Dear All,

Dhan has always focused on building the right experience for Super Traders and Long Term Investors. This experience begins from the moment you prepare for the markets to open to writing down your trading and investment notes in Trader’s Diary. After a year’s worth of learning through the peaks and troughs of the market, it is finally time to file your returns.

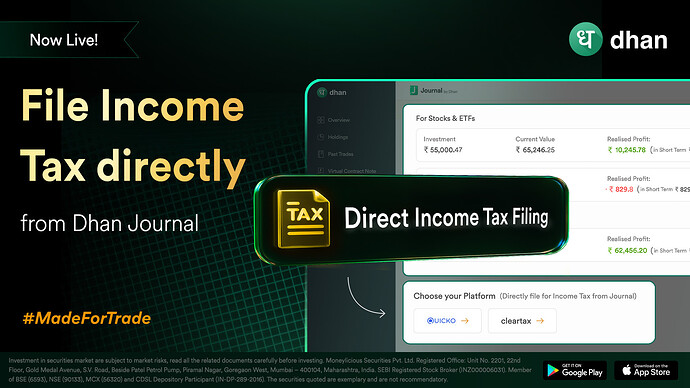

Yes, in our journey of building Dhan for you - we received wide criticism that we focussed a bit less on reporting systems and we worked on that feedback to build a Journal for you! We now continue to enhance your experience on Journal and take the next logical step to enable Income Tax filing for you!

We believe this experience should be as seamless and fast as placing the trade on Dhan. This is why we were early partners to both Quicko and Cleartax, the two of the largest online tax filing portals in India today.

While our users always had the ability to file their returns directly with these platforms, we’ve gone a step further by integrating this experience right from the very place you come to check your P&L.

Introducing Direct Income Tax Filing on Journal ![]()

With deep integrations built with both ClearTax and Quicko, you can now:

![]() Choose your preferred tax partner

Choose your preferred tax partner

![]() Connect Dhan as your broker with a single login.

Connect Dhan as your broker with a single login.

![]() Auto-sync all your trades, P&L, and realised gains from Dhan.

Auto-sync all your trades, P&L, and realised gains from Dhan.

![]() File your taxes seamlessly without manual uploads.

File your taxes seamlessly without manual uploads.

No more hopping between platforms. All your investments and tax filings are now connected, directly from Dhan Journal.

![]() Head to Journal > Direct Tax Filing and get started today.

Head to Journal > Direct Tax Filing and get started today.

As always, if you have any questions, please feel free to drop in a note at feedback@dhan.co.