using ddpi to sell holding is there need to maintain funds for it?

Hi @Mayuresh There is no need to maintain funds when selling via DDPI. Welcome to Dhan community.

thanks.

is there any special charges required for selling the holding through ddpi?

Hi @Mayuresh

No, additional charges will be applied if you sell shares through DDPI.

how much charges is applied?

give me every single information about it

Hi @Mayuresh

All charges are mentioned here: Pricing & Brokerage Charges | Dhan

Please use brokerage calculator to understand same: Brokerage Calculator - Calculate Delivery / Intraday Brokerage Charges | Dhan

charges on holding exit using ddpi?

Hi @Mayuresh Suggest you to please connect with Customer Care on help@dhan.co with all your queries.

Hello @VAggarwal

eDIS OTP is sent by CDSL directly. You can confirm if your email ID on Dhan is correct or not by going to your Profile.

For your DDPI status, you can reach out to the customer care team via email - help@dhan.co or even via chat/call.

Yes I got the e-DIS just a while ago – but the opportunity loss again because of delay

email and everything is correct

can you send me the chat link for dhan customer care – as they DO NOT REPLY TO EMAIL sent to help@dhan… – which is very unprofessional behavior of your customer care

ONLY RESPONSE COMES IN COMMUNITY FORUM ONLY

The delay in the email is something we cannot assist here, as the eDIS OTP is sent by CDSL team itself. On email support, the usual response time is 24-48 hours. But if you want instant resolution, then you can go to your Dhan App > Customer Service section and use chat support.

Upstox is giving DDPI free till 31st December 2024.

Is Dhan planning on same?

Hi @amish We do not compete on prices… and don’t prefer to react to marketing techniques around.

Our focus continues to build Dhan and offer incredible value. Very rarely have we changed our pricing. The other way to look around this - should we charge users pay brokerage on delivery? ![]()

Yes, we say it everyday - we need to make Dhan better. Lots of things coming up, we are work in progress @thisisbanerjee

On relative terms FnO and Intraday cash segment trading brings significantly more revenue relative to equity delivery trades. I think over 90% of trades fall into this category. So zero delivery charges shouldn’t hurt the broker much but looks catchy for the retail investor.

I am unable to activate my DDPI in Dhan, activate DDPI option is not seen in portfolio, manage portfolio or in Money section

Hi @bobshashi

Welcome to the MadeForTrade Community!

We see that your DDPI is already activated. Please check it once from your end.

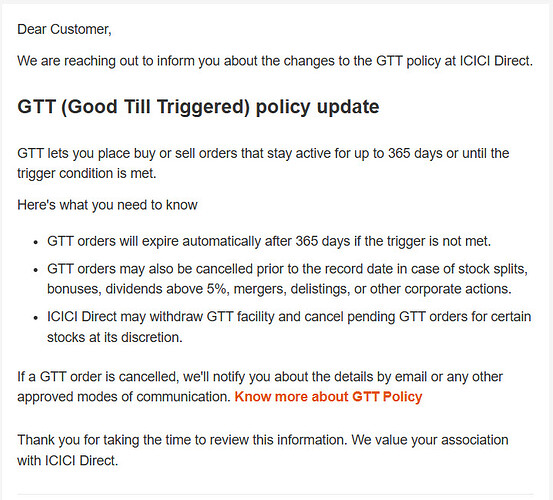

This is the latest update I have received form ICICI Direct about their version of Forever Orders.

Hope, you can also implement this feature now.

@ekveer “I believe these are standard and already implemented on Dhan as well.”

@PravinJ Are you able to confirm the same?

Lets say I active DDPI.

Is it possible to PAUSE it? Either at broker level or depository (CDSL) level?

Like say if I know that I wont be selling anything for six months. So can I PAUSE the DDPI? And then re-enable after six months whenever I want?

I do not want to cancel it. Just PAUSE it.

Please inform / consider.

Thank you.