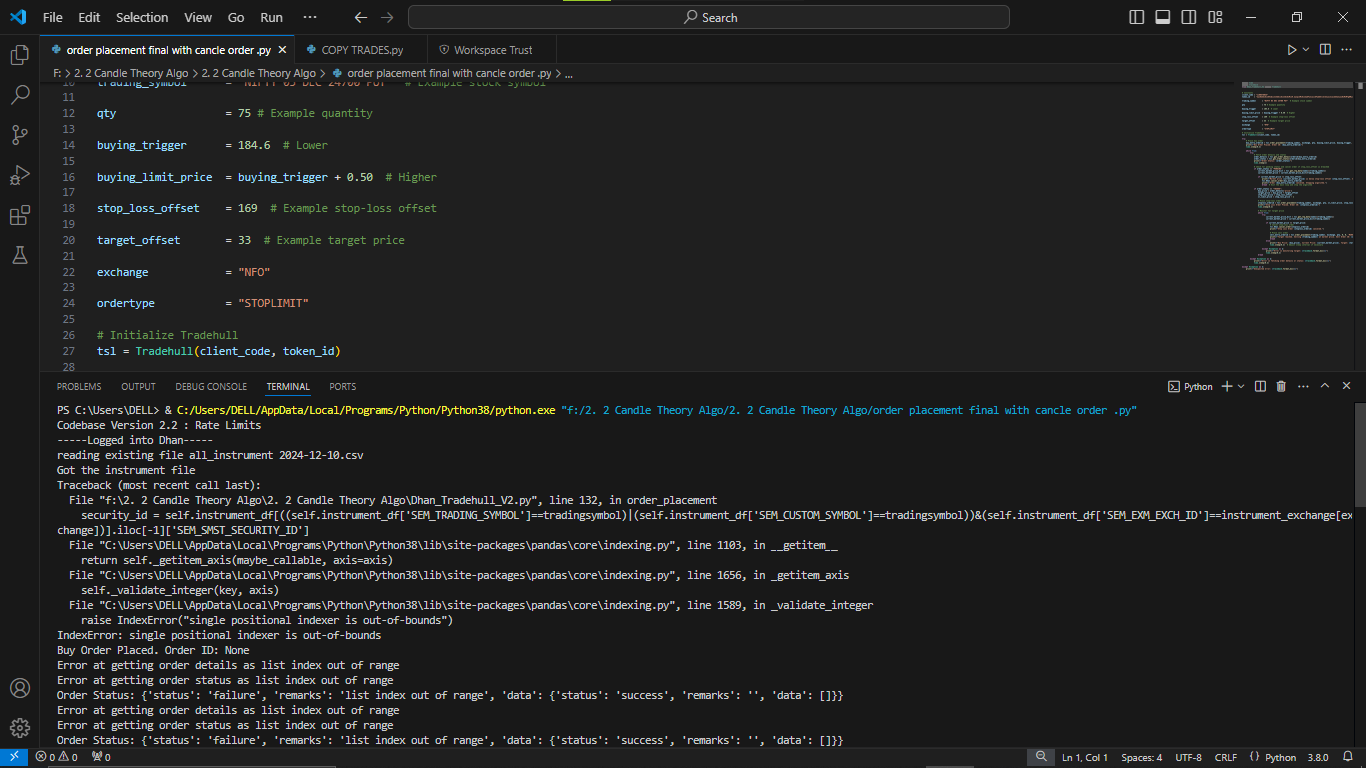

File “C:\Users\DELL\AppData\Local\Programs\Python\Python38\lib\site-packages\pandas\core\indexing.py”, line 1103, in getitem

return self._getitem_axis(maybe_callable, axis=axis)

File “C:\Users\DELL\AppData\Local\Programs\Python\Python38\lib\site-packages\pandas\core\indexing.py”, line 1656, in _getitem_axis

self._validate_integer(key, axis)

File “C:\Users\DELL\AppData\Local\Programs\Python\Python38\lib\site-packages\pandas\core\indexing.py”, line 1589, in _validate_integer

raise IndexError(“single positional indexer is out-of-bounds”)

IndexError: single positional indexer is out-of-bounds

Buy Order Placed. Order ID: None

Error at getting order details as list index out of range

trading_symbol = "NIFTY 05 DEC 24700 PUT" # Example stock symbol

qty = 75 # Example quantity

buying_trigger = 184.6 # Lower

buying_limit_price = buying_trigger + 0.50 # Higher

stop_loss_offset = 169 # Example stop-loss offset

target_offset = 33 # Example target price

exchange = "NFO"

ordertype = "STOPLIMIT"

# Initialize Tradehull

tsl = Tradehull(client_code, token_id)

try:

# Place buy order

buy_entry_orderid = tsl.order_placement(trading_symbol, exchange, qty, buying_limit_price, buying_trigger, ordertype, 'BUY', 'MIS')

print(f"Buy Order Placed. Order ID: {buy_entry_orderid}")

time.sleep(0.2)

while True:

try:

# Fetch order details and status

order_details = tsl.get_order_detail(orderid=buy_entry_orderid)

order_status = tsl.get_order_status(orderid=buy_entry_orderid)

print(f"Order Status: {order_status}")

time.sleep(1)

# Check for pending status and cancel order if stop_loss_offset is breached

if order_status == "PENDING":

current_market_price_dict = tsl.get_ltp_data(names=[trading_symbol])

current_market_price = current_market_price_dict[trading_symbol]

if current_market_price <= stop_loss_offset:

print(f"Market price {current_market_price} is below stop-loss offset {stop_loss_offset}. Canceling order.")

tsl.Dhan.cancel_order(buy_entry_orderid)

print(f"Order {buy_entry_orderid} canceled. Stopping algorithm.")

break # Exit the main loop and stop the algorithm

if order_status == "TRADED":

buy_price = order_details['price']

target_price = buy_price + target_offset

stop_loss_price = stop_loss_offset

sl_limit_price = stop_loss_price - 1

# Place stop-loss order

stoploss_orderid = tsl.order_placement(trading_symbol, exchange, qty, sl_limit_price, stop_loss_price, 'STOPLIMIT', 'SELL', 'MIS')

print(f"Stop Loss Order Placed. Order ID: {stoploss_orderid}")

time.sleep(0.2)

# Monitor for target price

while True:

try:

current_market_price_dict = tsl.get_ltp_data(names=[trading_symbol])

current_market_price = current_market_price_dict[trading_symbol]

if current_market_price >= target_price:

# Cancel stop-loss order

tsl.Dhan.cancel_order(stoploss_orderid)

print(f"Stop Loss Order {stoploss_orderid} canceled.")

# Place sell order

sell_entry_orderid = tsl.order_placement(trading_symbol, exchange, qty, 0, 0, 'MARKET', 'SELL', 'MIS')

print(f"Target reached. Selling {trading_symbol} at market price. Sell Order ID: {sell_entry_orderid}")

break

else:

print(f"Buy Price: {buy_price}, Current Price: {current_market_price}, Target: {target_price}")

time.sleep(0.2) # Adjust sleep interval if necessary

except Exception as e:

print(f"Error in monitoring target: {traceback.format_exc()}")

time.sleep(0.2)

break

except Exception as e:

print(f"Error in fetching order details or status: {traceback.format_exc()}")

time.sleep(0.2)

except Exception as e:

print(f"Unexpected error: {traceback.format_exc()}")

https://pypi.org/project/dhanhq/

Now @Dhan already introduced Option chain in api

@Tradehull_Imran sir and all friends

@Tradehull_Imran sir

@Tradehull_Imran sir