Hello Investors,

Over the past few months, we’ve been adding meaningful feature updates for Investors and Traders on Dhan. We recently introduced the option to select time for Stock & ETF SIPs on Dhan along with an option for users to make SIPs in Pay Later (MTF mode).

This provides investors more flexibility and control in how and when your SIPs are executed. This update was shaped directly by your feedback on how you prefer to invest on Dhan.

Continuing on the same path, one request we kept hearing from long-term investors was

the ability to increase allocation in existing portfolios. Whether it is taking advantage of market dips, or simply adding more to stocks you already believe in, users wanted a quicker, more streamlined way to act on these opportunities without placing multiple orders manually. To keep it simple - make it easier to double-down and invest more in what users already have invested in.

We have also seen how widely the Mutual Fund Top-up feature is used and the meaningful impact it has on your systematic investing. The convenience and flexibility it offers made it clear that a similar capability for stocks and ETFs would add real value to your equity investing journey.

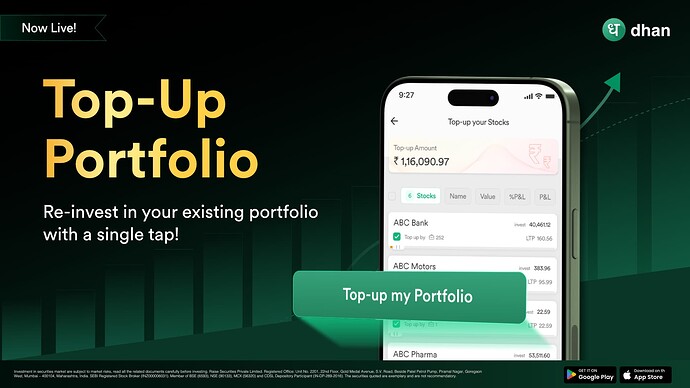

Introducing Top-Up Portfolio for Stocks and ETFs

This new feature enables you to invest across your entire portfolio with just a single tap. If you hold more than three stocks, you will now see the Top-up Portfolio option directly on Dhan. Your current holdings are pre-selected, and you can modify quantities and select stock giving you full control of your investments.

This feature is especially useful when:

● Markets dip and you want to boost your long-term investments efficiently

● Certain sectors move, and you want to strengthen positions

● You simply want to increase your exposure across existing holdings without placing multiple orders

● Or lastly, when you have extra cash with you - you want to invest more in your existing portfolio of stocks.

We hope this enhances your investing experience on Dhan. As always, your feedback continues to shape what we build and we look forward to hearing your thoughts on this.

Happy Investing,

Radhika