Hello Community Members,

We introduced Super Orders a few weeks back - I’m sure many of you already know of this, and most of you may have even used it by now.

At Dhan, we have always mentioned that Trading is the hardest way to make the easiest money. Having said that, Traders do make losses and the same was also emphasized in the studies that market regulator SEBI published sometime back.

It does concern us, and which is why we have provided many features, offerings and capabilities that assist traders in their journey - from the simplest forms like Transaction Estimator (with Net P&L) to very comprehensive risk management tools like Trader Controls like Alert on Losses, Over-Trading, Kill Switch or Trade Buddy. Eventually, we realised we had to do something more fundamental - which is introducing an Order Type that is built grounds up for Trader and also helps him win consistently or increases the odds for success. That’s how Super Order was conceptualized and launched.

Super Order is a significant shift in how Traders or Investors approach markets - strategically, confidently, and with full control. Super Orders are built on top of DEXT - our proprietary in-house trade execution engine that ensures low latency, high reliability, and seamless integration across trading workflows.

From the time we have launched it, Super Orders has seen strong adoption across the Dhan platforms. From retail traders to active investors, and from chart-based scalpers to positional traders, Super Orders is already becoming the default order type for many. What is exciting here is how deeply this New Order is being embedded into the trading routines of Traders on Dhan. Whether it is the Dhan App, Options Trader, web platforms, or directly on charts via tv.dhan.co, users are actively leveraging Super Orders to build a clear plan before entering trades.

To share some stats, Super Order is the 4th Order Type you see on Dhan’s Order Placement panel - yet we have over half-a-million orders placed in a few weeks, far exceeding our own expectations. Its usage is much ahead of the Cover & Bracket orders we have been offering for years now.

With Super Orders, a significant advantage has emerged for those who Trade on Charts. With a simple drag & drop interface on Dhan’s Charting console (tv.dhan.co), traders are placing Entry, Target, and Stop Loss in one go, making execution both fast and intuitive. It is not just convenience, it’s discipline made easy.

Here is the distribution of different legs of Super Orders, planned and placed on Dhan.

Combinations of Super Orders used:

- 62% traders combine Entry + Target + Stop Loss

- 12% traders combine Entry + Target + Trailing Stop Loss

- 12% traders combine Entry + Target

- 12% traders combine Entry + Stop Loss

- 2% traders combine Entry + Trailing Stop Loss

This variety of combinations clearly reflects how traders are tailoring Super Orders to their individual strategies.

Now, let’s talk about outcomes. Out of all the Super Orders where the entry leg was executed, 49% of them hit either the Target or the Stop-Loss leg.The remaining 51% may be still open for holdings, or manually exited. But the trigger rate is completely different when we see it combination wise.

Here is the breakdown of % of orders where Target / StopLoss are triggered:

- 20% of times - when placed only with a Target

- 71% of times - when placed with Entry & Stop Loss

- 72% of times - when placed with Entry & Trailing Stop Loss

- 49% of times - when placed as Entry, Target and Stop Loss

- 54% of times - when placed as Entry, Target and Trailing Stop Loss

As it is clearly evident, when Super Orders are placed on the Stop Loss side, in a whopping > 70% of cases users are able to reduce their losses. If the trader places both target & stop loss, the chances of hitting either are around 49%. Slightly higher (to 54%) if the stop loss is enabled with trail jump.

On the other hand, not placing a Stop Loss (like in the case of only Target) increases the chances of bigger losses to 80%.

While we would like to see outcomes on the target side and traders see positive outcomes in profits, it is important to also understand that Super Orders are helping traders with limiting their orders whenever used on the Stop Loss side.

But this doesn’t mean that hitting the Stop Loss or Trailing Stop Loss always results in a loss, or that hitting the Target always means a sure profit. You might wonder why. This is because traders often modify or trail their Target and Stop Loss - either manually or automatically using trail jump. These changes can sometimes move beyond the original entry price, which leads to the situations mentioned above. Let’s see below how these triggers convert into profit & loss.

What stands out from the chart is how even when Stop Loss or Trailing Stop Loss is triggered, a meaningful portion of trades still end in profit. 23% in the case of regular Stop Loss, and an even better 34% with Trailing SL. This clearly shows that these protective legs are not just about limiting downside, but also help lock in gains when the market moves favourably.

Entry with Target and Stop Loss, or Entry with Target and Trailing SL - further improve the balance between risk and reward. This is roughly around 41% & 33% win ratio respectively.

When we look at these numbers from a broader perspective, the next logical question is—out of all the Super Orders placed, how many actually resulted in positive outcomes and how many ended in negative outcomes? By combining the data across different combinations and outcomes, we get a clearer picture of the overall effectiveness of Super Orders in real trading scenarios. Here’s what the final outcome looks like when we bring it all together ![]()

We would like to conclude that 37% of times when Super Orders are used, traders see a positive outcome for themselves, while in 63% of cases they are able to limit their losses.

SEBI reports that over the last three financial years (FY22-FY24), only 7% of individual traders in the F&O segment managed to make a profit, while 93% suffered losses. And while markets remain unpredictable, what we are seeing with Super Orders is a shift. Traders who plan, define exits, and manage risk at the time of order placement are seeing better consistency. The edge comes not from being right all the time, but from being prepared all the time.

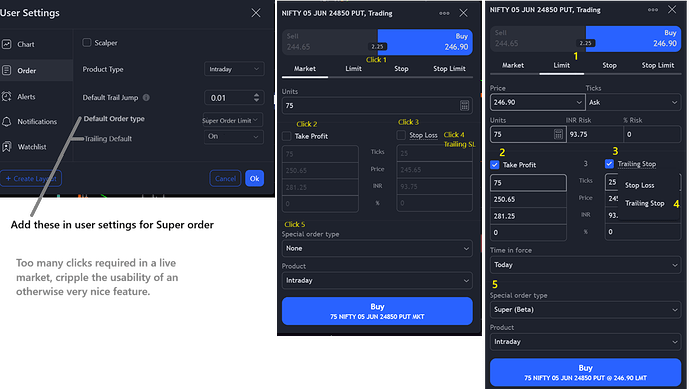

Super Orders have just started. In the coming weeks, we are bringing even more enhancements. These will further simplify the experience and empower you to focus more on strategy than execution.

If you have used Super Orders in your trades, tell us how it has helped you and what combinations work best for your style. And as always, tell us what you’d like to see next in Super Orders, we are building this with you, and for you.

Plan First, Then Trade - with Super Orders.

Thank you

PJ